What is GST calculator?

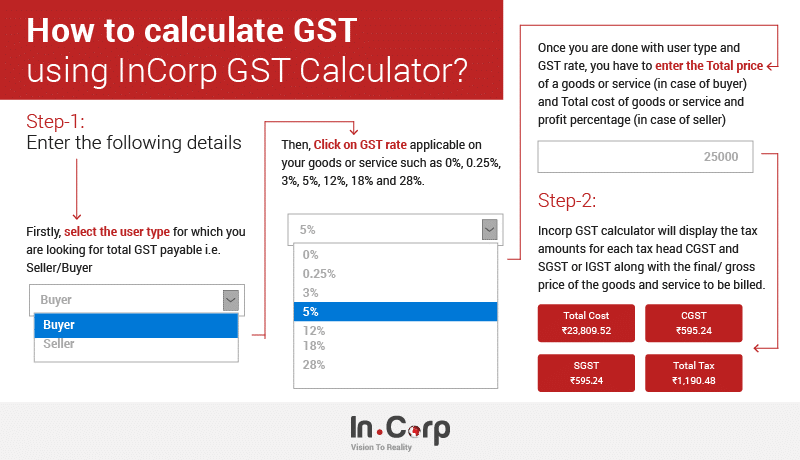

A GST Tax calculator is a handy ready-to-use online GST calculator to compute the GST liability payable for a month/quarter. This calculator can be used by different types of users, such as buyers, sellers, manufacturers, retailers and wholesalers.

Total Cost

CGST

SGST

Total Tax