E-Invoicing under GST is an authentication mechanism just like the E-way Bill system. However, the mechanism is different, wherein it involves submitting already generated invoices on the common e-invoice platform before issuing the same to the customer.

Table Of Contents

What is E-Invoicing Under GST?

What is the applicability under E-Invoicing?

When will E-Invoicing be non-applicable?

What are the benefits of E-Invoicing?

Process flow for E-Invoice generation

What are the contents of the E-Invoice?

What was the need for making E-invoice available for GST?

Buyer’s perspective on E-Invoice

How can InCorp help you?

FAQs

What is E-Invoicing Under GST?

It is a system in which Business to Business (B2B) invoices are authenticated digitally by GSTN. All the invoices uploaded on the e-invoice platform will be automatically transferred to the GSTN portal and E-way bill portal in real-time. So, with an e-invoice for GST, there will be no need to manually enter GSTR-1 return or to generate E-Way bills.

Invoice Registration Portal (IRP) will issue a QR code and unique document identification number for every invoice generated which will be called Invoice Reference Number (IRN). IRN is a 64 digit character created by combination of GSTIN, Financial Year and Invoice Number. It is mandatory to print a QR Code on the digital Invoice. A dedicated mobile app to scan and verify validity of e-invoice QR Code is provided on the portal.

This blog post will help you understand the criterias for e-invoicing applicability and the benefits for opting for it.

What is the applicability under E-Invoicing?

- E-invoicing GST has been made applicable from 1st October 2020. Businesses exceeding aggregate turnover of Rs. 500 crore in any preceding financial years from 2017-18 to 2019-20 can opt for digital invoice of GST.

When will E-Invoicing be non-applicable?

Sending an e-invoice of GST will not be allowed to the following registered persons even if the aggregate turnover exceeds the specified limits:

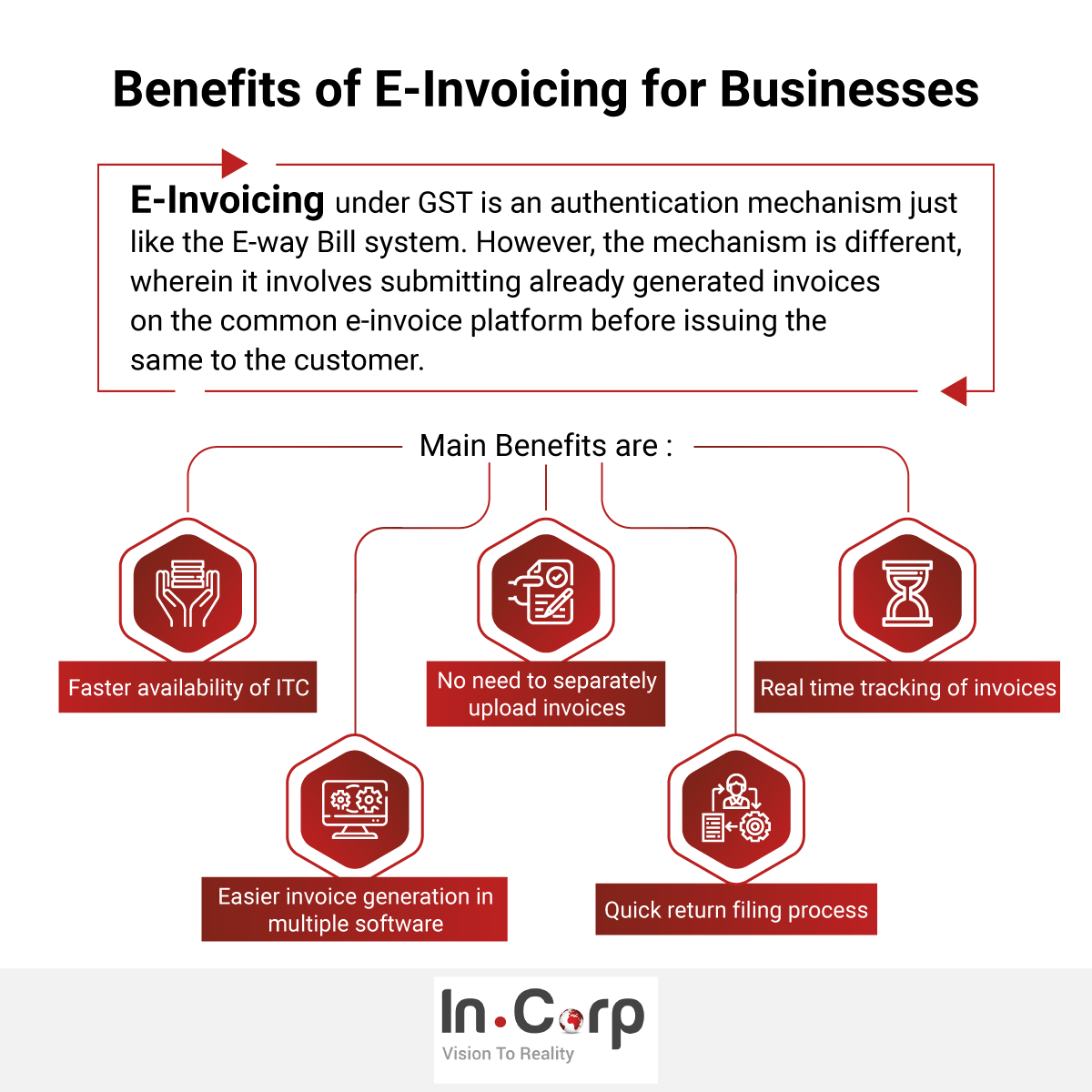

What are the benefits of E-Invoicing?

Businesses that are applicable to send out an e-invoice will have the following benefits:

- Faster availability of ITC

- Real-time tracking of invoices

- No need to separately upload invoices on GSTN portal and E-Way bill portal

- Faster data reconciliation which will lead to a reduction of mismatches

- Invoices generated in multiple software can be integrated on GSTN

- Faster return filing process as invoices are already auto-populated

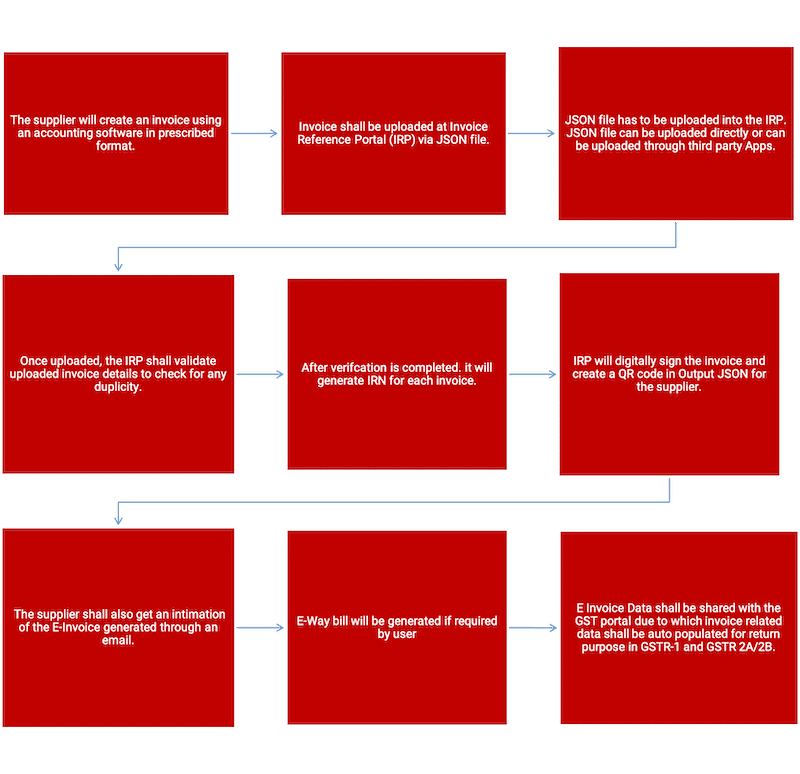

Process flow for E-Invoice generation

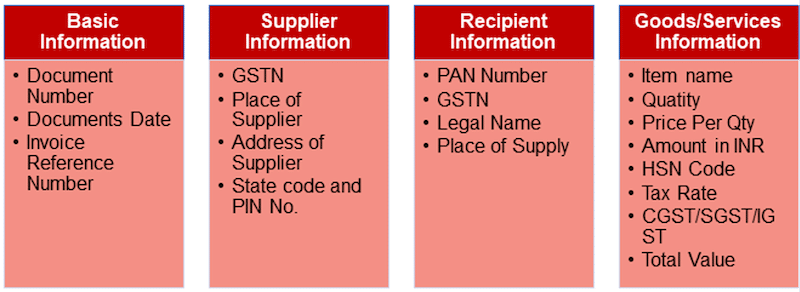

What are the contents of the E-Invoice?

E-Invoice will mandatorily contain the following fields:

What was the need for making E-invoice available for GST?

- Tax authorities will have access to transactions as they occur in real-time since the e-invoice will have to be compulsorily generated through the E-Invoice portal.

- Less scope for the manipulation of invoices since the invoice gets generated before carrying out a transaction.

- It will reduce the chances of fake GST invoices and the only genuine input tax credit can be claimed. Since the input credit can be matched with output tax details, it becomes easier for GSTN to track fake tax credit claims.

- This mechanism will help in overall reduction of tax evasion.

Buyer’s perspective on E-Invoice

- In order to claim ITC, it is mandatory that the buyer must be having a valid tax invoice.

- In terms of Rule 48(5) of the CGST Rules, if the invoice is generated without complying with the E-Invoicing requirement, it shall not be treated as invoice for GST purposes.

- The buyers must ensure that their vendors are compliant with this new requirement if it applies to them. Otherwise, there would be issues on claiming ITC.

- In this regard, the buyers must take confirmation from their suppliers regarding their E-Invoicing applicability. In case of non-compliance, the buyer has to agree on the implications.

How can InCorp help you?

We provide comprehensive advice and assistance on various indirect tax levies including Goods and Services Tax (GST) and Customs Duty. Our experts can help you with the following:

- Assisting entities to understand the impact on business operations due to the implementation of E-invoicing

- Assisting to configure the existing accounting ERP for compliance

- Assist in solving any problems faced by the entities in the E-Invoice environment.