The concept of warranty has been introduced to provide assurance to customers that in the event of failure of the product and parts, the customer will be indemnified against any loss or damage resulting from the purchase and use of the product.

A product could be defective because of faulty workmanship or materials. Warranty service is a kind of guarantee given by a trader or manufacturer to his customer to secure any defects in the products for a specified period of time.

In this article, we shall inform you about the different types of warranty and Implications of GST on warranty.

Table Of Contents

Types of Warranties

What do you mean by supply?

What is composite supply?

Implications of GST on Replacement Warranties

Implications of GST on Warranties for repair

Implications of GST on Extended Warranties

Implications of GST on E-commerce sales

Why should you choose Incorp?

What Are The Different Types Of Warranties Made Available To The Customers?

Assurances provided by way warranty is made available to a customer in various ways, such as:

- A replacement warranty is an assurance provided by the supplier at the time of supply to replace the product post-supply in a specified time.

- Further, no separate charge is recovered from the customer at the point of supply, as such costs are generally included in the product’s price.

- In such a case, the supplier undertakes to repair the defects found in the product. He may or may not charge additional consideration/ payment.

- An extended warranty is a prolonged warranty offered to consumers in addition to the standard warranty.

- It is usually an extension of the period of the manufacturer’s warranty provided at the time of supply of goods for consideration.

What Do You Mean By Supply?

To impose a tax on warranties, it is important to understand the scope of supply as per the tax laws.

Supply includes all forms of supply of goods or services or both.

A few examples of supply include:

| Sale | Exchange |

| Transfer | Rental |

| License | Lease or disposal |

| Barter | |

Such supply has to be made or agreed to be made for some consideration by a person in the course of business.

It is essential that the supply of goods is made for consideration.

What Is Composite Supply?

When two or more taxable supplies of goods or services or both, are bundled in natural course and are supplied with each other in the ordinary course of business, it is known as a Composite supply.

For example, A customer buys a TV from a retailer. He gets a warranty and maintenance service from the manufacturer for a specific time period. This would be considered as a composite supply where the TV is a principal supply and warranty services are ancillary supplies.

Now the question arises whether the supply of goods under warranty is made for consideration or not?

Let us take a look at Replacement Warranties

- Under replacement warranty, goods are supplied free of charge to customers. No separate consideration is charged at the time of replacement. This is because consideration for the same has been recovered at the time of supply of principal goods.

- Thus, tax on the same would have been paid at the time of principal supply of goods, as such costs are included in the price of principal goods sold.

- As consideration is missing in such transactions, it does not fall under the purview of ‘Supply’.

- Such transaction may be viewed as consideration received for supply of principal goods and goods under warranty and can be treated as composite supply.

What Are The Implications of GST On Warranty?

- Input tax credit on input and input services used to provide warranty services is available to the supplier.

- The price of warranty services is inbuilt in the supply price of the product; therefore, such warranty services have suffered output tax.

- Thus, you are eligible to claim an input tax credit against such services.

The government has clarified the same as under:

Question: What would be the tax liability on the replacement of parts under warranty (where no consideration is charged from a customer)? Is the supplier required to reverse the input tax credit?

Answer: No GST is chargeable on such replacement under warranty, as parts are provided to the customer without consideration. The costs to be incurred during the warranty period are included in the value of the supply made earlier.

Therefore, under warranty replacement, the supplier is not required to reverse the input tax credit on the parts/components replaced.

Determine Your GST Liability By Using Our GST Calculator

Let us take a look at Warranties for Repairs

- Where the repair is undertaken by the supplier –

- The supplier of goods provides repair services for any defects found in the products after the supply of goods. If separate consideration is not charged, then the same may not be treated as a separate supply.

- The consideration for the same has been inbuilt in the price of principal goods supplied. In such case, the price is charged by the supplier for the principal goods supplied and repair services, though the repair services are provided in the future course of action.

- The same may be treated as a composite supply of goods and services as per the principles discussed above, which altogether get taxed at the initial point of supply.

- Where the repair is undertaken by the distributor –

- In such a case, the distributor supplies the goods to the ultimate consumer with a warranty repair service.

- No separate recovery is made, as the price for such services is included in the price of goods supplied.

What Are The Implications of GST On Warranty?

GST shall not be payable on the supply of such warranty services by the distributor.

Case 1: Sometimes distributor recovers the cost of warranty repairs incurred by him from the original supplier of goods.

- The cost incurred by the distributor on behalf of the original supplier of goods represents the costs that the original supplier would have incurred if the original supplier had directly undertaken the repairs of the goods under warranty.

- There is no underlying supply between the distributor and the original supplier, so far as the cost recovery is concerned.

- Thus, GST shall not be payable if the distributor recovers only the cost component from the original supplier.

Case 2: Where a distributor charges a mark-up for the repair services performed on behalf of the manufacturer.

- In this case, the repairs performed by the distributor constitute a supply of service made in relation to such goods.

- Hence, the distributor must charge GST on the total value of the payments received from the manufacturer.

Case 3: Where the repair is undertaken by a third party.

- Sometimes supplier sells the good to the ultimate customer and hires a third-party vendor to perform the warranty repair service.

- The third-party vendor performs the repair service and bills the original supplier of goods for the service.

- The third-party vendor supplies repair service to the original supplier of goods in connection with the goods supplied by the original supplier.

What Are The Implications of GST On Warranty?

In this case, there is an underlying supply between the original supplier and the third-party vendor, thereby attracting the levy of goods and service tax.

This can be understood with the help of an example:

E.g., A manufacturer (M) has to provide repair services to their customers in the warranty period. This activity is outsourced by ‘M’ to ‘K’, who bills the ‘M’ for the services he provides to the customer.

In the instant case, ‘K’ is providing service to the ‘M’. Hence, in respect of bills raised by ‘K’ on ‘M’, GST is payable. (i.e. on the value of any supplies made by ‘K’ to ‘M’.)

Let us take a look at Extended Warranties

- When consideration is charged at the time of extending the warranty period by the original supplier, the same shall be treated as supply, thereby attracting the levy of goods and service tax.

- However, consequent to such extension, any supply of goods or service is made under warranty free of cost; then the same shall not be treated as a separate supply. This is because consideration has been included in the price paid at the point of extension of warranties.

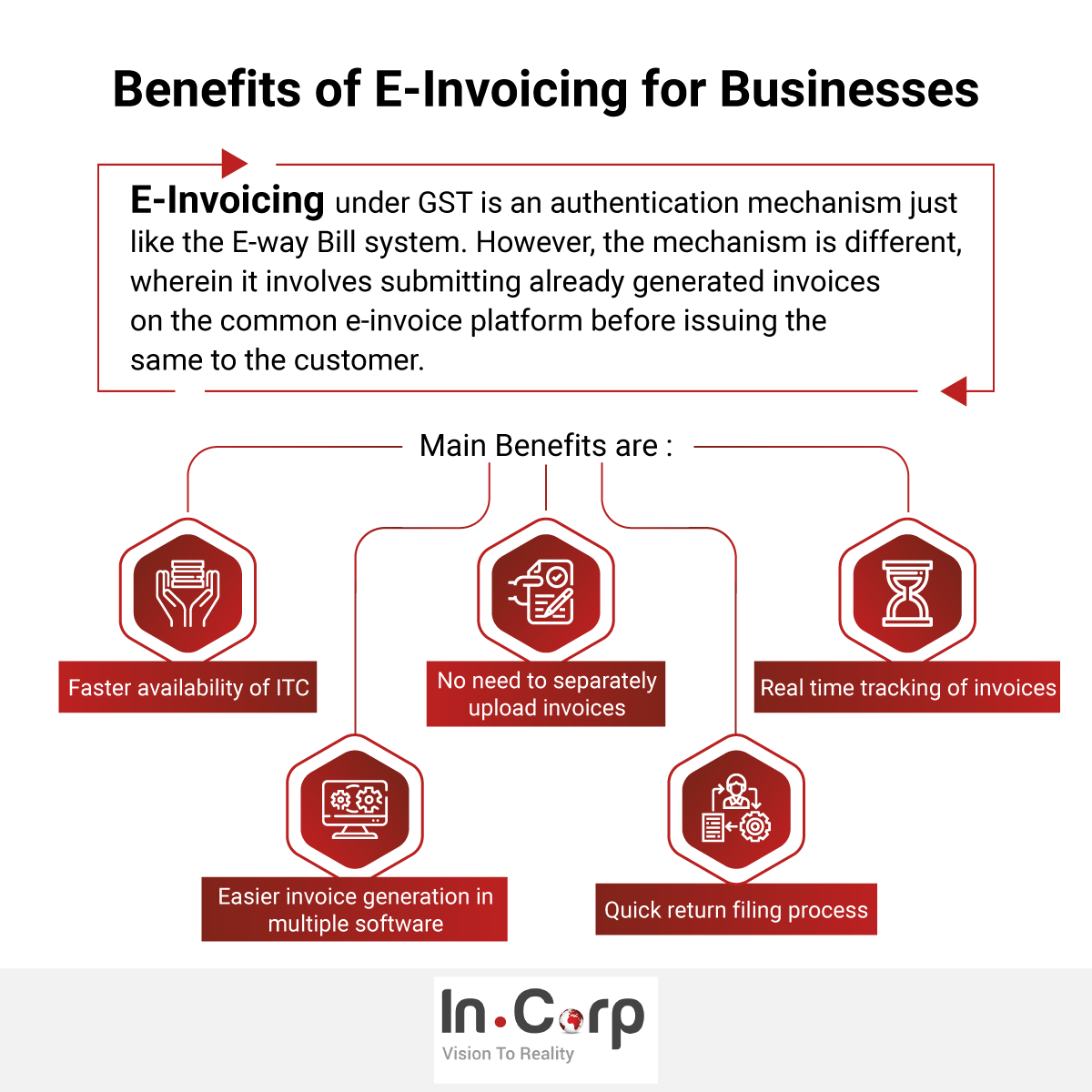

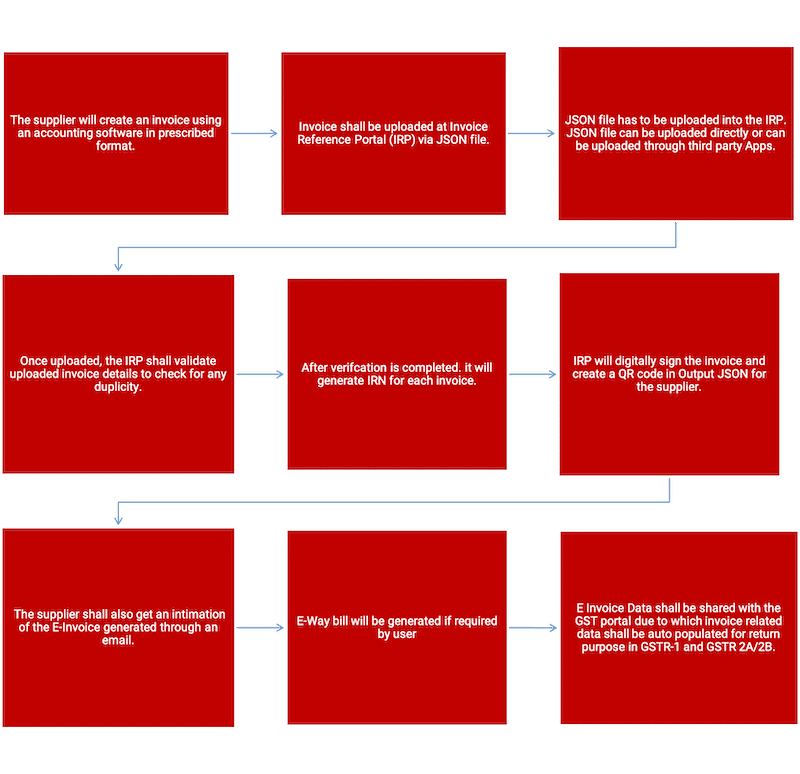

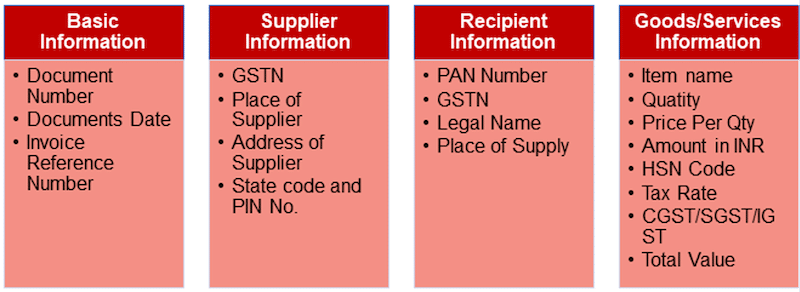

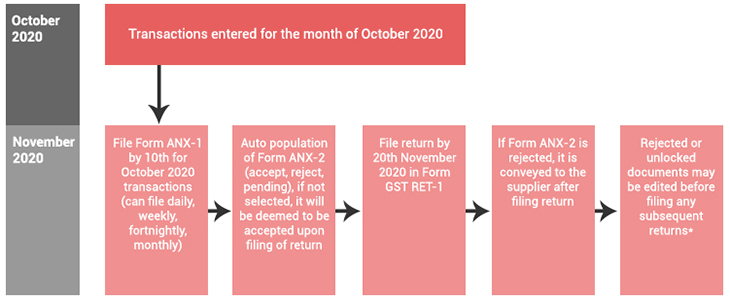

Related Read: E-Invoicing Under GST

Let’s take an example of E-commerce sales

Generally, major E-commerce operators sell goods through private labels with some warranty attached to the product. This warranty may be in form of a replacement warranty or repair warranty.

What Is The GST Impact On This Transaction?

Selling goods along with warranty falls under composite supply of goods, hence no GST is payable again at the time of replacement of goods under warranty or undertaking repairs for the same.

GST on the warranty is already discharged at the time of sale earlier.

Further, no Input tax reversal is applicable for goods supplied free of cost under warranty.

We have included a few Advance ruling Judgements to provide better clarity on GST implications on warranty on sales.

They are as follows:

- Volvo-Eicher Commercial Vehicles Ltd. In re, AAR, Karnataka

- The appellant is in the business of selling Volvo branded trucks and providing after-sales support services, including warranty services.

- The appellant and Volvo Sweden have entered into an arrangement in which the appellant handles the distribution in India and after-sale support services of Volvo products.

- The appellant sells its products with a warranty of 1 to 2 years, the cost of which is included in the sales price of the products.

- The appellant is responsible for the servicing of warranty claims of its customers.

- The onus to reimburse such expenses incurred for discharging the warranty obligation lies with Volvo Sweden.

- In pursuance of this agreement, the appellant has been engaging in discharging the warranty claims of customers in India.

The Authority for Advance Ruling (AAR) held that the repair and servicing of Volvo vehicles by the appellant for Indian customers during the warranty period would be an activity amounting to a composite supply of goods and services with principal supply being a supply of service for Volvo Sweden.

- Saraswathi Metal Works, In re AAR, Kerala

- The applicant is a manufacturer of Marine propellers, Rudder set, Stern tube set, Propellers shaft, MS shaft for couplings used in fishing or floating vessels.

- The applicant requested an advance ruling on the tax rate of the products mentioned above.

- They asked the following:

- ➔ Investment Accounting and relevant documentation support.

- ➔ Investment Accounting and relevant documentation support.

AAR held as follows:-

- The replacement of parts during the warranty period is a free supply.

- Warranty is a written guarantee. It is issued to the buyer of goods by its manufacturer, promising to repair or replace it if necessary within a specified period of time.

- If the goods are supplied with a warranty, the consideration received as part of supply includes the consideration for ‘the promise to repair or replace’.

What Are The Implications of GST On Warranty?

- Since the parts are provided to a customer without consideration under warranty, no GST is chargeable on such replacement.

- The value of supply made earlier includes the costs to be incurred during the warranty period. Therefore, the supplier who has undertaken the warranty replacement is not required to reverse the input tax credit on the parts/components replaced.

- Even though the raw materials consumed attract a higher tax rate than the finished products or parts, input tax paid is eligible to avail as an input tax credit.

- However, it is subject to a condition that such goods or services or both are used or intended to be used in the course or furtherance of his business.

- Thus, the tax rate of Marine propellers, Rudder set, Stern tube set, Propellers shaft, MS shaft for couplings used as part of fishing vessels, factory ships, and other vessels for processing or preserving fishery products are taxable at 5 percent GST.

- All parts of fishing/floating vessels come are taxable at 5 percent. The supply of parts under warranty being without consideration, no GST is payable.

- The value of supply made earlier includes the costs to be incurred during the warranty period.

- Therefore, the applicant who undertakes the warranty replacement is not required to reverse the input tax credit on the parts/components replaced.

- The supplier/manufacturer is eligible to avail the credit of higher input tax paid on the purchase of raw materials, even though the manufactured products are taxable at a lesser tax rate.

Why Choose Incorp?

At Incorp, we have the expertise and skills to guide you on various indirect tax levies including Goods and Services Tax (GST). We have with us professionals having in-depth knowledge and wide-ranging experience to help you in the effective planning and structuring of your business to ensure compliance with the regulations.