Family investment fund (FIF) in the International Financial Service Centre (IFSC) would refer to self-managed fund established by single family that operate within the regulatory framework and infrastructure provided by an IFSC.

GIFT IFSC is set-up in Gandhinagar, Gujarat to undertake financial services transactions that are currently carried on outside India by overseas financial institutions and overseas branches/ subsidiaries of Indian financial institutions.

GIFT City IFSC opens a great opportunity to High-net-worth individuals (HNIs) who are currently investing in overseas funds to benefit from the favourable financial environment, access to global markets, and potential tax advantages offered by the IFSC.

Table Of Contents

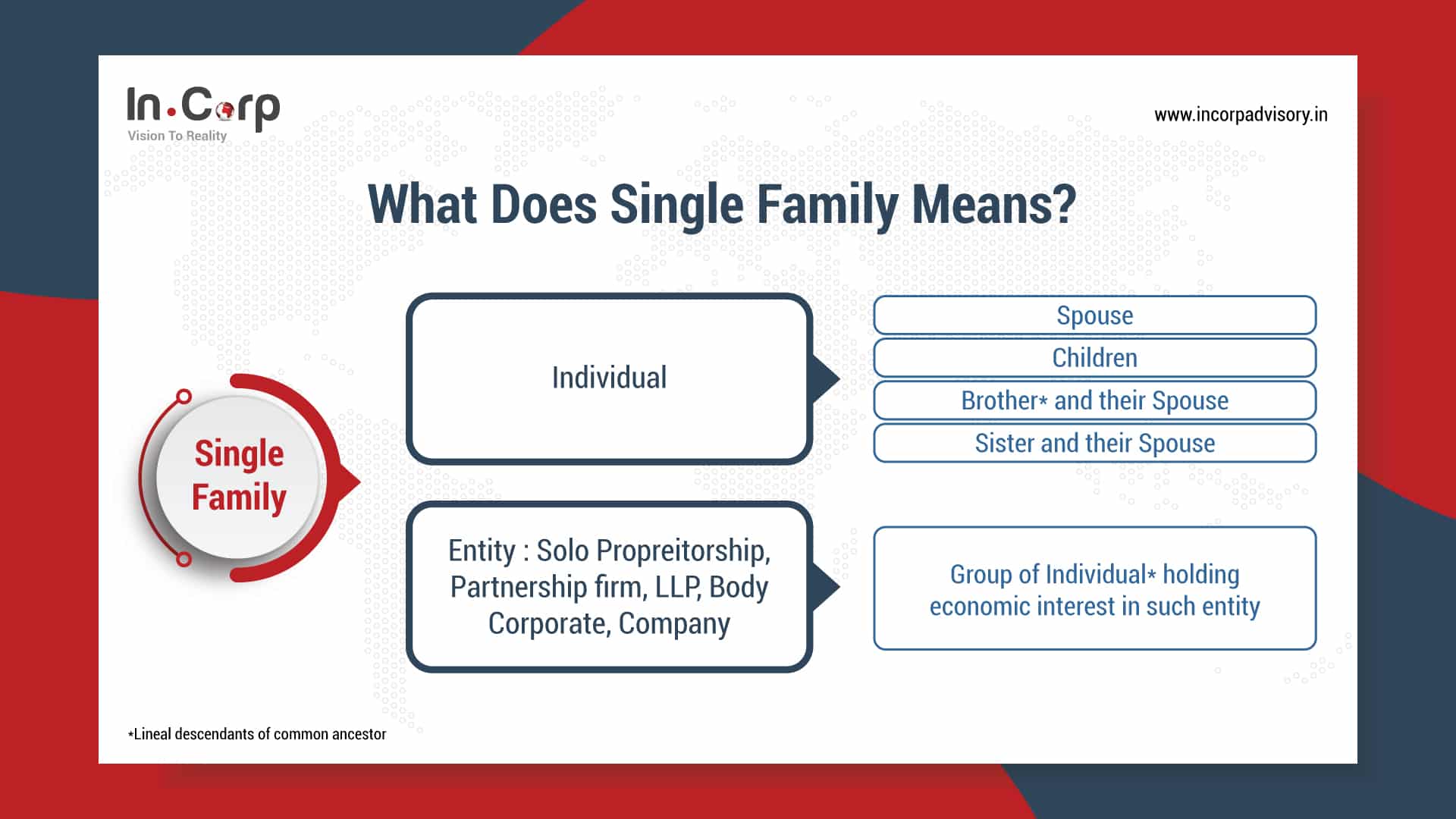

What Does Single Family Means?

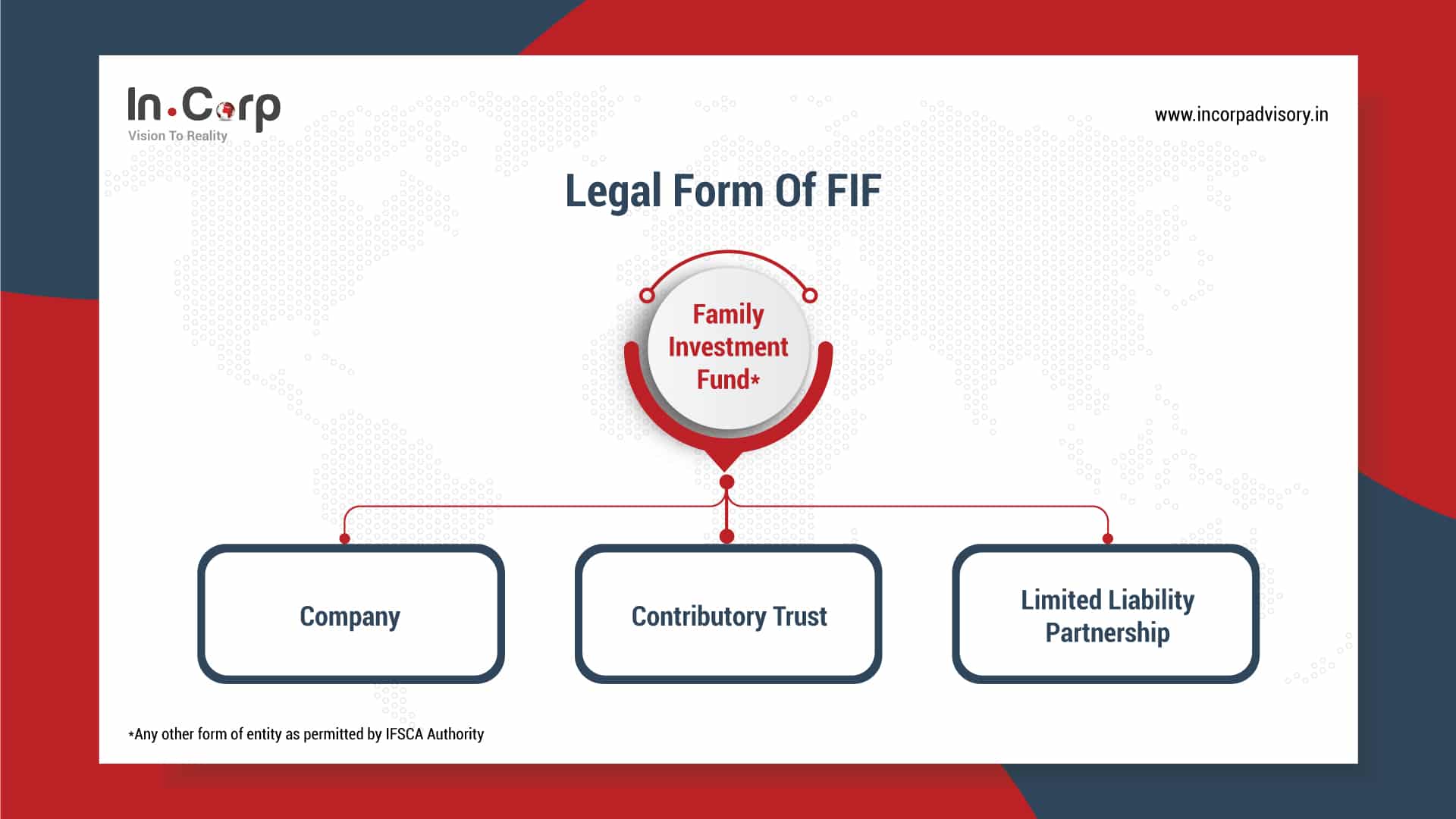

Legal Form Of FIF

Important Considerations:

Permissible Investment By FIF

Brief Roadmap

Tax Benefits

Why Choose InCorp?

FAQs

What does Single Family Means?

Related Read: Benefits Of Setting Up A Business Entity At GIFT City

Legal form of FIF

Important Considerations:

- FIF shall seek registration as an ‘Authorised FME’.

- FIF should maintain a minimum corpus of USD 10 million within 3 years from the date of obtaining certificate of registration.

- FIF can undertake all activities related to managing FIF as specified by Authority.

- FIF can borrow funds or engage in leveraging activities as per their risk management policy.

- FIF could be open ended or close ended depending upon the requirement of family

- Resident Individuals may invest in FIF upto USD 2,50,000 per year and Resident Entity may invest upto 50% of their net worth.

- FIF set up in IFSC will be considered as an Indian resident for tax purposes and an overseas resident/ offshore unit from an exchange control perspective.

Related Read: Benefits of a Private Family Trust in India

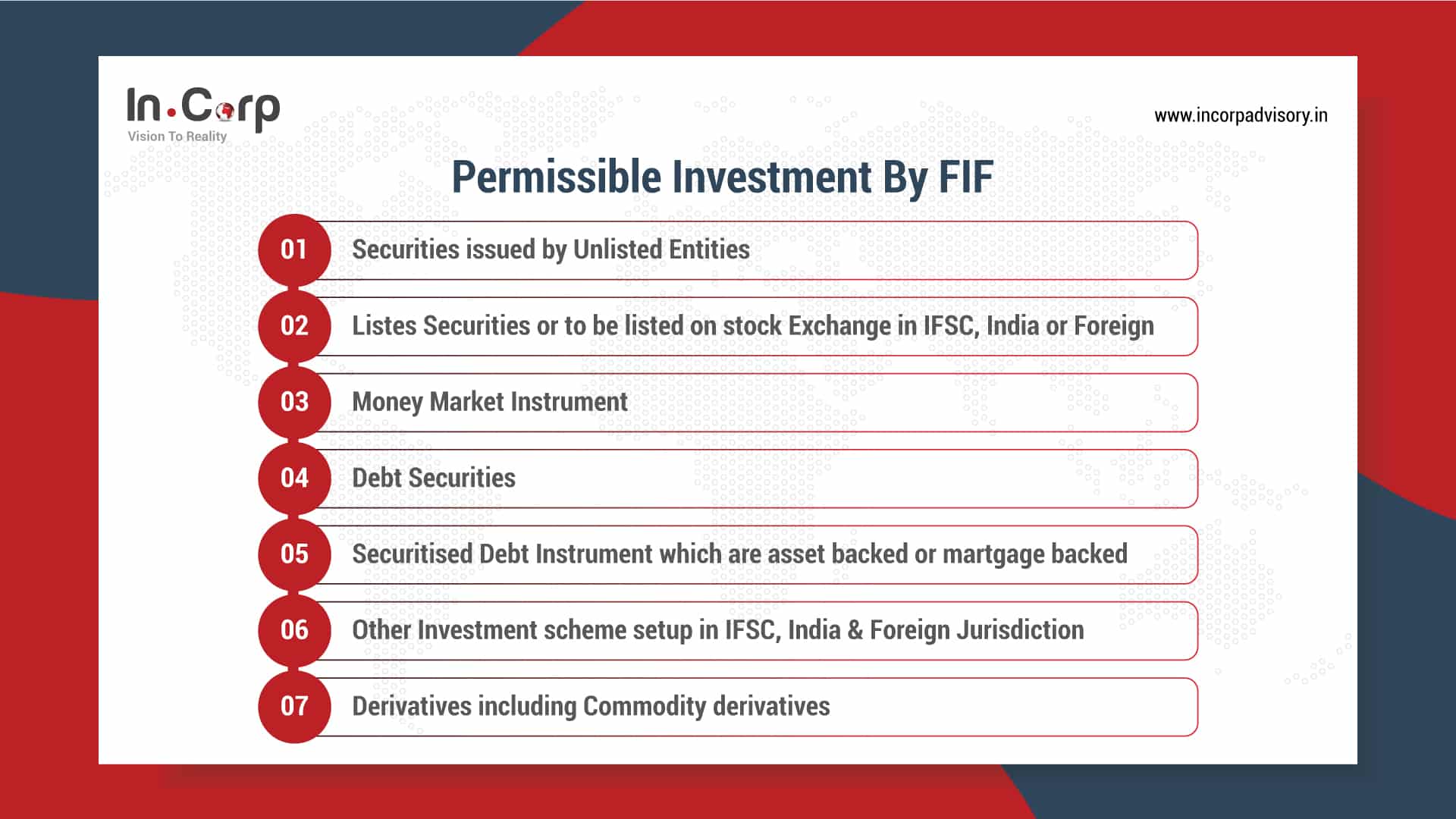

Permissible Investment by FIF

Tax Benefits

- FIF would be entitled to 100% income tax exemption for ten consecutive years out of fifteen years.

- FIF would be entitled to GST exemptions on services received by unit in IFSC or provided to IFSC / SEZ units, Offshore clients.

- FIF may be subject to MAT/AMT, as applicable, and the amount thus paid should be available as credit in subsequent years. Also, TCS at 20% would be applicable from October 1, 2023, using LRS (subject to regulation) for investing in FIF.

Related Read: GIFT City: An Overview and Tax Benefits

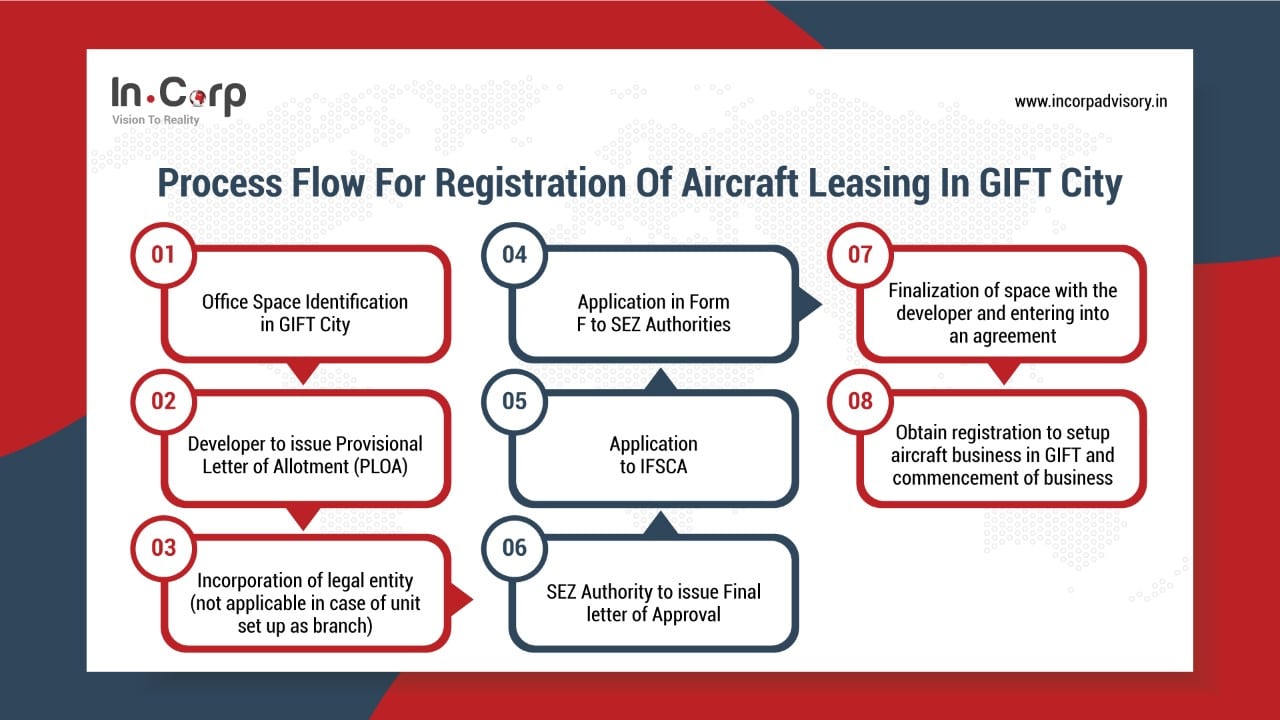

Brief Roadmap

- Application for name reservation for a setup (Company/LLP) of proposed unit under Gift City-IFSC

- Identification of suitable office space at GIFT City

- Application for incorporation of Company/Limited Liability Partnership entity with MCA

- Application to the SEZ Authority

- Application to the IFSCA Authority

- ODI/LRS Compliance for transferring funds to GIFT City in case of resident individuals

Why Choose InCorp?

Incorp will assist you in the following services:

- Assistance in structuring the FIF as per the requirement

- Providing advisory services on regulation & taxation to ensure compliance and optimal structuring

- Assistance in preparing necessary documentation required for incorporation of FIF in GIFT City

- Assistance in setting up FIF and post setup requirements and compliance if any required by FIF

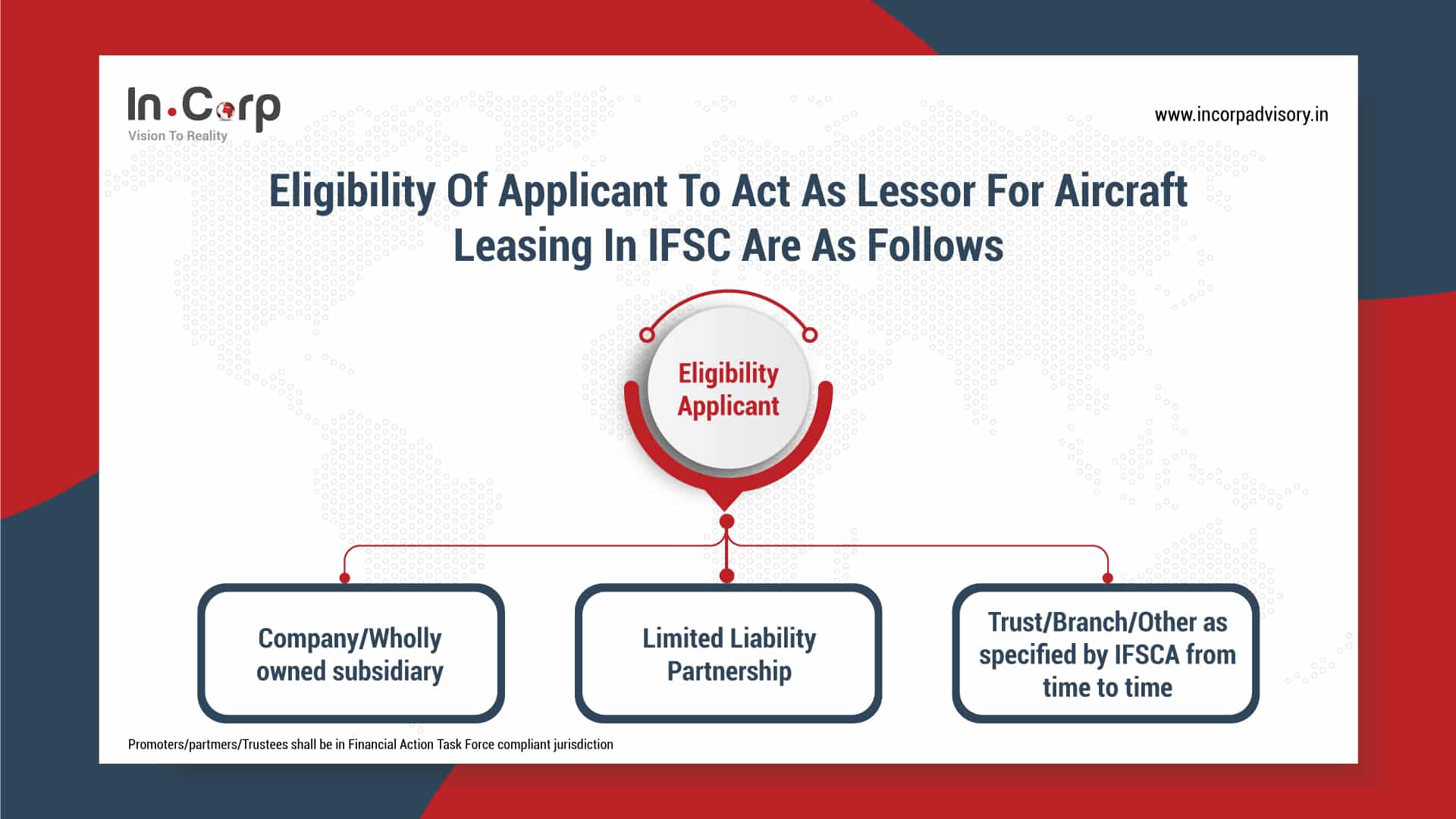

Promoters/partmers/Trustees shall be in Financial Action Task Force compliant jurisdiction

Promoters/partmers/Trustees shall be in Financial Action Task Force compliant jurisdiction