In order to keep pace with the global momentum in ESG disclosures, there is gradual yet pragmatic push by Government of India for adoption of responsible and sustainable business practices. The disclosure boundary on sustainable performance by corporates is thus steadily growing. The erstwhile BRR gradually culminated into BRSR to incorporate the current global practices in non-financial sustainability reporting based on the NGRBCs.

Table Of Contents

Introduction

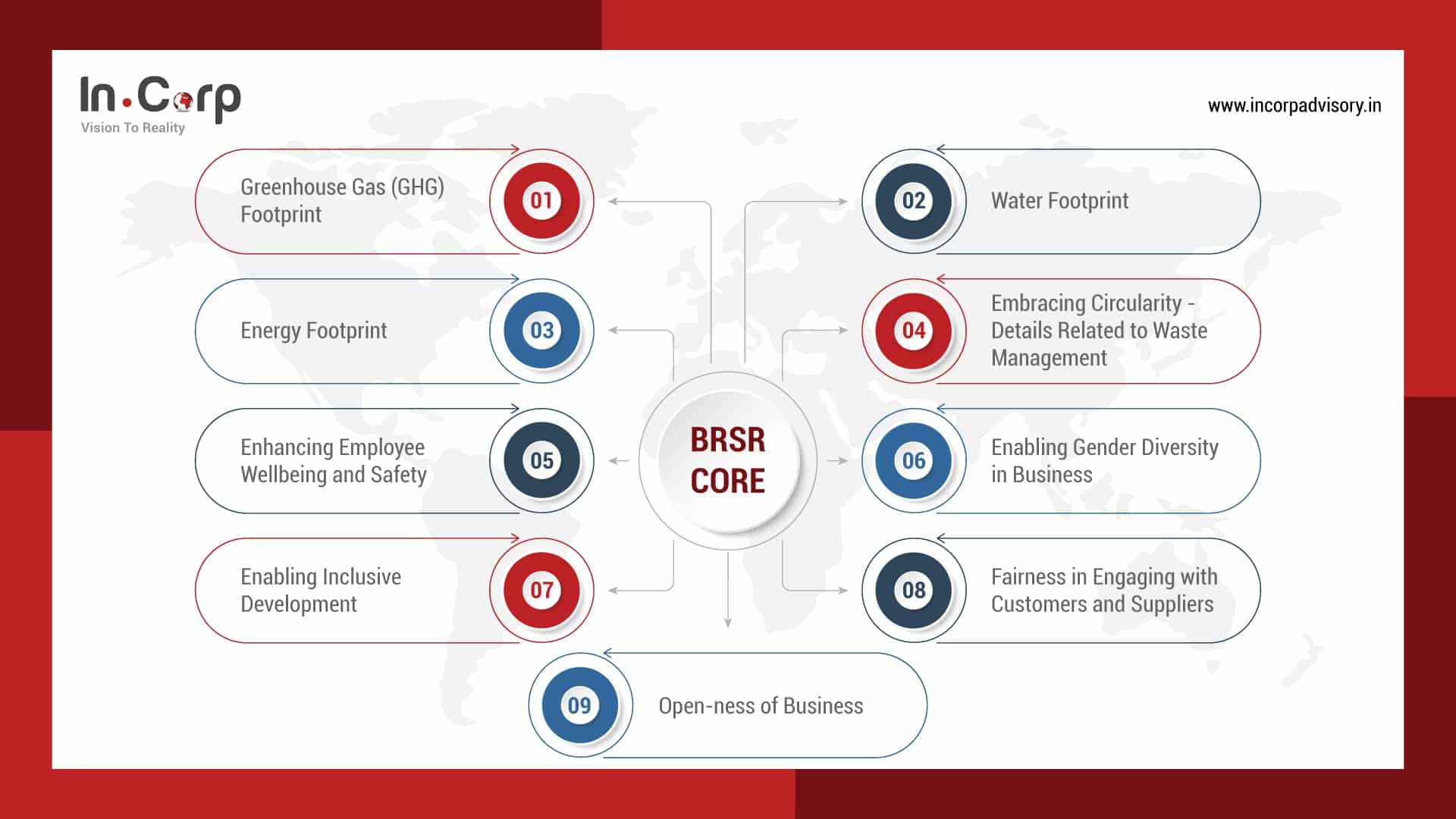

Nine Attributes Of BRSR Core

Changes In The Extant BRSR To Incorporate BRSR Core KPIs

Criteria When Selecting BRSR Core Assurance Provider

Conclusion

Why Choose InCorp?

FAQs

Introduction

SEBI had mandated top 1,000 listed entities (by market capitalisation) to file BRSR (“extant BRSR”) as part of the Annual Report with SEBI from FY 2022-23 onwards. In February 2023, SEBI issued a consultation paper to widen the periphery of ESG disclosures and proposed phased manner of applicability of BRSR Core, value chain disclosure and assurance thereof.

SEBI through a notification dated 14 June 2023 amended the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 (Listing Regulations) to introduce the BRSR Core and BRSR Core for a company’s value chain. Subsequently, on 12 July 2023, SEBI issued the framework (“the framework”) prescribing the disclosure and assurance requirements for BRSR Core, ESG disclosures for value chain, and assurance requirements.

In the sections below, we intend to give our synopsis on the framework as issued by SEBI vide Circular no. SEBI/HO/CFD/CFD-SEC-2/P/CIR/2023/122 dated 12 July 2023).

The framework enumerates disclosure requirements and assurance applicability in a glide path and can be divided into THREE categories:

- BRSR Core (sub-set of extant BRSR)

- Updated BRSR (extant BRSR + BRSR Core)

- BRSR Core for Value Chain (Cumulatively comprising 75% of its purchases / sales (by value) by the top upstream and downstream value chain partners of a listed entity)

| Categories | Financial Year | Disclosure Requirements | Assurance Requirements | Applicability |

|---|---|---|---|---|

| Updated BRSR | FY 2023-24 | Top 1000 Listed Companies by Market Capitalisation | Top 150 Listed Companies by Market Capitalisation | Reasonable Assurance of BRSR Core |

| FY 2024-25 | Top 250 Listed Companies by Market Capitalisation | Reasonable Assurance of BRSR Core | ||

| FY 2025-26 | Top 500 Listed Companies by Market Capitalisation | Reasonable Assurance of BRSR Core | ||

| FY 2026-27 | Top 1000 Listed Companies by Market Capitalisation | Reasonable Assurance of BRSR Core | ||

| BRSR Core for Value Chain* | FY 2024-25 | Top 250 Listed Companies by Market Capitalisation -Disclosures for value chain – cumulatively comprising 75% of its purchases / sales (by value) top upstream and downstream partners of a listed entity on COMEX basis | – | |

| FY 2025-26 onwards | – | Top 250 Listed Companies by Market Capitalisation – on COMEX basis | Limited Assurance of BRSR Core |

* Reporting may be segregated for upstream and downstream partners or can be reported on an aggregate basis

* Scope of reporting and any assumptions or estimates, if any, should be clearly disclosed

Nine Attributes of BRSR Core

Related Read: BRSR 2.0 – Latest Recommendations From SEBI

Changes in the extant BRSR to incorporate BRSR Core KPIs

* New Insertion in Essential Indicator (N)

* Transposition from Leadership to Essential Indicator (T)

| Principles | Parameters | Delta | Related Attribute of BRSR Core |

|---|---|---|---|

| Principle 1 – Businesses should conduct and govern themselves with integrity, and in a manner that is Ethical, Transparent and Accountable | Number of days of accounts payables ((Accounts payable *365) / Cost of goods/services procured) for CY and PY |

N |

Fairness in Engaging with Customers and Suppliers |

| Concentration of purchases and sales with trading houses, dealers, and related parties along-with loans and advances & investments, with related parties for CY and PY |

N |

Open-ness of Business | |

| Principle 2 – Businesses should provide goods and services in a manner that is sustainable and safe

|

No Change |

||

| Principle 3 – Businesses should respect and promote the well-being of all employees, including those in their value chains | Spending on measures towards well-being of employees and workers (including permanent and other than permanent) for CY and PY |

N |

Enhancing Employee Wellbeing and Safety |

| Principle 4 –

Businesses should respect the interests of and be responsive to all its stakeholders |

No Change |

||

| Principle 5 – Businesses should respect and promote human rights | Gross wages paid to females as % of total wages paid by the entity for CY and PY |

N |

Enabling Gender Diversity in Business |

| Complaints filed under the Sexual Harassment of Women at Workplace (Prevention, Prohibition and Redressal) Act, 2013 |

N |

||

| Principle 6 – Businesses should respect and make efforts to protect and restore the environment | Details of total energy consumed (in Joules or multiples) from renewable and non-renewable sources, Energy intensity per rupee of turnover adjusted for Purchasing Power Parity (PPP) and Energy intensity in terms of physical output |

T |

Energy footprint |

| Water intensity per rupee of turnover adjusted for Purchasing Power Parity (PPP) and water intensity in terms of physical output |

N |

Water footprint | |

| Details related to water discharged for the current and previous financial year |

T |

Water footprint | |

| With respect to the disclosure of greenhouse gas emissions (Scope 1 and Scope 2 emissions) & its intensity, the listed entity is also required to disclose the Total Scope 1 and Scope 2 emission intensity per rupee of turnover adjusted for Purchasing Power Parity (PPP) and in terms of physical output |

N |

Greenhouse gas footprint and water footprint | |

| Waste intensity per rupee of turnover adjusted for Purchasing Power Parity (PPP) and waste intensity in terms of physical output |

N |

Embracing circularity – details related to waste management | |

| Principle 7 –

Businesses, when engaging in influencing public and regulatory policy, should do so in a manner that is responsible and transparent |

No Change |

||

| Principle 8 – Businesses should promote inclusive growth and equitable development | Percentage of input material (inputs to total inputs by value) sourced from suppliers – Directly from within India (the change is made from input materials sourced from within the district and neighbouring districts) |

N |

Enabling Inclusive Development |

| Job creation in smaller towns – Disclose wages paid to persons employed (including employees or workers employed on a permanent or non-permanent / on contract basis)

in the rural, semi-urban, urban and metropolitan locations, as % of total wage cost for CY and PY |

N |

||

| Principle 9 – Businesses should engage with and provide value to their consumers in a responsible manner | Information relating to data breaches |

T |

Fairness in Engaging with Customers and Suppliers |

Criteria when selecting BRSR Core Assurance provider

Expertise: The listed entity’s Board should confirm that the chosen assurance provider for the BRSR Core possesses the necessary competence to execute reasonable assurance.

No Conflict of Interest: The listed entity needs to ascertain that there’s no conflict of interest with the selected assurance provider in charge of assuring the BRSR Core disclosures.

For example, the entity must ensure that neither the assurance provider nor any of its affiliates market their products or offer non-audit/non-assurance services, such as consulting, to the listed entity or its group companies.

Related Read: BRSR Report – A New Avatar Of ESG Reporting

Conclusion

An important feature of the circular is its focus on inclusion of value chain disclosures. Though this will contribute to a comprehensive assessment of a company’s environmental, social, and governance impact, this approach significantly increases the burden of compliance, as integrating sustainability policies within the supply chain becomes a complex and laborious task. The responsibility for reporting still lies with the listed entity. However, the circular encourages value chain partners to align with the company’s sustainability policies, as they risk losing business from the listed entities if they don’t comply.

Why Choose InCorp?

InCorp Advisory provides a complete ecosystem and support for your BRSR needs. Our team of experts conducts a 360-degree assessment to identify and highlight potential risks and opportunities which can arise with BRSR reporting. Our clients range from listed companies to investors as we help them not only improve their ESG reports but also help create valuable investments.