Countries

Singapore is ranked no. 2 in the ease of doing business report 2020, which creates a benchmark for foreigners or locals looking to incorporate a business in Singapore. Here’s a quick overview of the different types of Singapore business entities :

- Private Limited Company

- Limited Liability Company

- Subsidiary Company

- Branch Office

- Representative Office

- Key Factor of Setting up a Singapore Company

Types of Singapore Business Entities

Private Limited Company

The most common choice- a private limited company in Singapore has a separate legal status from its owners and directors who have limited responsibility for the company’s debts and losses. This business entity provides the owner with the right to own properties.

Minimum Setup Requirements:

Limited Liability Partnership

A limited liability partnership is a combination of a Private Limited Company and Partnership, providing the most flexibility while ensuring its legal entity remains separated from its partners.

Minimum Setup Requirements:

Subsidiary Company

A subsidiary company is a private limited company with an external corporate company as a shareholder. This external corporate company can own 10% of the company. A subsidiary company in Singapore benefits from the same perks as a private limited company incorporated in Singapore.

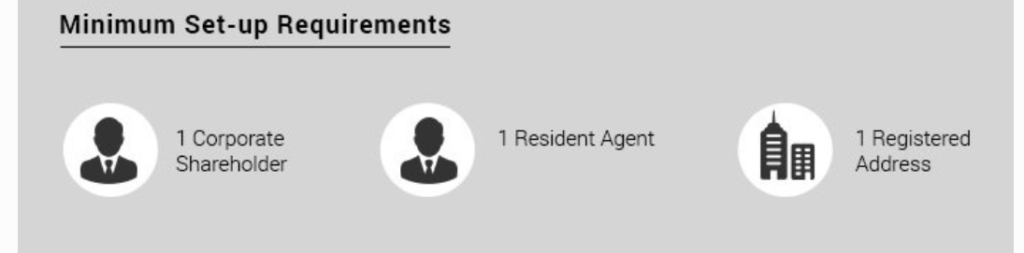

Minimum Setup Requirements:

You can either apply for a Singapore employment pass and relocate to Singapore or appoint a Nominee Director and run your operation from overseas.

Branch Office

A branch office is an expansion of a foreign corporate company that is not based in Singapore. It is considered to be a non-resident and therefore does not enjoy tax exemptions like other Singapore private limited companies. If your company wishes to relocate or send employees to Singapore to run operations, then you are required to apply for a Singapore employment pass.

Representative Office

A representative office is a short-term setup, a maximum of three years. This allows foreign corporate companies to relocate temporarily to explore and interact with local distributors and study the Singapore market. A Singapore employment pass is required to relocate.

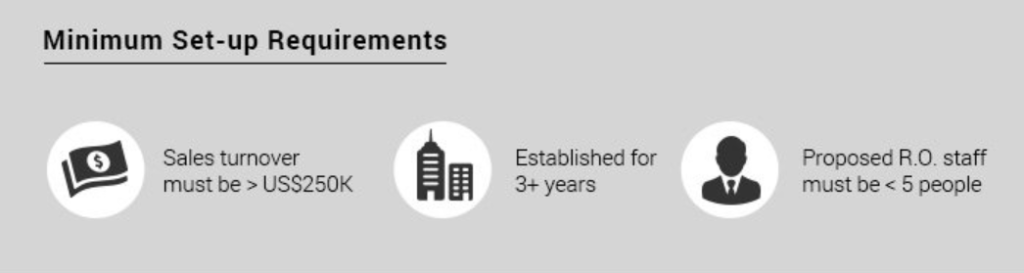

Minimum set-up requirements:

Key Factors of Setting up a Singapore Company

Liability/ Legal Entity

When choosing an organisational form, one of the main things to consider is the liability structure. It is beneficial for a business owner as well as the company if the two are separate entities legally. This will allow for a cap on what/who is liable for company debts if any.

Ability to Grow

As a business, a long term goal is to always grow, and therefore business owners must consider which organisational form will allow them to widen their horizons and expand into either different markets or into new products/services.

Cost of Setting Up

If the company is a startup, it is important for the company to be thoughtful of the capital required to incorporate a company in Singapore.

How can InCorp help?

Setting up a company in Singapore could turn out to be a great decision, provided that you choose the right business structure. InCorp Global has helped thousands of Indian companies like yours to set up a Singapore company and get started in the new market.