This framework in GIFT city facilitates set up of Foreign Universities within the city. It aims to provide students with a world-class education and exposure to global standards. It also offers opportunities for collaboration between Indian and foreign universities, including student exchange programs.

The framework mentions entry guidelines for foreign universities and foreign educational institutions to setup their campus/center in GIFT City. The framework has defined the following terms:

- “Foreign University” shall mean a university established outside India which is duly accredited to award degrees for courses within and outside its home jurisdiction.

- A “Foreign Educational Institution” refers to an educational institution located outside India that is not classified as a university but is duly authorized to provide courses, including research programs, in approved subject areas both within and outside its native jurisdiction.

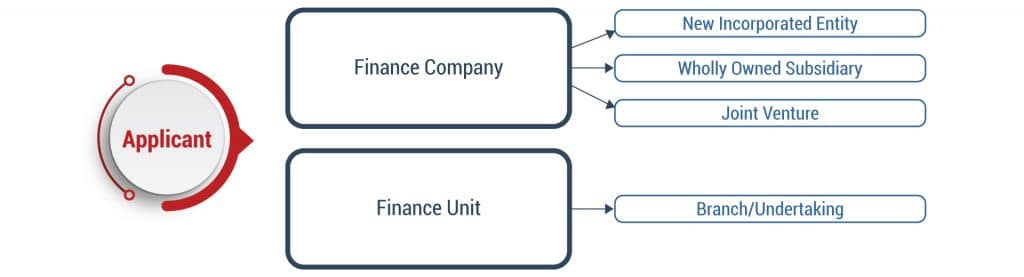

What is the legal structure?

The following can be the categories of the entity setup for foreign universities in GIFT IFSC:

– Foreign Universities → Set up an International Branch Campus (IBC) in GIFT IFSC

– Foreign Educational Institution → Set up an Offshore Educational Centre (OEC) in GIFT IFSC

- If the applicant is a Foreign University, it must have achieved a position within the top 500 in the most recent QS World Universities ranking*, either in global overall ranking and/or subject ranking.

- For Foreign Educational Institutions, the applicant should be a well-reputed institution within its home jurisdiction.

* Quacquarelli Symonds (QS) World Universities ranking.

What are the permissible courses for Foreign Universities?

The following courses including research programs are permitted in GIFT IFSC

- Financial Management

- FinTech

- Science

- Technology

- Engineering

- Mathematics

- Other topics as approved by IFSCA

What are the criteria for courses to be offered in GIFT city?

- Every course or program conducted by a registered entity in GIFT IFSC must mirror the course or program offered by the parent entity in its home jurisdiction.

- The degree, diploma, or certificate awarded to International Branch Campus (IBC) or an Offshore Education Centres (OEC) students shall be directly conferred by the parent entity in the same manner as it does for its students in its home jurisdiction. However, IBC or OEC is permitted to make adjustments in the approved course curriculum or content.

- The degrees, diplomas, or certificates issued for courses or programs held in GIFT IFSC will be accorded the same recognition and status as if they were conducted by the parent entity in its home jurisdiction.

How to register an International Branch Campus (IBC) or an Offshore Education Centres (OEC)?

Subject to the basic conditions fulfilled for setup the applicant is required to demonstrate financial capability to establish and sustain the proposed activities in GIFT IFSC and the applicant commits to implementing appropriate infrastructure and facilities to conduct courses, including research programs, in permissible subject areas.

The process flow for registration of IBC & OEC in GIFT City

Step 1. Application to MCA for setup of branch of parent (foreign) entity

Step 2. Application to IFSCA for in-principle approval

Step 3. Application to be referred to the committee of experts set up by the GIFT City.

Step 4. Authority may grant in-principal approval and give 180 days to set-up infrastructure, course, fees

Step 5. Application to SEZ Authority to set up IBC or OEC

Step 6. Obtaining SEZ approval

Step 7. Setting up of infrastructure, course and other capabilities for commencement of operation

Step 8. Authority may issue Certificate of Registration upon fulfillment of conditions

Step 9. Commencement of Operation for which the license is granted

What is the fees to be paid to IFSCA & SEZ Regulators?

An IBC or OEC desirous of undertaking permissible activities would be required to pay the following fees:

A) IFSC Authority

| Particulars | Amount ( in US$) |

| Application Fees (one time) | $ 1,000 |

| Initial Registration Fees (one time) | $ 25,000 |

| Annual Fees | $ 10,000 |

| Processing Fees | $ 10,000 |

B) SEZ Authority

| Particulars | Amount (in INR) |

| Application Fees (one-time) | ₹ 5,000 |

| Registration fees (one-time) | ₹ 25,000 |

| Recurring fees (Annual) | ₹ 5,000 |

FAQs

1. How can resident students remit funds to Foreign Universities/Foreign Educational institutions established in the GIFT IFSC to study?

Liberalised Remittance Scheme (LRS) allows resident individuals to remit funds in light of the provision of the Circular Dated 22.06.2023. Now, a student is permitted to make remittance to the foreign university established in the IFSC to study. This remittance will be treated as remittance under the purpose ‘studies abroad’ as mentioned in Schedule III of Foreign Exchange Management Rules, 2000.

2. What are the benefits of setting up an IBCs or OECs in an IFSC?

There are several benefits to setting up an IBC or OEC in an IFSC, including:

- Access to a large pool of talent and potential students in India

- A liberalized regulatory environment

- Tax benefits

- Relaxed land acquisition norms

3. How does the recognition of degrees from Foreign universities/ Foreign Education Institutions in GIFT City IFSC work internationally?

Degrees acquired through IBCs and OECs within GIFT IFSC will be considered as international degrees. The recognition and status accorded to the degree, diploma, or certificate issued for courses or programs held in GIFT IFSC will be equivalent to those conducted by the Parent Entity in its Home Jurisdiction.