In recent years, Singapore and GIFT City IFSC have emerged as two of the most prominent financial hubs in Asia. Both locations offer world-class infrastructure, skilled talent pools, and access to global markets, making them attractive destinations for stockbrokers looking to expand their regional operations. However, there are significant differences between the two locations that stockbrokers must consider when deciding where to set up their business.

In this blog, we will compare the advantages and disadvantages of setting up a brokerage firm in Singapore versus GIFT City IFSC.

Table Of Contents

Introduction

Market Access

Regulatory Framework

Tax Incentives

Conclusion

Why Choose InCorp?

Frequently Asked Questions On GIFT City IFSC

Market Access

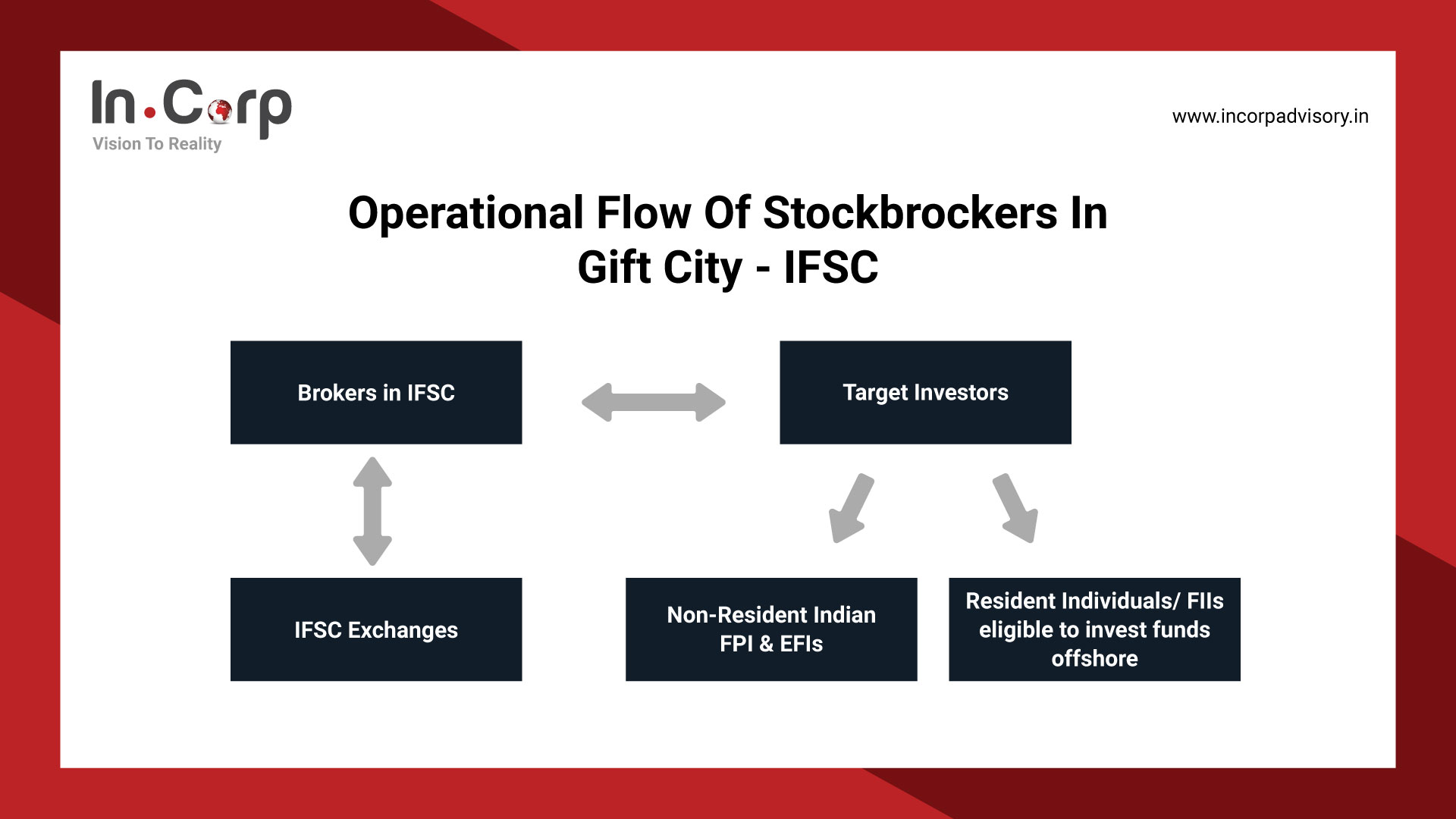

One of the most critical factors that stockbrokers must consider when selecting a location is market access. Singapore and GIFT City IFSC have different markets with different regulatory frameworks and market structures. Singapore has a well-established financial market with a sophisticated regulatory framework and access to global markets. Stockbrokers in Singapore can trade in equities, fixed income, derivatives, and other financial products, making it a well-diversified market. However, Singapore’s financial market is relatively small compared to other global financial centers, such as New York and London.

In contrast, GIFT City IFSC offers access to India’s financial market, one of the fastest-growing economies globally. India has a large and rapidly growing middle class, driving demand for financial products such as insurance, mutual funds, and equities. Stockbrokers in GIFT City IFSC can access the Indian market through the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE). Moreover, India has a vast unbanked population, which provides opportunities for innovative financial products and services. Therefore, stockbrokers looking to tap into the growth potential of the Indian market may prefer GIFT City IFSC over Singapore.

Related Read: Budget 2023: Major Boost & Benefits For GIFT City IFSC

Regulatory Framework

Another crucial factor that stockbrokers must consider when selecting a location is the regulatory framework. Singapore is known for its strict regulatory environment, which offers a high level of investor protection. The Monetary Authority of Singapore (MAS) regulates all financial institutions in Singapore and ensures that they comply with strict standards for risk management, customer protection, and market integrity. The MAS has also implemented regulations to combat money laundering and terrorist financing, which reduces the risk of fraud in the financial system.

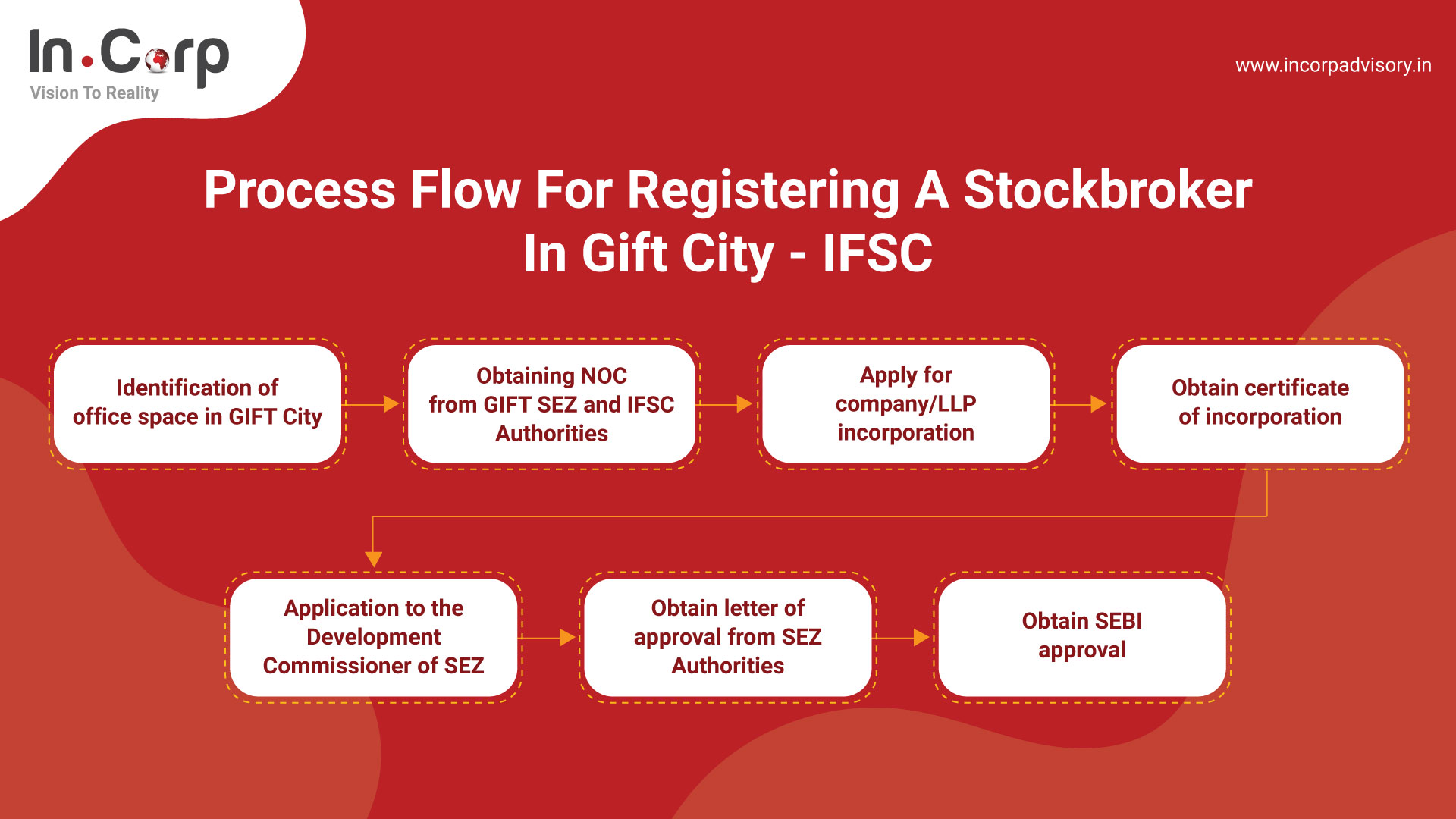

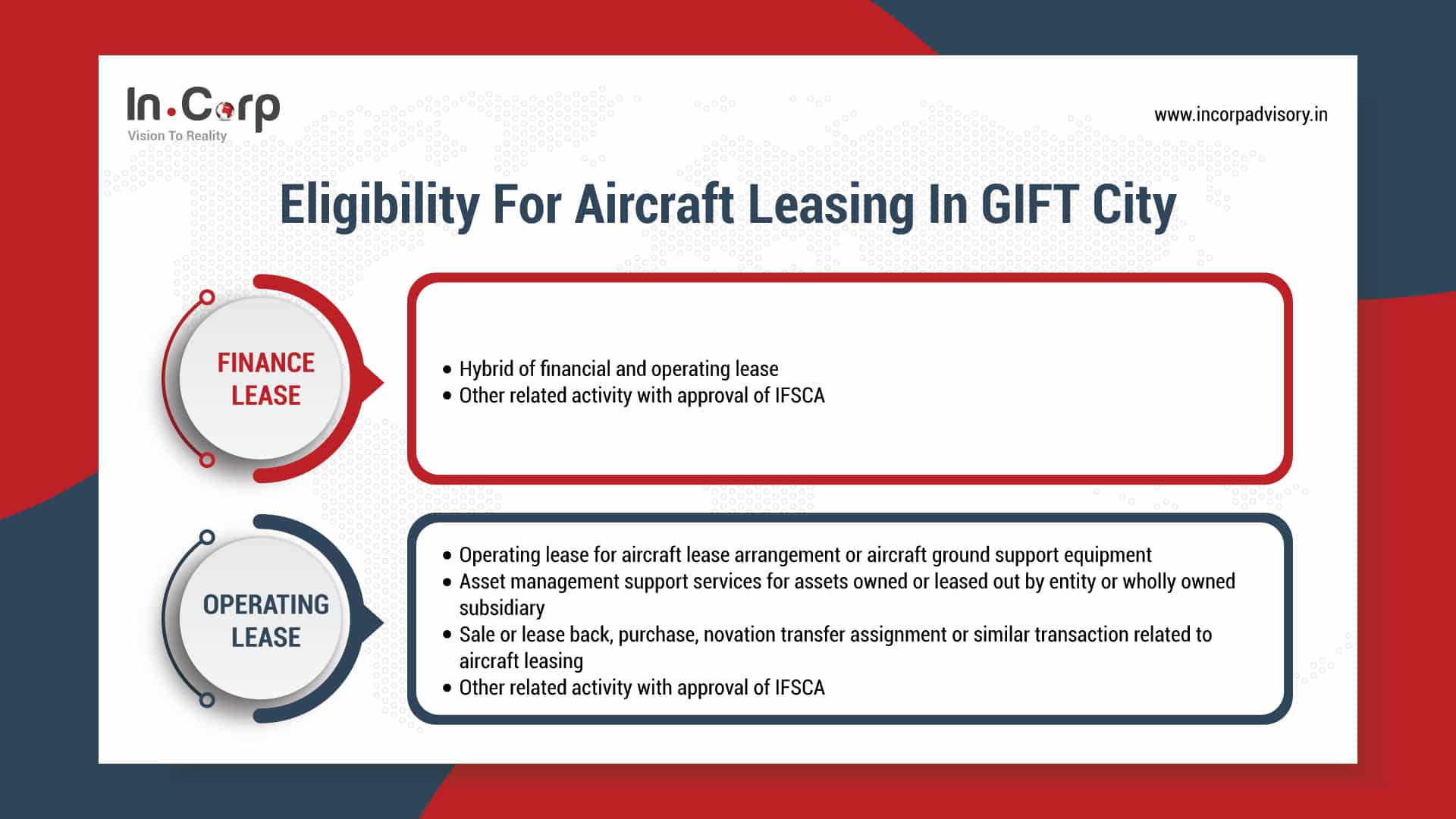

In contrast, GIFT City IFSC has a less stringent regulatory environment than Singapore. The International Financial Services Centre Authority (IFSCA) regulates financial institutions in GIFT City IFSC and has implemented a more flexible regulatory framework to attract foreign investors. The IFSCA has also implemented tax incentives, such as tax exemptions on income from international transactions, which reduces the tax burden on stockbrokers.

Tax Incentives

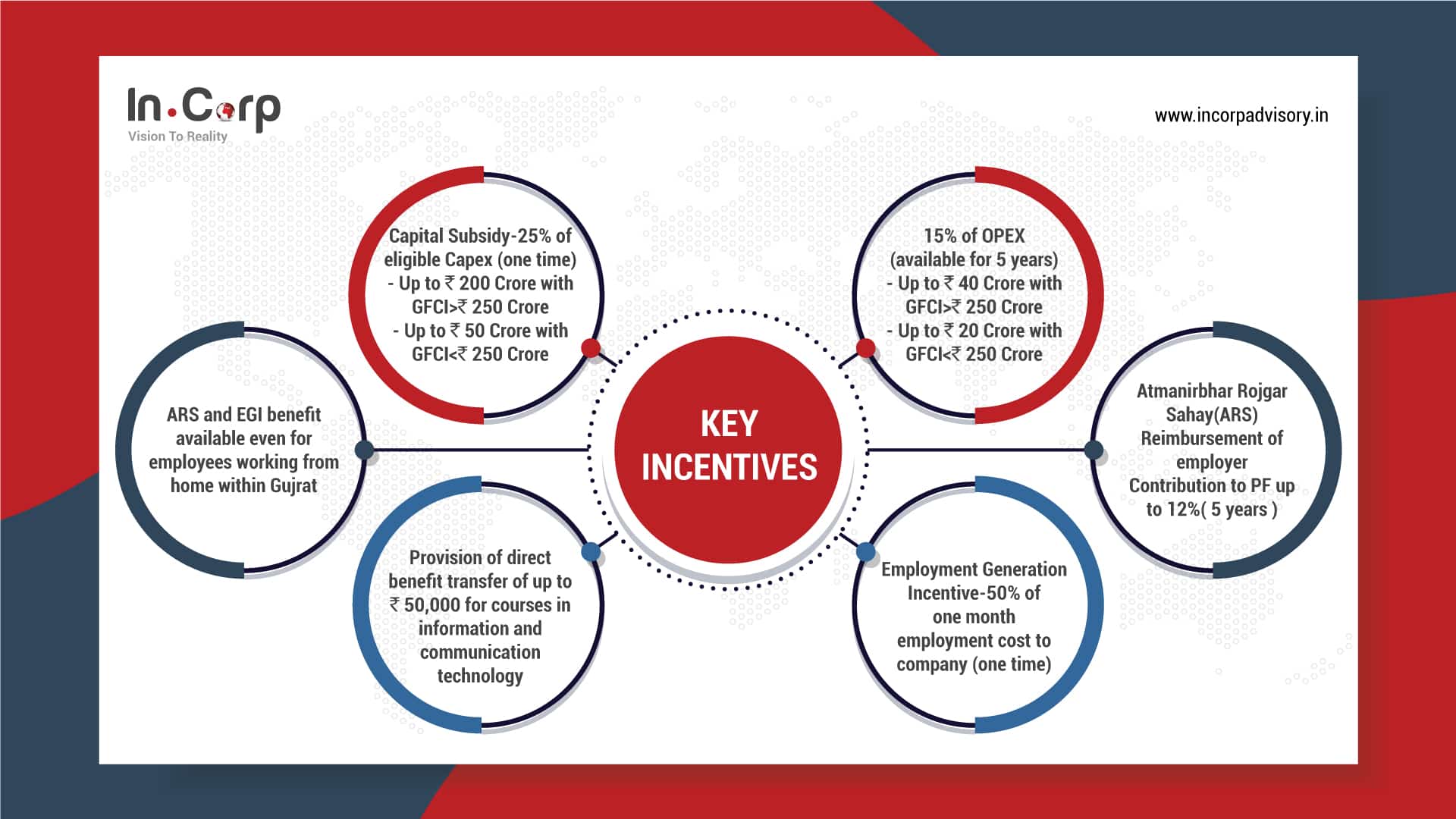

One of the most significant advantages of GIFT City IFSC over Singapore is the tax incentives. The Indian government has implemented several tax incentives to attract foreign investors to GIFT City IFSC. For example, companies operating in GIFT City IFSC are exempt from taxes on income generated from international transactions. Moreover, the Indian government has also implemented a low tax rate of 9% for companies operating in GIFT City IFSC, which is significantly lower than the tax rates in Singapore.

In contrast, Singapore has a higher tax rate than GIFT City IFSC. The corporate tax rate in Singapore is 17%, which is higher than the tax rate in GIFT City IFSC. Moreover, Singapore has implemented a Goods and Services Tax (GST), which imposes a tax of 8% on goods and services sold in Singapore.

Related Read: A Complete Overview Of IFSC Gift City And Tax Benefits

Conclusion

Singapore and GIFT City IFSC are attractive destinations for stockbrokers looking to expand their operations in Asia. Singapore offers access to a well-established financial market with a sophisticated regulatory environment and access to global markets. On the other hand, GIFT City IFSC provides access to the fast-growing Indian market, which offers vast opportunities for growth and innovative financial products.

Additionally, GIFT City IFSC offers more relaxed regulations and tax incentives, making it a more cost-effective option for stockbrokers. Ultimately, the decision between Singapore and GIFT City IFSC will depend on each stockbroker’s unique business needs, risk tolerance, and growth strategy.

Related Read: Benefits For Stock Brokers Registered In IFSC GIFT City

Why Choose InCorp?

InCorp can offer comprehensive guidance to existing and new setups like stockbrokers looking to establish a business in the IFSC jurisdiction.

Our expert team provides valuable insights on regulatory compliance, tax planning, and business strategy to ensure that you can navigate the complexities of setting up your business efficiently and effectively. With our assistance, you can be confident in your ability to establish a successful business plan from the IFSC jurisdiction.

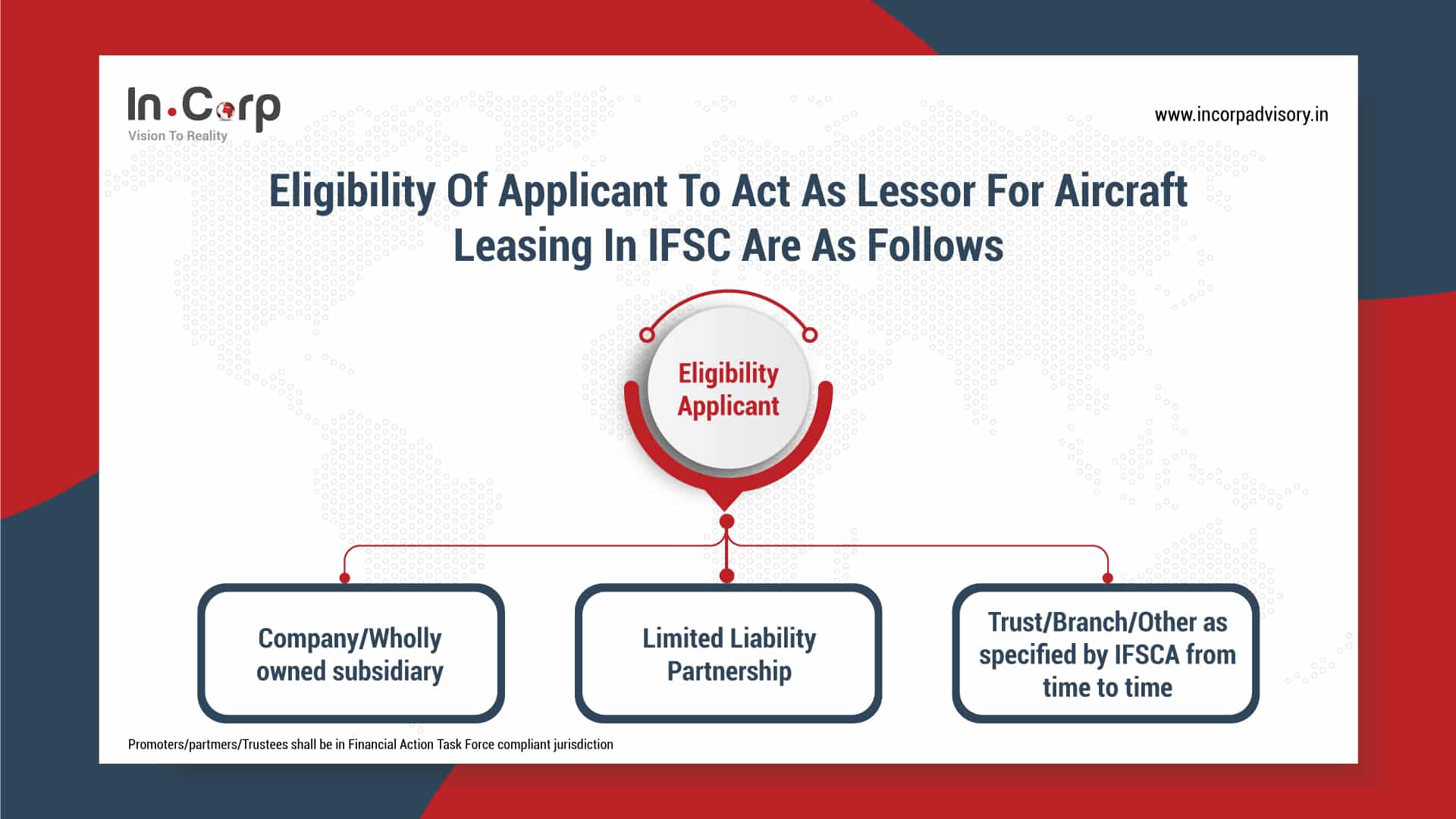

Promoters/partmers/Trustees shall be in Financial Action Task Force compliant jurisdiction

Promoters/partmers/Trustees shall be in Financial Action Task Force compliant jurisdiction