Employee Stock Ownership Plan (ESOP) provides an opportunity for employees to become part owners of stock in the company they work for, at a discounted price. By embracing ESOPs, Family-owned businesses (FOBs) can foster a thriving work environment where employees truly feel invested in the company’s achievements. This often encourages employees to be a part of the organization for a longer duration. Companies of all sizes, including mid-sized and large publicly traded corporations, prefer having ESOPs for their employees. In the recent past, ESOPs have gained popularity as more and more company owners are willing to share ownership and financial rewards with their employees. From tax benefits, talent retention, succession planning, financial flexibility to building a culture of shared ownership, ESOPs offer a holistic approach in addressing various challenges faced by family-owned businesses. As ESOPs continue to be in discussion, in this article we look at the key benefits and succession strategy of ESOPs for family-owned business.

1. ESOP as a solution for the transition of family-owned business

a. Family-owned businesses, a key pillar of the Indian economy, make up a significant number of the privately held companies across our country.

- ESOP can be planned differently based on family transition goals

- For family members who wish to continue to own and run the business, the ESOP can provide significant tax advantages and support powerful gifting strategies to preserve family ownership.

- For family members who are not actively engaged in the business, the ESOP can provide a liquidity option or an income stream that supports life outside the family business.

b. ESOP will become crucial as family-owned businesses transition into the second, third, and fourth generations, aiming to motivate and retain senior management personnel during the succession to the next generation.

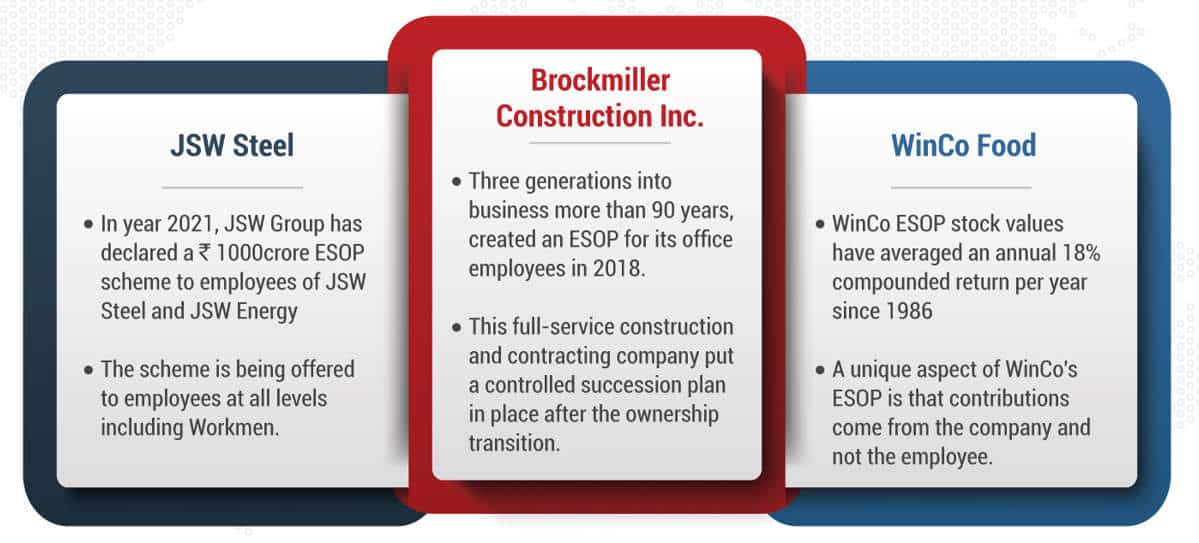

2. Below are a few ESOP success stories of family-owned businesses:

Family-owned businesses worldwide have embraced ESOPs where shared ownership not only secures the company’s future across generations but also encourages and inspires employees to be key contributors to the company’s success. Read below some of the inspiring ESOP success stories.

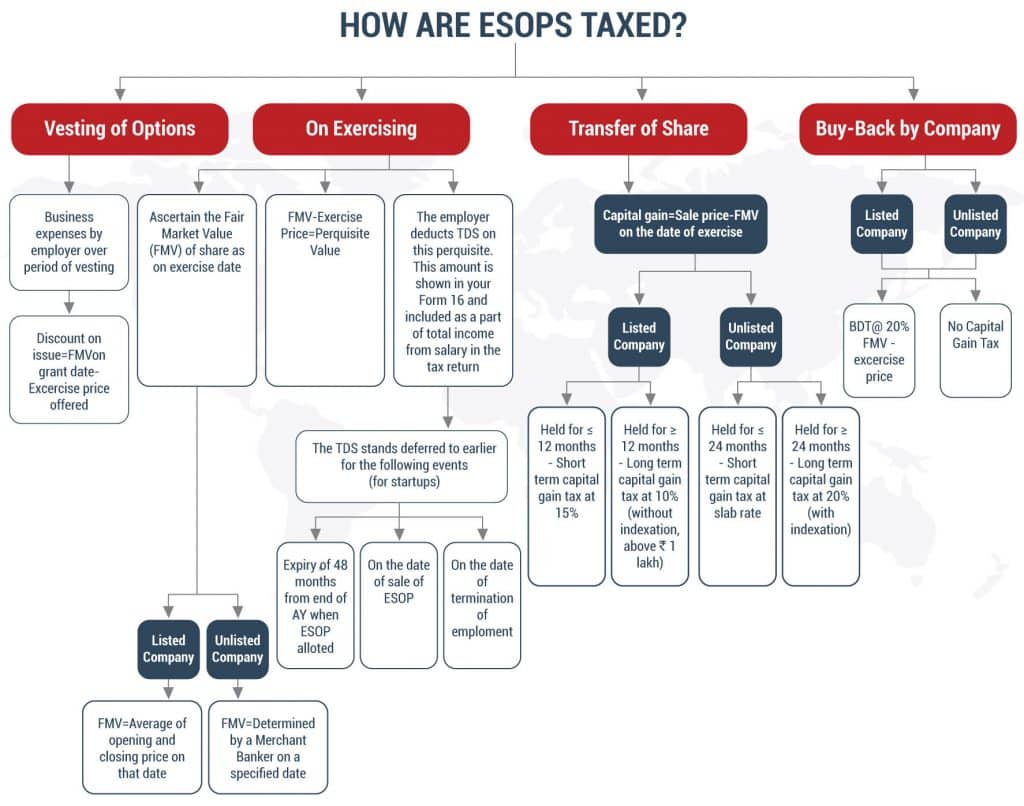

3. The following example will help in understanding the taxation of bonuses in comparison to Employee Stock Ownership Plan in a family-owned business.

a. Employee A is a highly reliable and hardworking member of XYZ Pvt. Ltd., a family-owned business that has spanned three generations in India. Mr. A is eligible for a project-linked bonus of Rs. 12L by the end of the third year at XYZ, i.e., by 31 March, 2026. XYZ is currently deliberating whether to distribute the bonus equally over a period of four years. Below are the options by which XYZ can pay a bonus to Employee A.

- Option 1- XYZ Limited declares and pays a bonus of Rs. 3L annually to ‘A’ from March 31, 2023, onwards.

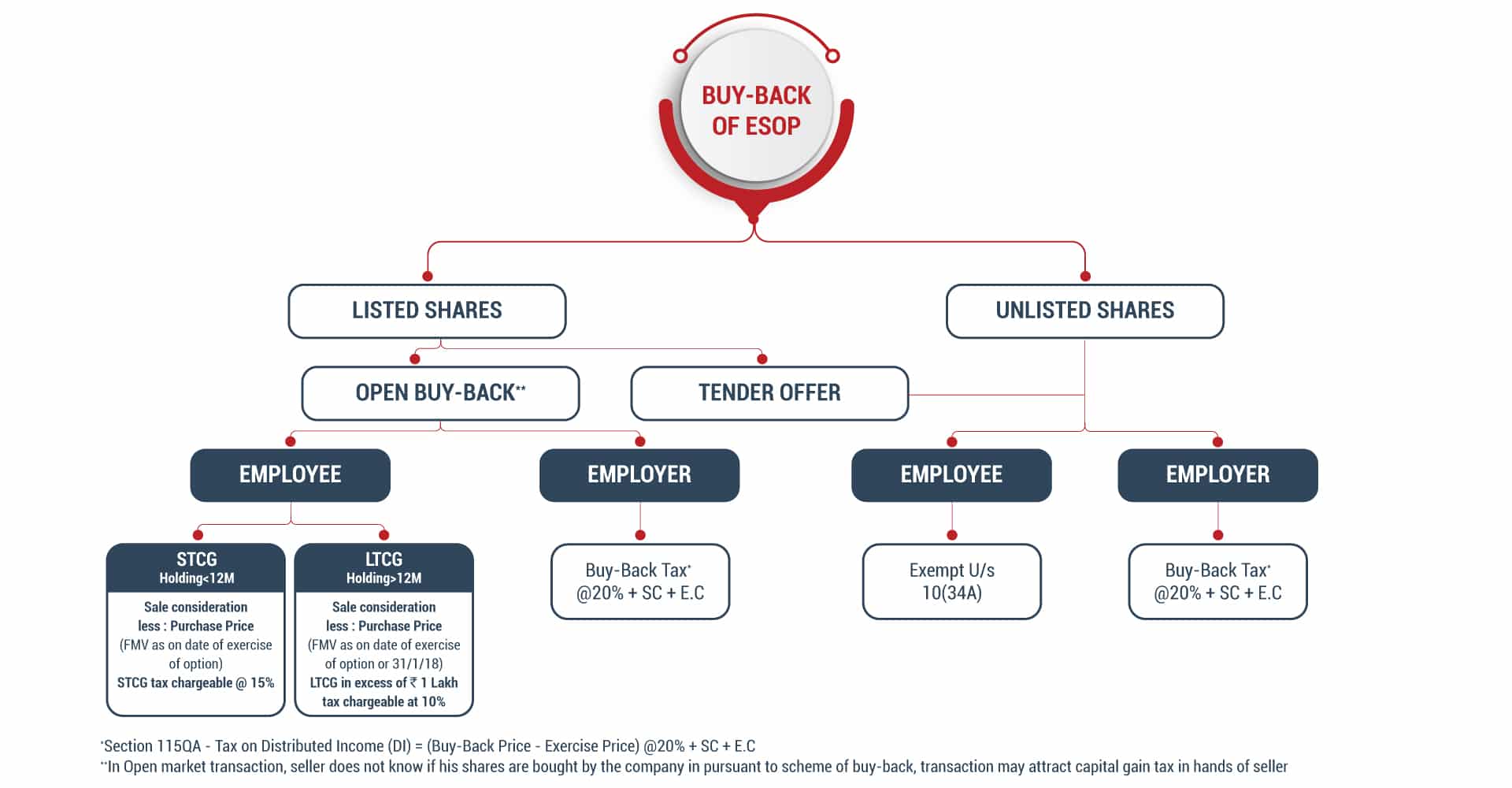

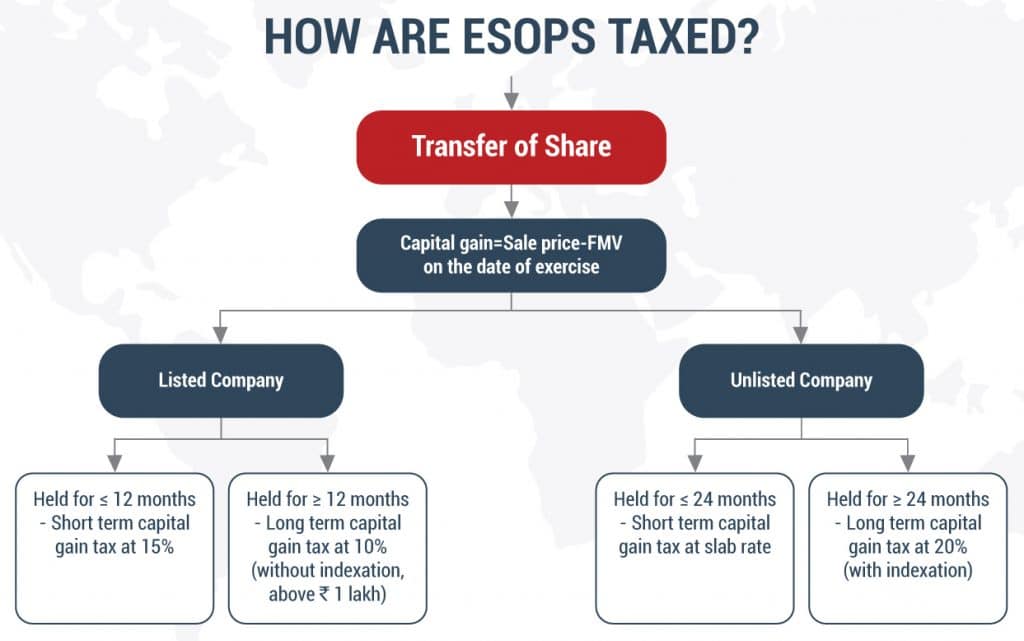

- Option 2- In March 2023, XYZ grants ESOP of Rs 3L with zero exercise price and XYZ is anticipating a growth of 33% year on yearly basis. These ESOP are exercised by employee ‘A’ on 31 March, 2024. By 1 April 2026, the share value of Rs. 3L will be Rs. 12L based on the anticipated growth. On 15 August 2026, XYZ announces a scheme of buy-back of shares and employee ‘A’ participates in the scheme of buy-back.

b. Now let us see the taxability in the hand of employee ‘A’ over the period under Option A & B.

Option A Amount (₹. In lakh)

| 31 March 2023 | 31 March 2024 | 31 March 2025 | 31 March 2026 | Total | |

|---|---|---|---|---|---|

| Bonus | 3 | 3 | 3 | 3 | 12 |

| Tax @ 30%* | 0.9 | 0.9 | 0.9 | 0.9 | 3.6 |

*Surcharge and E-cess will be applicable additional.

Option B

| Taxable Events | Employee A | Amount (₹. In lakh) |

|---|---|---|

| 31 March 2024 | Exercise of ESOP | |

| Perquisite in the Hands of ‘A’ (Rs 3L – 0) | 3 | |

| Tax on perquisite @30%* | 0.9 | |

| 15 August, 2026 | Buy-Back | |

| Long Term Capital Gain | Sale Consideration | 12 |

| Less: Indexed Fair Market Value

(3L*402/348) |

(3.46) | |

| Long term Capital Gain | 8.54 | |

| Tax @ 20%* | 1.71 | |

| Total tax liability | (0.9+1.71) | 2.61 |

Note: Cost Inflation Index for FY 2023-24: 348 and for FY 2026-27: 402 (assumed)

*Surcharge and e-Cess will be applicable additional

| Option A | Option B | Saving in tax in option B | Taxing saving % | |

|---|---|---|---|---|

| Total tax liability | Rs.3.6 Lakh | Rs. 2.61 lakh | Rs. 0.99 Lakh | 8.25% (0.99/12*100)

|

Based on the above facts, it will be noted that the tax liability of employee ‘A’ will be less under option B (ESOP) by around 8.25%. From employer XYZ’s perspective, the employee will remain with the company for almost 5 years. Accordingly, family-owned businesses should consider implementing ESOPs for long-term benefits to both the employee and the employer.

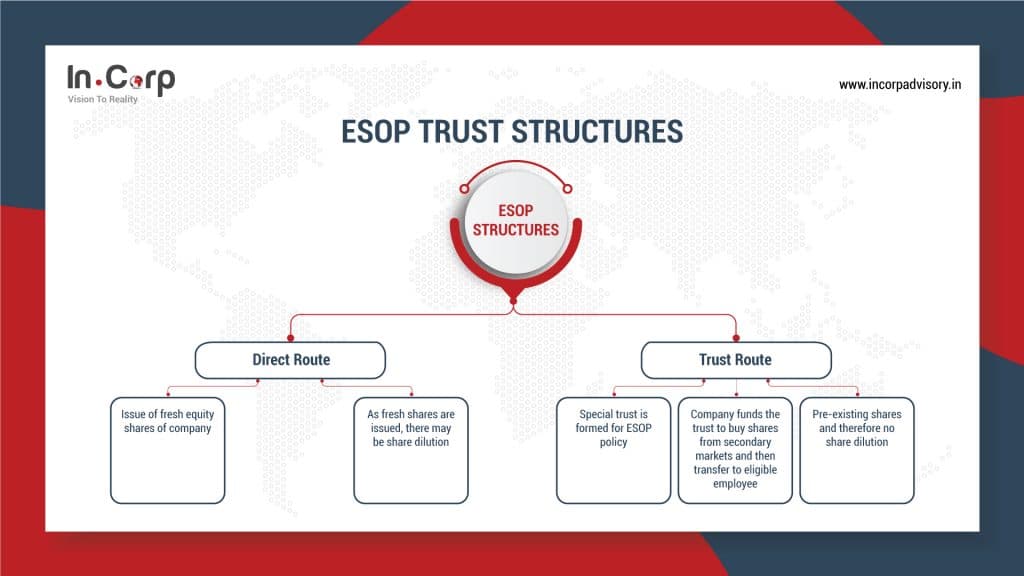

4. Key benefits of ESOP for family-owned businesses (FOB)

- An ESOP holder can own a minority stake in the company.

- The business remains under the control of the board of directors, ensuring continuity in senior management.

- Discounts on the issue of ESOP can be claimed by the company as tax-deductible expenses.

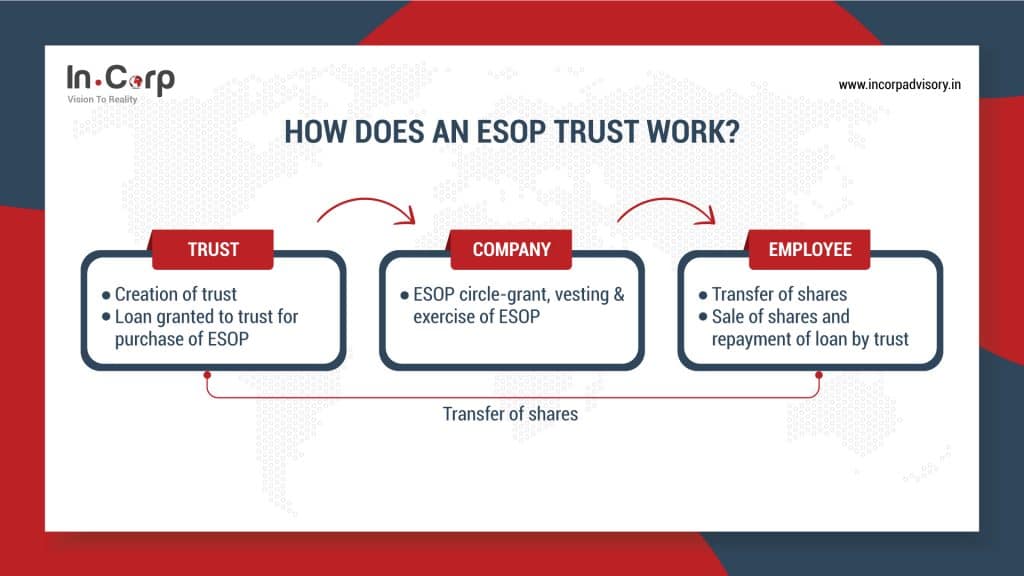

- An ESOP trust, managed by an ESOP Trustee, holds company stock on behalf of employees, maintaining non-employee control over the company.

- Upon achieving profitability, FOB (Family-Owned Business) has the ability to distribute dividends among shareholders, allowing employees (as ESOP holders) to earn additional income.

- FOB can avoid cash compensation as a reward to employees and thus save on immediate cash outflow during the project commissioning phase.

- To secure future control, the promoter’s family will receive warrants for purchasing a significant portion of the company at a predetermined valuation milestone, ensuring ongoing benefits for the FOB families.

5. Takeaways

- In the evolving landscape of smaller nuclear families in India, ESOPs play a crucial role in preserving the legacy of a company and fostering its growth. Moreover, ESOPs contribute significantly to succession planning in family-run businesses by extending ESOPs to longstanding and loyal employees.

- This strategic approach not only aids in retaining key personnel but also serves as a powerful incentive, aligning the values of the company with the interests of its employees. The result is a harmonious balance that supports the continuity of family values while ensuring the sustained success and development of the business.

- Selling a portion of the family-owned business to the employees through an ESOP is often a natural and comfortable transition, and it allows the culture of the company to remain intact while giving the family ultimate flexibility to meet the needs of all family members. They should structure ESOP in such a way that maximum holding remains with them.

Why Choose InCorp?

Incorp is part of a global family with a strong base in India. From company incorporation and compliance to providing tax planning, advisory services, and assurance, our team of experts ensures that you can confidently navigate the complexities of the Indian market. Over the years, we have worked with family-owned businesses in setting up ESOPs and smoothen the transition phase. Our team of experts can assist you in establishing an ESOP Plan, ESOP Trust, and other related services for your organisation.

ESOPs create a direct alignment of interests with the success of the company being linked to the success of employees and co-owners. We help you setup this culture of shared success and maintain the collaborative spirit that drives individual and organisational growth.