Gone are the days when one felt that Section 195 was a mind-numbing T(e)D(iou)S provision. Two years ago, when one thought that 194Q was the largest sea, now we plunged into the ocean of Section 194R and 194S.

Section 194R of the Income Tax Act, 1961 was first introduced in the Finance Act 2022 and the Central Board of Direct Taxes (CBDT) published certain guidelines dated 16.06.2022 to enable effective implementation of the provision. Section 194R regulates the taxability on benefits/perquisites arising to any resident from business or exercise of profession.

We have detailed the key principles and the objective of the Revenue department for inserting Section 194R.

Table Of Contents

Nature Of Income – Any Benefit/Perquisite Provided To A Resident

Nature Of Relationship – Other Than “Employer-Employee Relationship”

Benefit/Perquisite Provider And Receiver

Chargeability Of The Section 194R

Key Takeaways

Implications Of Section 194R Under Special Case Scenarios

Ramifications Of Section 194R

Why Choose Incorp?

1. Nature of income – Any benefit/perquisite provided to a resident

By itself it can be inferred that “any benefit/perquisite” enlarges the scope of this provision to a range of transactions. The primary checkpoint before applying section 194R is that the benefit/perquisite is provided to a resident and arises from business or exercise of profession by said resident.

Case Study 1.1

Mr. X runs a trading business in the garment industry. He provides various incentives to its agents to boost sale targets. During FY 2022-23, Mr. X provides free tickets for an event to Mr. A- its resident agent with the highest turnover. Does this benefit/perquisite come under the purview of section 194R?

Yes. There is a benefit/perquisite (free tickets for an event) provided by a person (Mr. X) to a resident (Mr. A) on account of business or exercise of profession carried on by such resident. Therefore, it can be concluded that the benefit provided to him is on account of business or exercise of profession by Mr. A to Mr. X.

Case Study 1.2

Company XYZ is a trader in the automobile industry that manufacturers and sells motor vehicles. It has recently launched an electric vehicle. It provides a free test drive to its prospective customers. Does this benefit/perquisite come under the purview of section 194R?

No. Free test drive does not arise on account of business or exercise of profession. The customers are end consumers of the motor vehicle and do not engage in any business or profession to avail such benefit. Therefore, any benefit provided to end consumers do not fall under purview of 194R.

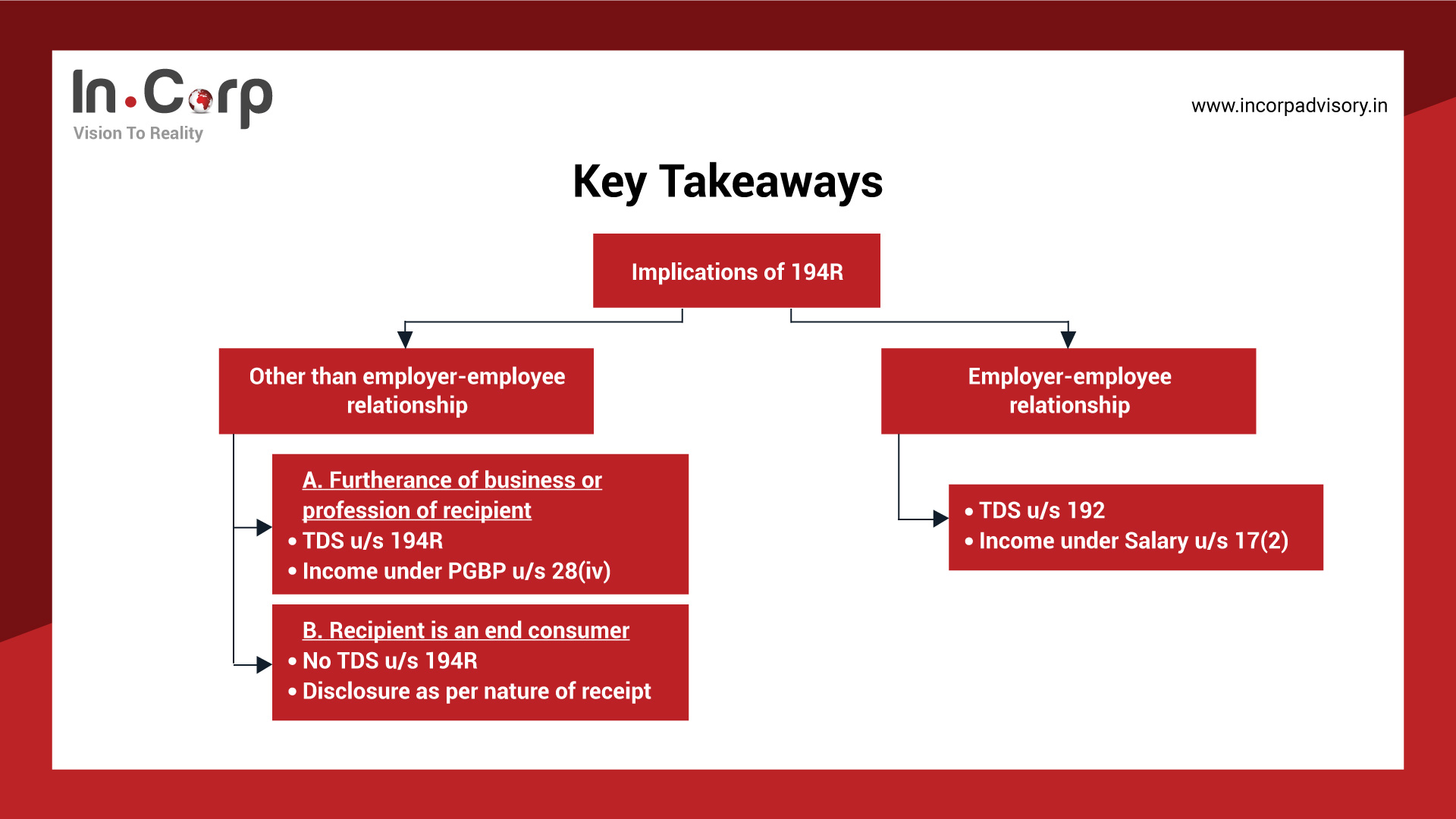

2. Nature of relationship – Other than “employer-employee relationship”

Another interpretation made from the provisions of the section as well as the guidelines issued by CBDT is that Section 194R targets to regulate the Benefits/perquisites provided in other than an “employer-employer relationship”. Benefits/perquisite provided in an employer-employee relationship are already governed by the provisions of Section 17 and corresponding TDS Section 192 of the Income Tax Act.

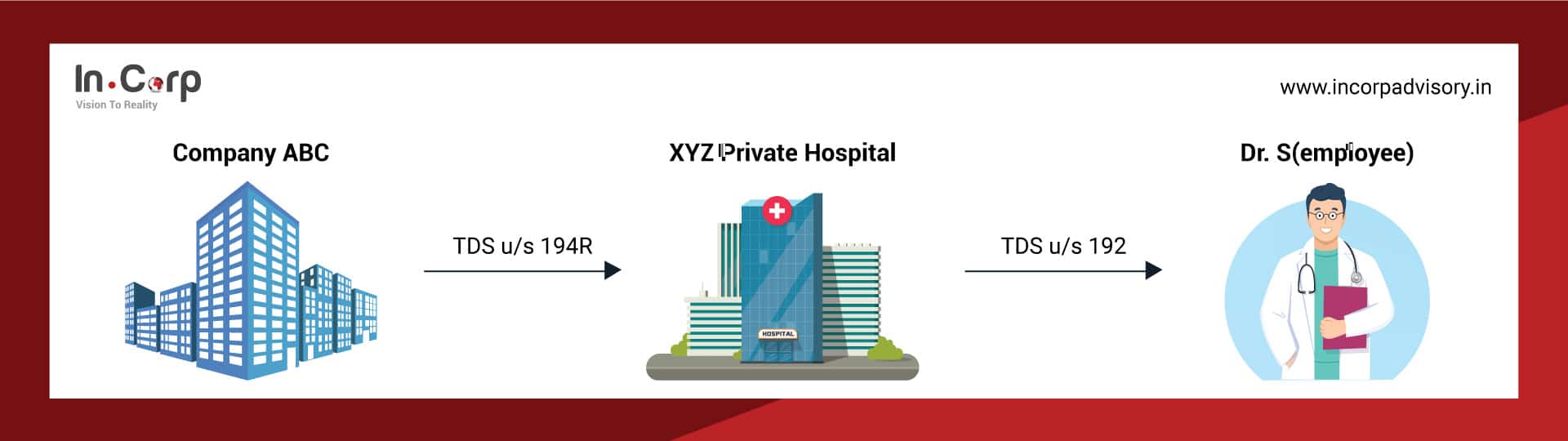

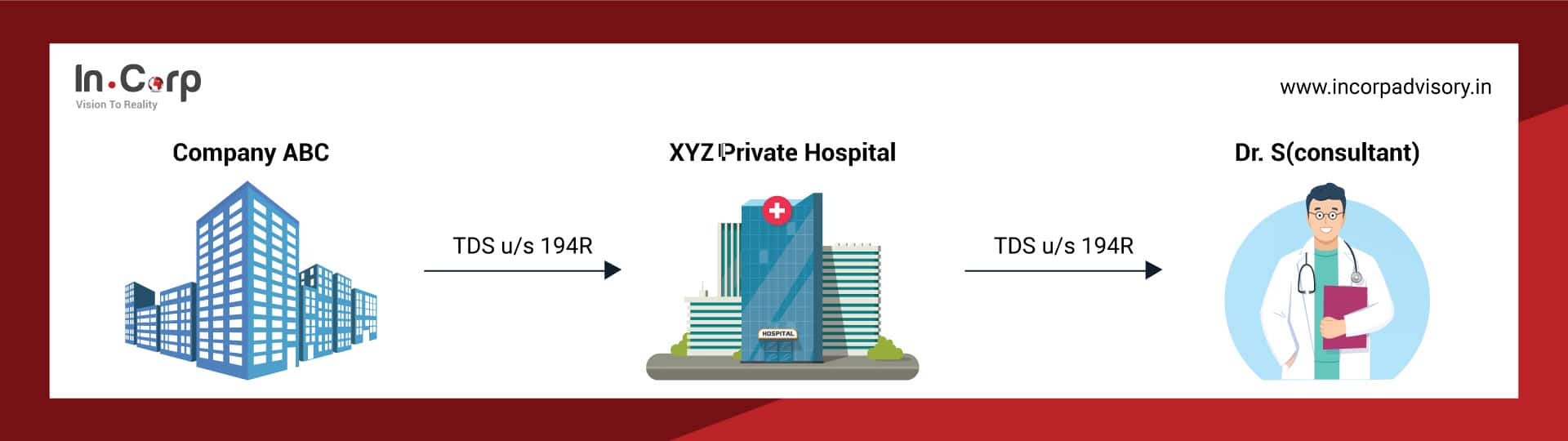

Case Study 2

Company ABC is a pharmaceutical company. It has administered a new drug and to obtain recognition it distributes free samples to Dr. S a medical practitioner. Does this benefit/perquisite come under the purview of section 194R if:

- Dr. S is an employee at XYZ Private Hospital.

- Dr. S is a consultant at XYZ Private Hospital.

Situation I – there are two tranches of benefits/perquisites provided.

- Tranche A: Company ABC and XYZ Private Hospital = other than “employer-employee relationship”. Therefore, 194R is attracted.

- Tranche B: XYZ Private Hospital and Dr. S = “employer-employee relationship”. Here section 192 is attracted instead of 194R.

Situation II – the two tranches of benefits/perquisites provided constitutes to other than “employer-employee relationship” only. Therefore, 194R is attracted to both tranches.

Note: In the above case scenarios, if the benefit/perquisite is provided to a government entity not carrying out business or profession (eg: Government hospital) then no TDS under section 194R.

Related Read: TDS On Purchase Of Goods W.E.F 01.07.2021

3. Benefit/Perquisite provider and receiver

As per the provisions laid down in the Income Tax Act, the provider may be a resident or a non-resident, but the receiver must be a resident. The implications of the same are tabulated hereunder:

| Benefit/perquisite provider | Benefit/perquisite receiver | Implications |

|---|---|---|

| Resident/Non-Resident* | Resident having business or profession. | Tax deduction u/s 194R |

| Resident/Non-Resident | Resident being an end consumer. | No Tax deduction u/s 194R |

| Resident/Non-Resident | Non-Resident | No Tax deduction u/s 194R |

Note: If the benefit/perquisite provider is an individual/HUF whose gross turnover from business < Rs.1 crore or receipts from profession < Rs. 50lakhs then, no tax deduction under section 194R.

*Practical difficulty: In case of a provider being a non-resident, giving benefit/perquisite to a resident will have to carry out excessive compliance procedures with the tax laws of India to provide certain benefits/perquisites.

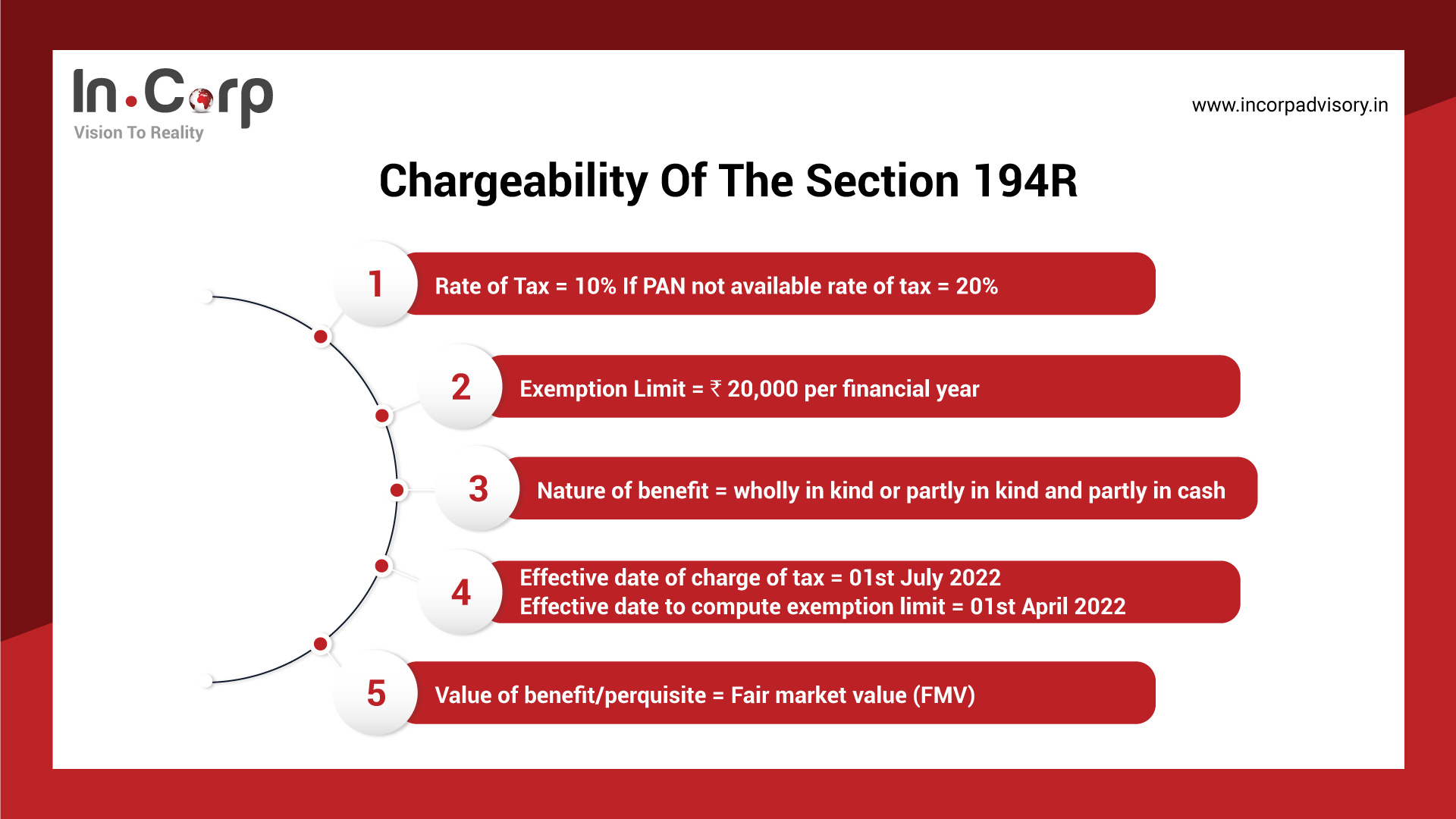

4. Chargeability of the section 194R

Note: Two exceptional cases to derive value of benefit/perquisite where:

- Benefit/perquisite is specifically purchased to provide benefit/perquisite = Purchase price

- Benefit/perquisite is manufactured = Price charged to customers

Case Study 4.1

Ms. B is a social media influencer who promotes various brands to its followers. Company DEF is a luxurious handbag brand who wishes to market its product through influencer marketing. Company sends its handbags to Ms. B to promote the brand. What are the implications under section 194R?

The nature of benefit provided by the company is wholly in kind (supply of handbags). Therefore, the implications are stated hereunder if:

- Handbags sent on return basis – No tax deduction u/s 194R.

- Handbags are not sent on return basis – Tax deduction u/s 194R @10%.

Case Study 4.2

Company MNO is a smartphone manufacturing company having numerous agents. It is company policy to provide various benefits/perquisites to its agents on achieving pre-determined sales targets. Determine the value of benefit/perquisite provided by the company for achievement of targets if the top sales agent receives the following

a. Painting

b. Car purchased by the company.

c. Smartphones manufactured by the company.

| Benefit/perquisite received | Value of benefit/perquisite | Actions by Company MNO |

|---|---|---|

| Painting | FMV of the painting. | Obtain valuation report. |

| Car | Purchase price of Company MNO. | Invoice defining purchase value (excluding GST) to be kept on record. |

| Smartphones | Sales price charged to customers by Company MNO. | Latest arm’s length sales price. |

Practical difficulty: FMV of the benefit/perquisite may not be easily available due to the nature of benefit/perquisite provided. For instance – redeemable coupons/points at a future date. Moreover, in case of a newly manufactured product where no market has been established, it may be difficult to compute the sales price chargeable to the customers.

Case Study 4.3

Chargeability of Section 194R under various scenarios:

| Value of benefit/ perquisite up to 01.04.2022 | Value of benefit/ perquisite from 01.07.2022 | Total value for FY 2022-23 | Value on which TDS charged @10% |

|---|---|---|---|

| Rs. 15,000 | Rs. 18,000 | Rs. 33,000 | Rs. 13,000 |

| Rs. 2,00,000 | Rs. 15,000 | Rs. 2,15,000 | Rs.15,000 |

| Rs. 65,000 | Nil | Rs. 65,000 | No tax on benefits provided prior to 01.07.2022. |

5. Key Takeaways

6. Implications of Section 194R under Special Case Scenarios

Sales discount, cash discount and rebates allowed to customers

As the provision states tax on “any benefit/perquisite”, sales discount, cash discount and rebates also come under the purview of 194R. However, guidelines issued by CBDT specifically state that no tax is required to be deducted under 194R in case of sales discount, cash discount and rebates allowed to customers.

Reimbursement of expenditure

A. Making payment on behalf of a party and then being reimbursed for the same amount is a routine transaction carried out by a variety of industries, especially professional service providers. Principles of reimbursement of expenditure are stated hereunder:

- Backing by actual third-party documentation.

- Form & substance should clearly evidence that the expenditure is of the payer and is being reimbursed to the payee.

- Evaluate the nature of expenditure incurred and whether the same are to be reimbursed.

B. One can say that the implications of section 194R are manifold and inconceivable. This realisation is encountered when “reimbursement of expenditure” come under purview of “any benefit/perquisite”. Guidelines issued by CBDT give further clarifications on application of 194R in case of reimbursement of expenditure.

Case Study – in line with CBDT guidelines

Mr. T is the auditor of Company DEF having branches all over India. As per assurance engagement, Mr. T travels to different cities to audit the branches. Mr. T incurs certain lodging and boarding expenditure that are later reimbursed by Company DEF. What are the implications of section 194R?

| Name on invoice | Expenditure paid by | Re-imbursed by company | Implications |

|---|---|---|---|

| Mr. T | Mr. T | Yes | 194R applicable |

| Mr T | Company DEF | NA | 194R applicable |

| Company DEF | Mr. T | Yes | 194R not applicable* |

*It is important to note that the expenditure that are re-imbursed are incurred wholly and exclusively to provide assurance services by Mr. T.

Business conferences held for dealers/agents

| Prime objective of business conference | Implications |

|---|---|

| To educate agent about new product launch or address queries or new sales techniques etc. | 194R not applicable |

| To select agent who have achieved pre-determined targets. | 194R applicable |

7. Ramifications of Section 194R

- GST implications on free supply, reimbursement of expenditure needs to be considered.

- 194R opens a pandora’s box for the recipient, if such benefits/perquisites are not recorded in the books of account resulting in non-disclosure of income along with adverse tax implications.

Why Choose Incorp?

At Incorp, we have the expertise and skills to guide you through the entire TDS and TCS processes. We are here to ensure peace of mind, from setting up your company to staying compliant and managing your taxes on time with ease.