Industries and businesses, especially MSMEs, were severely hit due to the outbreak of COVID-19. The pandemic forced several MSME businesses to shut down while the others continued to struggle with liquidity and access to loans. To provide relief to the MSME, the government announced several measures in the Union Budget-2021.

This article will brief you about the MSME schemes that the government launched, their applicability, benefits as well as the reforms it introduces.

Table Of Contents

What Is An MSME?

Who Can Register and avail the MSME schemes?

What Is The Registration Process for MSME?

What Are The Qualifications Under The Udyam Process?

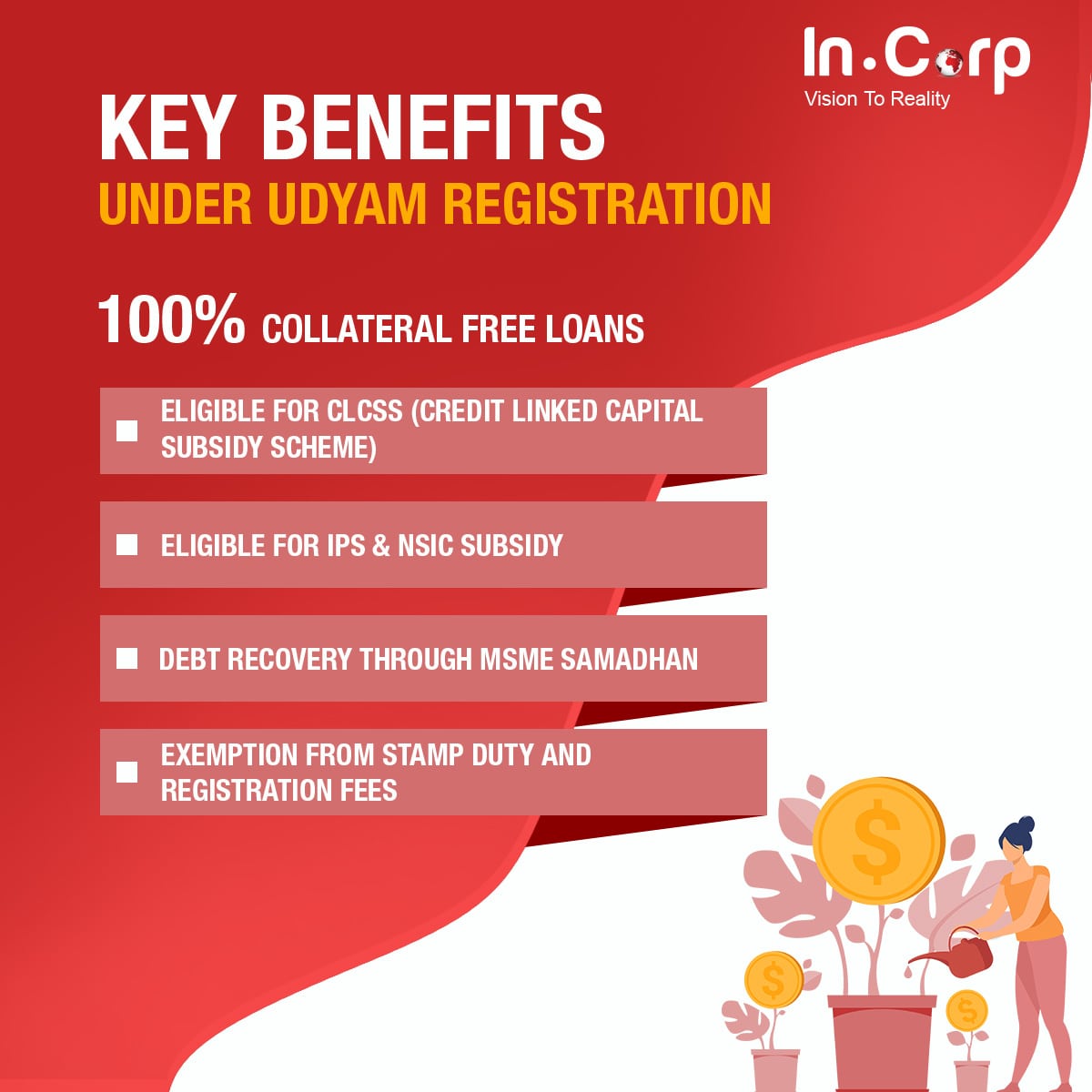

What Are The Benefits Of Registration Under The Udyam Process?

What Are The Advantages Of The Schemes for MSME?

What Are The Financial Incentives Proposed By the Government In The Union Budget Of 2021?

How Can InCorp Help You?

MSME stands for Micro, Small, and Medium Enterprises. Based on the Micro, Small, and Medium Enterprises Development (MSMED) Act in 2006, the enterprises are classified into two divisions.

- Manufacturing enterprises – engaged in manufacturing or production of goods in any industry.

- Service enterprises – engaged in providing or rendering services.

Classification

Micro

Small

Medium

Manufacturing & Services

Investment* < Rs 1Cr and turnover < 5Cr

Investment < Rs 10Cr and turnover < 50Cr

Investment < Rs 50Cr and turnover < 250Cr

*Investment – The original value (Purchase Price) of Plant and Machinery or Equipment is to be considered while calculating the amount of Investment.

Each kind of business element is qualified to acquire the Udyam registration certificate.

| Proprietorship | Limited liability partnership (LLP) |

| Hindu Undivided Family (HUF) | Private limited or limited company |

| One Person Company (OPC) | Co-operative Societies or |

| Partnership firm | Any association of persons |

- The minimum threshold to initiate insolvency proceedings raised to INR 1 crore

- Suspension of fresh initiation of insolvency proceedings up to 1 year

- Exclusion of COVID-19 related debt from the definition of ‘default’ for triggering insolvency proceedings

To support the economy and MSMEs that were severely affected due to the outbreak of

COVID-19:

- The government announced an allocation of INR 15,700 crores for the MSME sector which is double the Budgeted Expenditure of 2020

- A higher budget has been allocated towards the Prime Minister Employment Generation Programme (PMEGP) and Other Credit Support Scheme to help the pandemic that struck MSMEs. The previous year the budget was INR 2800 crore and currently, it has been increased to INR 12499.70 crore.

- Customs duties have been reduced to 7.5 percent on semis, flat, and long products of non-alloy, alloy, and stainless steels (raw materials for certain MSME businesses) which would help them procure raw material at cheaper rates than were otherwise available in the domestic market at a higher rate.

- To provide relief to metal recyclers, mostly MSMEs, the exemption in customs duty in steel scrap up to 31st March 2022. Also, ADD (Anti-dumping Duty) and CVD (Countervailing Duty) on certain steel products have been revoked.

- In order to provide relief to copper re-cyclers, duty on copper scrap has been reduced from 5 percent to 2.5 percent.

- On the other hand, on certain finished products produced by MSMEs players, custom duties have been increased to revive the domestic industry of garments, leather, handicrafts, and finished synthetic gems. The minister also announced increasing duty on steel screws and plastic builder wares from 10 percent to 15 percent.

The above-mentioned MSME schemes will help the sector to revive from the impact of COVID-19 and help to create employment opportunities. Efforts have been made to revive small businesses.

The focus has been given on operation reforms in MSME which will increase the confidence in MSME players such as:

- Focus on alternate methods of debt resolution and a special framework for MSME shall be introduced.

- National Company Law Tribunal (NCLT) framework will be strengthened keeping in mind MSMEs.

- E-court shall be implemented for the early resolution of disputes. Ease in dispute resolution will also increase the lenders’ confidence and financing for MSMEs would be readily available.

- Implementation of e-courts and ease in dispute resolution will also reduce litigation costs and enable faster resolution of the disputes.

- Relaxation in One person company’s conditions, this, in turn, will lead to set up of business in a more structured way.

- In the direction of ease of doing business and ease of compliances, there is an increase in the threshold limit of small companies, resulting in the formation of more companies rather than partnership firms or proprietorship firms. The government proposes to do this by increasing the thresholds limit of paid-up capital of small companies from ₹50 lakh to ₹2 crores, and turnover from ₹2 crores to ₹20 crores.

- MSMEs can form companies under the category of small companies so that they can gain the confidence of lending institutions.

Furthermore, the Government wants to focus on helping Covid-hit MSMEs through the MSME loan scheme. It helps by allocating The Emergency Credit Line Guarantee Scheme, which provides 100% guarantee coverage of up to Rs 3 lakh crore to eligible MSMEs, while the allocation for Interest Subvention Scheme for Incremental Credit to MSMEs is at Rs 199.66 crore this year.

How Can InCorp Help You?

Through some amazing reforms, the economy has an opportunity for the economy to grow sustainably. A lot of measures have been introduced to reduce the compliance burden on MSMEs. By way of various incentives to the MSME structure, the government aims to boost the local business and generate employment opportunities.

Incorp can help you with navigating MSME registration and regulations. Our team will guide you and ensure peace of mind from setting up your India company to staying compliant and managing your taxes on time with ease.