Family trusts are incredibly effective and convenient. If utilized wisely, they can be a terrific instrument for succession planning and managing assets, money, and investing in securities, as well as using the trust’s earnings for the beneficiary’s purpose.

In this article, we discuss the types, advantages and the process involved in setting up private family trust in India.

Table Of Contents

What Do You Mean By A Private Family Trust?

Who Are The Parties To The Private Family Trust?

What Are The Different Types Of Private Family Trusts Prevailing In India?

What Are Revocable And Irrevocable Private Family Trusts?

What Are The Objectives And Importance Of Setting Up Irrevocable Family Trust In India?

What Is The Process Of Transferring Assets Through Private Family Trusts?

Conclusion

Why Choose Incorp?

Frequently Asked Questions

What do you mean by a Private Family Trust?

The Indian Trust Act, 1882 has describes a Private Family Trust as:

- A private family trust is a powerful tool for transferring property from one person (owner) to another for the benefit of an individual or a defined group of persons. Generally, it is established by a family member for securing the future of their dependents and relatives.

- The most important reason for setting up a family trust is wealth protection, family succession planning, and asset transfer primarily for the benefit of family members, both during and after the settlor’s lifetime.

- The Settlor is a party or an individual who establishes the trust. They place an asset they own into the trust by transferring it to another individual or party known as a trustee. It comes along with plain instructions that the asset be held for the profit of a third party.

- The goal of a private family trust is for the settlor of trust to gradually transfer his assets to the trust so that the settler legally owns no assets. Still, beneficiaries benefit from them through the trust.

Related Read: What Is A Will And Why Do I Need One Now?

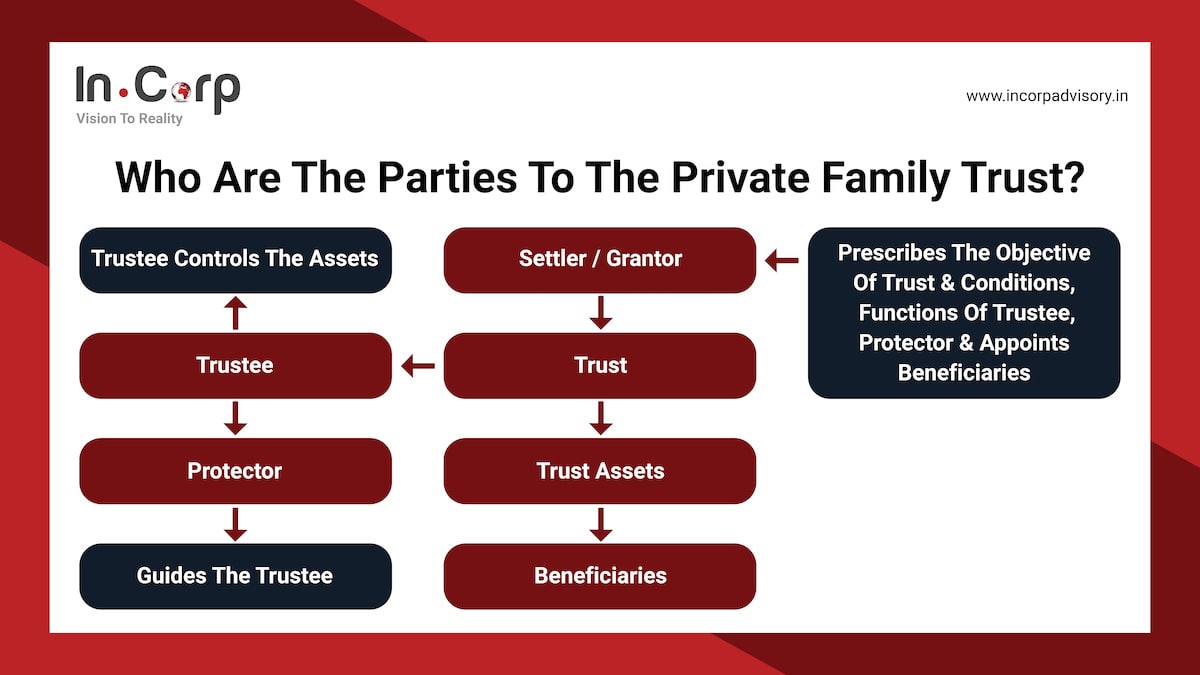

Who are the Parties to the Private Family Trust?

What Are The Different Types Of Private Family Trusts Prevailing in India?

A Private Family Trust can either be a discretionary trust or a non-discretionary trust

- Beneficiaries of discretionary family trusts often have no control over any of the assets held in the trust or how they are distributed.

- The chosen trustee(s) manage the trust money and assets on behalf of the beneficiaries. The trustee has complete discretion over whether to advance payments to one or more beneficiaries or spend the funds on their behalf.

- Under a non-discretionary family trust, the trustee does not have full authority over distributing or paying out the trust assets.

- In some cases, one or more of the beneficiaries may have partial control over the distribution of the assets held in trust. In other cases, the trustee is required to distribute trust assets and income according to predetermined instructions.

- Let’s take a look at the table below to understand the difference between them.

-

Particulars Discretionary Trust Non-Discretionary Trust Control and Power It rests entirely with the Trustee/s It rests with the trustees and partial control with the beneficiaries Rights with Trustees Discretionary rights As per predetermined instructions Distribution of income Distribution is flexible with respect to income or capital Not very flexible Trust operations The beneficiaries cannot interfere with Trust operations Minor interference is possible. Ideal Trustee It is advisable to have a professional expert. A knowledgeable family member. (Elders in the family) When is it right time to create a trust? The ideal time is when the beneficiaries are minor or vulnerable. When beneficiaries are of sound mind and can make accurate decisions. Cost of Trust management You need to incur the costs of a professional trustee. It is cost-effective. Benefits of Trust You can explore better investment options using the expertise of the Trustees. It can help generate higher and sustainable returns. You can efficiently preserve ancestral family wealth. - Furthermore, an asset can be transferred to a trust in the following ways:

- Transfer asset during the lifetime as per wishes of Trust creator/ author /Settler

- Transfer of asset after demise via trust as will

What are revocable and irrevocable Private Family Trusts?

The regulations governing setting up of a family trust in India, allow Discretionary and Non-Discretionary family trusts to either be revocable or irrevocable.

- As an owner of a revocable trust, you may change the terms of the trust at any time.

- You can remove beneficiaries, designate new ones, and modify stipulations on managing the assets within the trust.

- As the owner retains such a level of control, the assets in the trust are not shielded from creditors. If they are sued, the trust assets can be ordered liquidated to satisfy any judgment put forth.

- In contrast, the conditions of an irrevocable trust are set in stone the moment the agreement is signed.

- The main benefit of creating an irrevocable trust is that it provides you with complete asset protection against creditors because the asset no longer belongs to the trust owner.

Want a systematic way to consolidate your finances?

Use our free Personal Finance Tracker!

What are the objectives and importance of setting up Irrevocable Family Trust in India?

The objectives and importance of setting up Irrevocable Family Trust are detailed below:

- In the event of a bankruptcy, a trust can safeguard assets against creditor claims if the assets were transferred two years previous to the bankruptcy being filed through an irrevocable and discretionary trust.

- Assets held in a family trust may have a better chance of being excluded from a property settlement than assets owned directly by an individual in the case of a family settlement.

- Placing assets in a family trust can help avoid Will contests by ensuring that assets kept in the trust are not included in a deceased person’s estate.

- The settlor and the trustee both have a specific function to perform in managing the Trust.

- A trust would lose its legal validity if the settlor’s continued to interfere with the Trust’s activities after signing the trust deed.

- Trusts can be created to possess specific assets that would be inappropriate or impractical for a settlor to split between individuals, such as property or a stake in a family business. The use of a trust allows these individuals to benefit from the assets even though they do not own them. A trust will also aid in the preservation of such assets’ capital value for future generations.

- The settlor can order the managing and advisory committees to advise the trustees on the application and management of trust assets, allowing for a relatively substantial pool of assets/investments under one roof.

- A Living Trust trusts can help safeguard vulnerable beneficiaries from making poor financial decisions if they have sole control of their assets.

- The settler can impose restrictions on the transfer of wealth/assets. The assets of the Trust can be utilised as a tool for preserving family values. For example, a trust deed could include a condition stating that the beneficiary will only be entitled to business revenue provided he looks after the family’s elders.

- Since the legal title to the assets moves from the settlor to the Trustee when they are “settled”. There is no change of ownership when the settlor dies, avoiding the requirement for probate of a will in the case of trust assets.

- The use of a trust can also help a surviving spouse avoid the financial suffering of waiting for probate to be granted. Furthermore, gaining probate in one nation for a will executed in another can be time-consuming and challenging, adding to the grief of bereaved families.

- When a family relocates to another country, it is often an ideal – if not the only – time to establish a trust to avoid taxation in the destination country, safeguarding family wealth and offering management flexibility. Such arrangements necessitate a great deal of professional advice and direction.

- Trust can aid in pursuing business opportunities, such as offshore ventures, interest purchases, and family cross-border travel.

- A trust offers greater flexibility in the organisation and distribution of a settlor’s estate after their death. A discretionary trust established inter-vivo – literally, “during one’s lifetime” – permits the settlor to direct the trustees on how the trust assets should be maintained and dealt with or distributed after his death.

- Such arrangements are usually established privately between the settlor and the trustees. They are set out in a carefully drafted Letter of Wishes that the Trustees keep for future reference.

- In this manner, a settlor can maintain the confidentiality of his dealings with the trustees and ensure that no one, including the trust’s beneficiaries, is aware of his plans.

- A trust can also be used to hold the property for someone who cannot do so themselves, such as minors or bankrupt individuals. It can be used to conceal the beneficial ownership of the real estate.

- Because a trust is a separate legal entity, it can be used for tax planning purposes. Subject to the Income Tax Act restrictions, one might organise the distribution of assets and wealth properly.

Determine your income tax liability by using

our Income tax calculator

What is the process of transferring assets through Private Family Trusts?

The process of transferring assets through a trust can be summarised as under:

Draft a Trust Deed determining the beneficiaries as per objectives set. The trust deed down the basic terms and objective of the trust. The rights and obligation of the Settle, Trustee, Protector & Beneficiaries.

Register Trust with registration authorities. Mandatory in case trust property includes any immovable property.

Transfer asset to trust with payment of required stamp duty.

The Trustee manages the affairs of the Trust.

The Trustee makes income or corpus distribution only to the beneficiaries based on the terms mentioned in the Trust Deed on the instruction of the Settlors or Protector.

Conclusion

A private family trust can be used to provide for specific family requirements, such as education, health, travel, or marriage, by acting as a vehicle that maintains assets specifically for that purpose, multiplying, safeguarding, managing, and securing them for that reason.

Setting up a family trust in India can prove to be very beneficial for your family in the long run.

Why Choose Incorp?

We understand that regulatory compliance and succession planning can be complicated. Our dedicated team of family office management experts, legal professionals, tax & financial advisors who have the required knowledge and experience are happy to assist you.