Remittance to Non-Resident

Any payment made to a non-resident or a foreign company is subject to various rules and regulations. As per provisions of Section 195 of Income tax Act,1961 any person responsible for paying money to a non-resident including foreign company shall deduct income tax for payment made to non-resident.

The remitter making payment to non-resident should furnish an undertaking in Form 15CA containing the information relating to payment of such sum along with certificate attested by Chartered Accountant in Form 15CB. Various aspects of the above compliance are covered as under-:

Part 1: Applicability

Form 15CA is a declaration by any person intending to make remittance:

- to non-resident or to foreign company (irrespective of whether remittance is subject to tax)

- by remitter who can be resident /non-resident/ domestic company/foreign company

- when income accrues/ arises/ received or deemed to accrue/ arise/ received in India (Section 5 of Income Tax Act).

Form 15CB is a certificate required to be filed by the Chartered Accountant when remittance is made

- to non-resident or foreign company is taxable and

- the payment exceeds Rs. 5,00,000/-; and

- when order/ certificate has not been received from Assessing Officer (AO).

Part 2: Non-Applicability

-

1. When is Form 15CA not required?

- When the remitter makes remittance as per the specified list of payments in Rule 37BB of Income Tax Rules.

(Refer: Income Tax Rules) - Not applicable to an individual who does not require RBI approval as per Section 5 of the Foreign Exchange Management Act, 1999.

Example: Mr. A remitted USD 1,25,000 to his son who went to Germany for higher educations. The amount remitted does not exceed the threshold limit of USD 2,50,000 therefore no RBI approval is required for such remittance and Mr. A is not required to file Form 15CA.

-

2. When is Form 15CB not required?

- When the remittance is not taxable.

- If the income is taxable in the country of residence of the remittee.

- When the aggregate of remittances during the financial year does not exceed Rs. 5,00,000.

-

3. Which are the specified payments where Form 15CA/15CB is not required?

The following are the specified payments where Form 15CA/15CB is not required:

» Indian investment abroad » Loans extended to Non-Residents » Advance payment against imports» Imports by diplomatic missions» Intermediary trade » Imports below Rs.5,00,000 » Payment for operating expenses of Indian shipping companies operating abroad » Construction of projects by Indian companies including import of goods at project site » Freight insurance » Operating expenses of Indian Airlines companies » Travel under basic travel quota (BTQ)/ business travel/ pilgrimage/ medical treatment/ education » Payments for maintenance of offices abroad » Remittances by foreign embassies in India » Remittance by non-residents towards family maintenance and savings » Remittance towards personal gifts and donations » Remittance towards donations to religious and charitable institutions abroad » Remittance towards grants and donations to other Governments and charitable institutions established by the Governments » Contributions or donations by the Government to international institutions » Remittance towards payment or refund of taxes » Refunds or rebates or reduction in invoice value on account of exports » Payments by residents for international bidding Part 3: Taxability

-

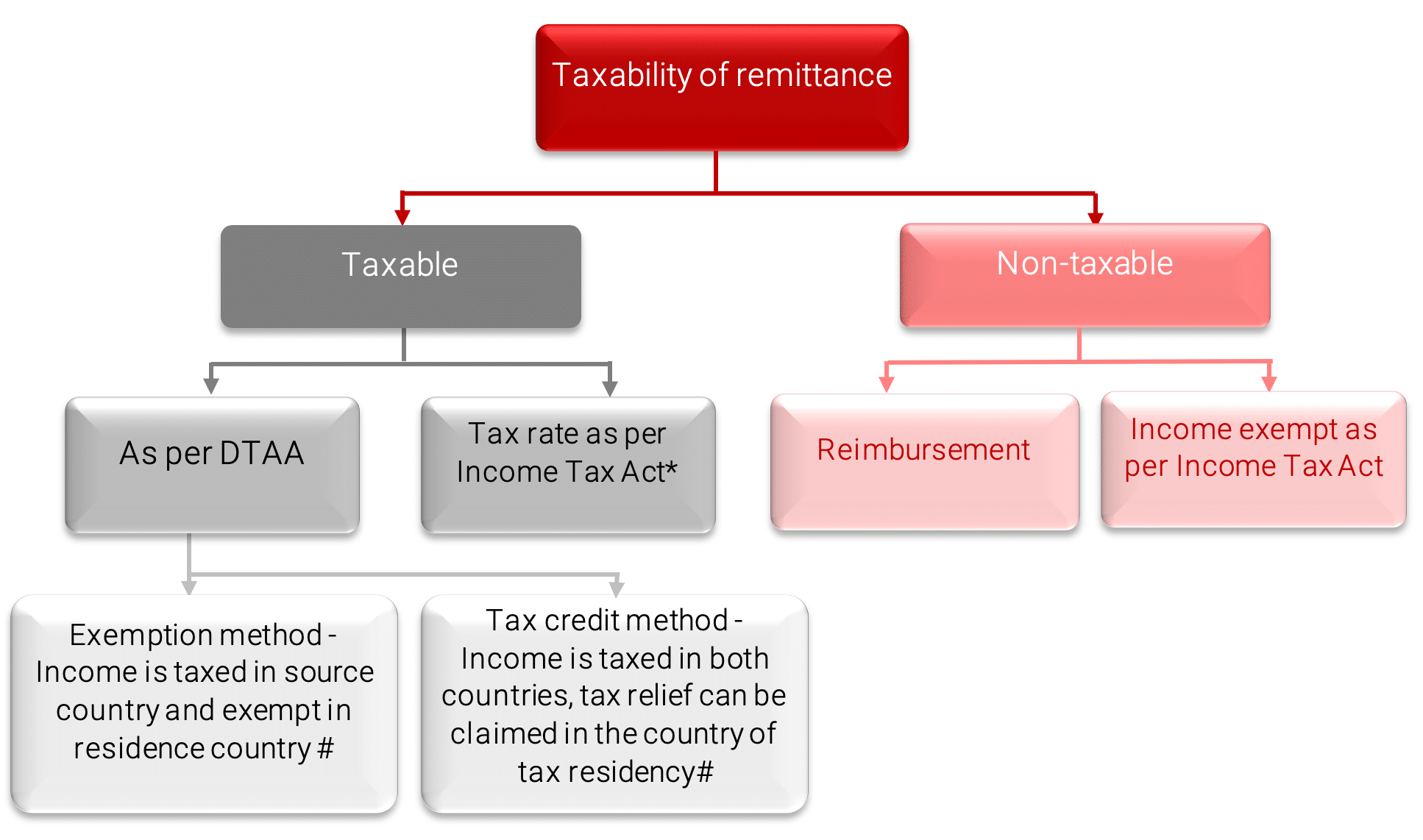

1. What is the tax treatment of the remittances?

*In case if no PAN is furnished then TDS will be deducted at 20% (if details of remittee is not furnished as per Rule 37BC of Income Tax Rules) or relevant TDS rate whichever is higher.

# Person can opt for Exemption method or Tax credit method whichever is beneficial.-

2. What are TDS rates applicable?

Nature of Payment Foreign Company Other than Foreign Company Long Term Capital Gains u/s 115E, 112, 112A 10% 10% Other Long-Term Capital Gains (excluding u/s 10(33) & 10(36))

20% 20% Short Term Capital Gains u/s. 111A 15% 15% Interest payable on moneys borrowed or debt incurred in Foreign Currency 20% 20% Royalty & Fees for technical services u/s. 115A 10% 10% Winnings from Lotteries, Crossword Puzzles and Horse Races 30% 30% Income by way of dividend 20% 20% Any Other Income 40% 30% -

3. What are the rates of surcharge and education cess?

Type of Payment Income/Payment Surcharge Health and Education Cess Payments to Foreign Co. Up to 1 crore Nil 4% 1 crore > 10 crores 2% > 10 crore 5% Payments to Non-Residents (Other than Foreign Company)

Up to 50 lakh 10% 4% 1 crore > 2 crores 15% 2 crore > 5 crores 25% > 5 crores 37% Part 4: Compliance

-

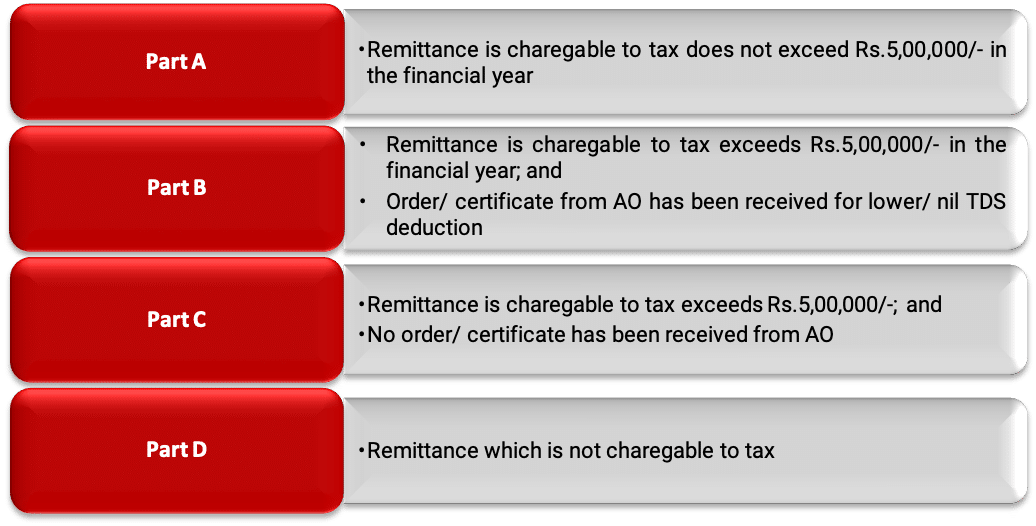

1. What are the various parts of Form 15CA?

-

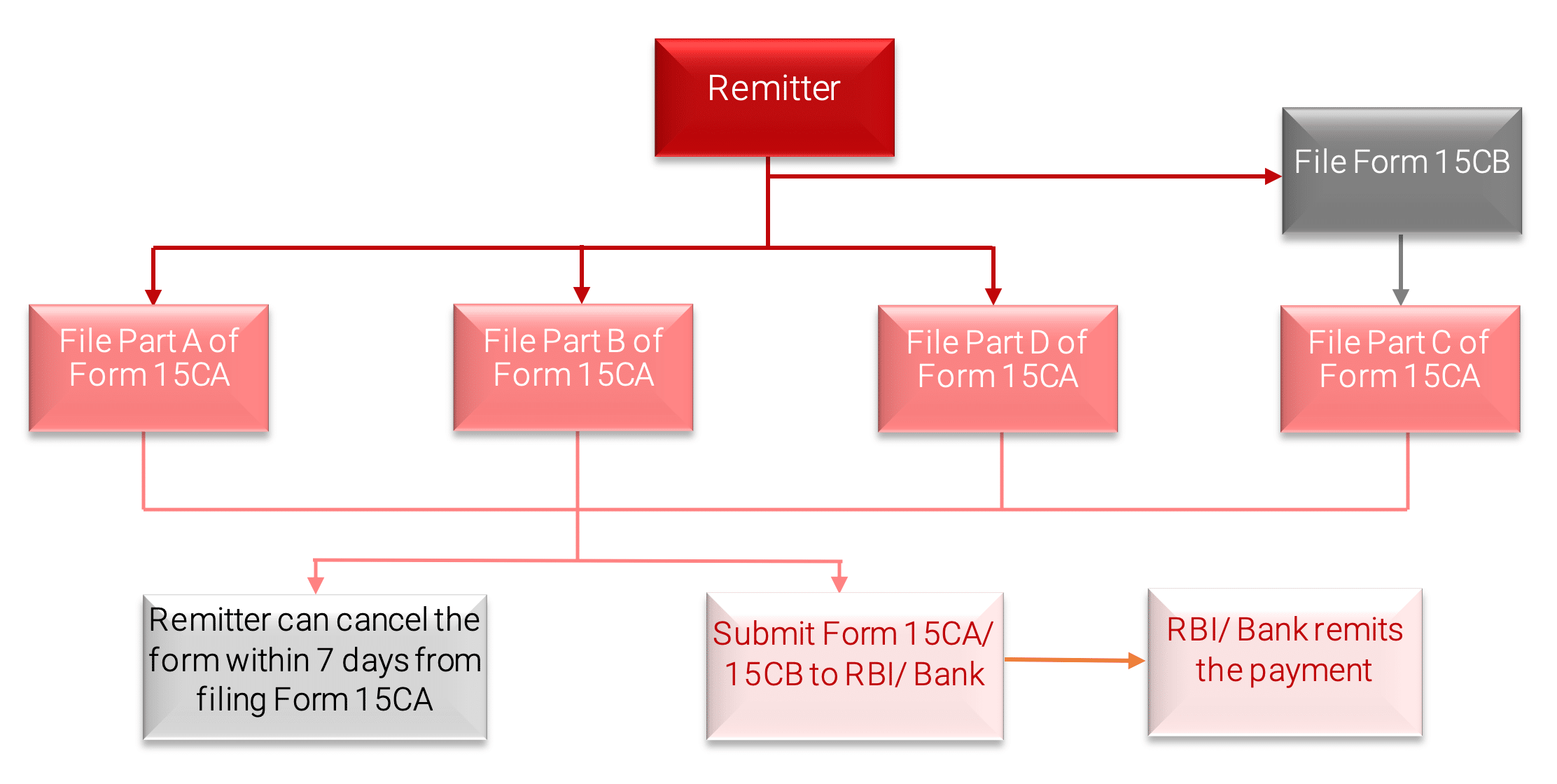

2. What is the procedure for filing Form 15CA and 15CB?

-

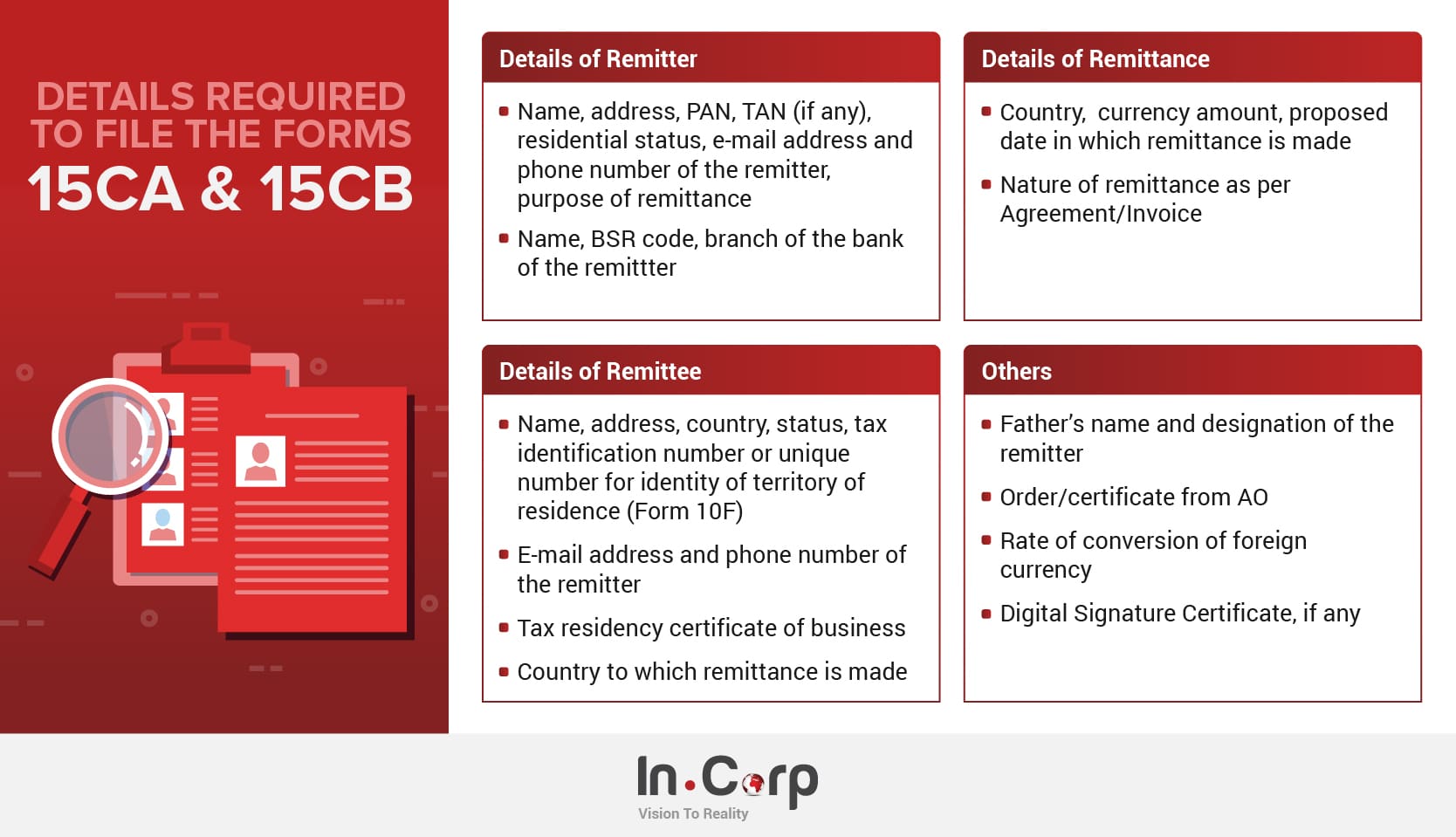

3. What are the details required to file the forms?

Part 5: Frequently Asked Questions (FAQs)

At InCorp, our Team provides seamless support with advisory services and assist you in complying with all the applicable laws and framework thereafter. Explore all our tax services and feel free to get in touch with our experts today.

-