The Union Budget 2023-24 presents a range of tax provisions aimed at boosting the economy and providing relief to taxpayers. The Union Budget 2023-24 proposes changes to the personal income tax structure, rationalization of tax exemptions, and simplification of tax compliance. Additionally, the budget proposes several measures to promote the growth of the agricultural and small business sectors and to enhance the ease of doing business. Overall, the tax provisions in the Union Budget 2023-24 aim to provide a balanced approach to economic growth and fiscal stability, while ensuring that taxpayers receive the support, they need to achieve their financial goals. In this blog, we will highlight the key takeaways from Union Budget 2023-24 for taxpayers and what has brought about significant changes in the Direct Tax & Indirect Tax provisions.

Direct Tax Provisions

A direct tax is a tax that is paid directly by an individual or organization to the government and cannot be shifted to someone else. Direct taxes are typically based on a person’s income, wealth, or property and are usually progressive, meaning the more one earns, the higher the tax rate. Following are the direct tax provision made in Union Budget 2023-24.

Tax Rates

- New Tax Regime shall operate as a Default regime instead of the Old Regime. However, still, the taxpayer shall have the ion to opt for Old Regime

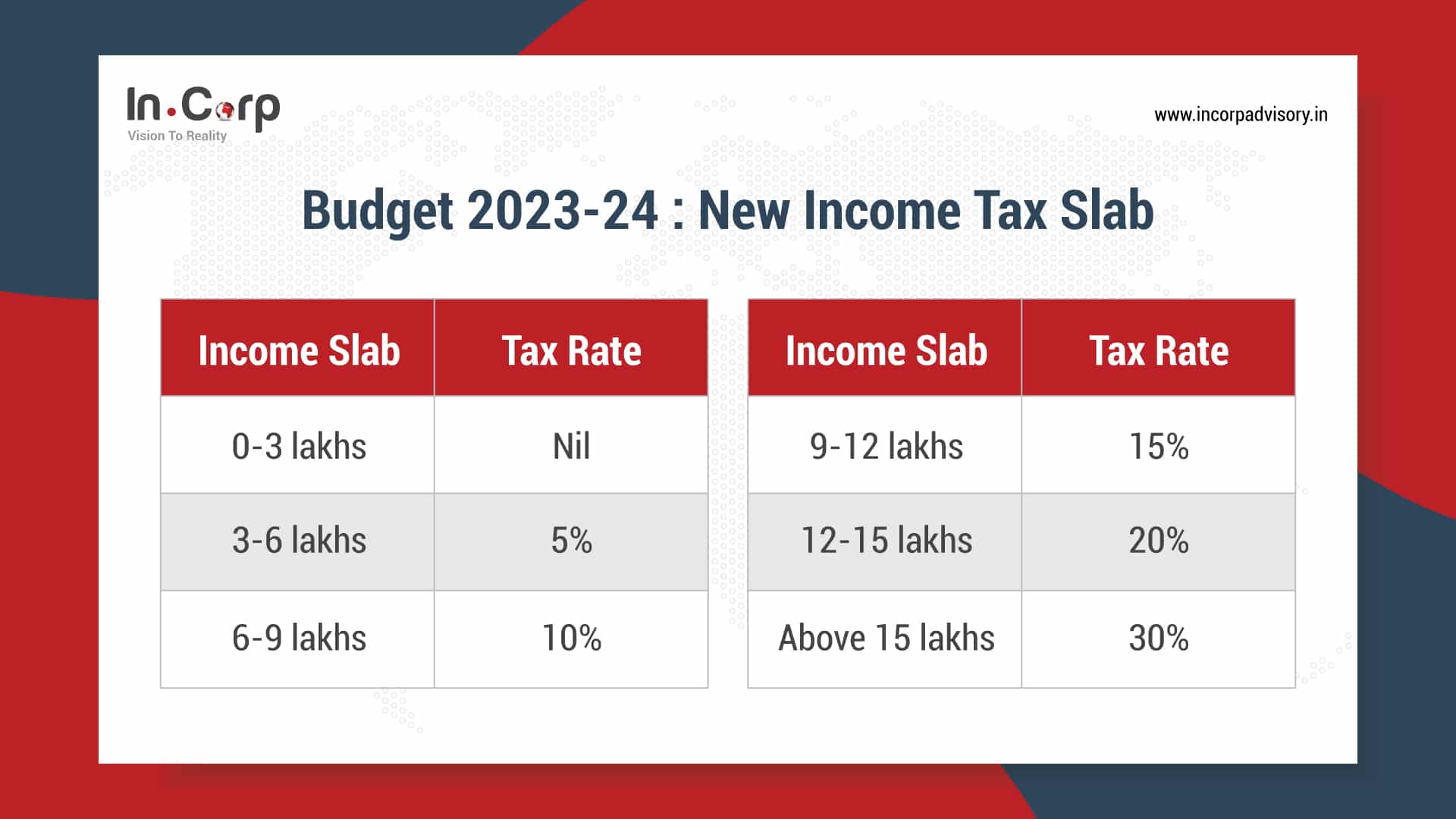

- Changes in personal taxation slab rates for FY 2023-24 under ‘New Income Tax Regime’:

- Rebate limit for income budget increased from INR 5,00,000 to INR 7,00,000 under New Tax Regime

- Highest surcharge rate was reduced to 25% from 37% in the new regime

- Benefit of Newly Incorporated Co-Operative Society engaged in manufacturing shall be taxable at 15% on par with Private Companies

- In case an application for renewal of Charitable Trust is not made in Time, Exit Tax shall be applicable under 115TD

TDS /TCS

- TDS on income from online gaming will be taxed at 30% with no threshold limit

- Threshold limit for cooperative society to withdraw cash without TDS increased to INR 3 crores

Startups

- Date of incorporation for startups to avail of income tax benefits extended to 31-03-2024

- The benefit of carrying forward losses on change in shareholding of startups has been increased to 10 years from 7 years

Business Re-organization

- In case of business re-organization where the return is filed by a successor, the successor shall modify the return within six months

Small Business/MSMEs

- Small businesses having a turnover up to INR 3 Crores (INR 2 Crores Earlier) can opt for the presumptive scheme and similarly professionals having a turnover up to INR 75 Lakhs (INR 50 Lakhs Earlier) can opt for the presumptive scheme, provided gross receipts in cash does not exceed 5% of Gross Turnover

- Expenses on account of services availed from MSME shall be allowed only on a payment basis

Rationalization in Tax Provision

- Special audit of inventory in the books u/s 142(2A) along with audit of books of accounts

- De-criminalization of three Offences w.e.f. 01st April 2023.

Indirect Tax Provisions

An indirect tax is a tax that is collected by an intermediary, such as a retailer or manufacturer, from the person who ultimately bears the economic burden of the tax. The intermediary then remits the tax to the government. Indirect taxes are typically levied on the sale or provision of goods and services, and the burden of the tax is passed on to the final consumer in the form of a higher price. Following are the indirect tax provision made in Union Budget 2023-24.

Related Read: BUDGET 2023 – GST, Customs, Excise Duty Highlights

GST

Relief in GST Provisions

- Prosecution under CGST Act for tax amount increased from INR 1Crore to INR 2 crores (exception for invoicing without supply)

- Decriminalization of certain offences under the CGST Act related to obstruction of duty, tampering of evidence, and failure to supply information

- Reduction in compounding amount from the present range of 50 to 150 per cent of tax amount to the range of 25 to 100 per cent

- Amendments proposed in Section 10 of the CGST Act to enable unregistered suppliers and composition taxpayers to make the intra-state supply of goods through E-Commerce Operators (ECOs), subject to certain conditions

Rationalization in GST Law

- Input tax credit not available for expenditure related to CSR

- Insertion of new Section 158A in CGST Act for sharing of information on the common portal

- Amendment to the definition of “non-taxable online recipient” and “online information and database access or retrieval services” in the IGST Act

- In cases of transport supplier and recipient are both located in India for transportation of goods outside India, the place of supply will be considered as a place of the recipient and not the destination of goods

- Restriction of return filing under GST to a maximum of 3 years from the due date

Customs

Rate changes in Customs (to be effective from 02.02.2023)

Agricultural Products and By-Products

- Pecan nuts: 100% to 30%

Chemicals – BCD on:

- Denatured ethyl alcohol: 5% to Nil

- Acid grade fluorspar: 5% to 2.5%

- Crude glycerin: 7.5% to 2.5%

- Naphtha: 1% to 2.5%

- Styrene & Vinyl Chloride Monomer from 2% to 2.5%

Rubber

- Rate increased for Compounded Rubber from 10% to 25% or INR 30 per kg., whichever is lower

Electronics Goods

- Camera lens and its inputs/parts for camera module of cellular mobile phone: 2.5% to Nil

- Specified chemicals/items for Pre-calcined Ferrite Powder: 7.5% to Nil

- Palladium Tetra Amine Sulphate: 7.5% to Nil

- Specified parts for manufacture of an open cell of TV panel: 5% to 2.5%

Electrical Appliances

- Rate increased for Electric Kitchen Chimney from 7.5% to 15%

- Heat Coil (used in the manufacture of Electric Kitchen Chimneys): 20% to 15%

Automobiles

- New or retreaded pneumatic tyres of rubber tax rate reduced from 3% to 2.5%

- Base metals clad with silver, gold (including gold plated with platinum), platinum, base metals, silver, or gold, clad with platinum, waste and scrap of precious metal, coin tax rate reduced from 12.5% to 10%

- Vehicle (including electric vehicles) in Semi-Knocked Down (SKD) form: 30% to 35%

- Vehicle in Completely Built Unit (CBU) form (other than with CIF more than USD 40,000 or with engine capacity of more than 3000 ccs for petrol-run vehicles and more than 2500 cc for diesel-run vehicles, or with both): 60% to 70%

Specified Capital Goods

- Import of Specific capital goods/machinery for the manufacture of Lithium-ion cells, used in batteries of electrically operated vehicles (EVs): Nil to Nil (no change)

Export Promotion

BCD on certain ingredients/inputs for use in the manufacture of aquatic feed is being reduced subject to IGCR conditions as follows:

- Fish lipid oil & Algal Prime (flour): 30% to 15%

- Fish meal, Mineral and Vitamin Premixes & Krill Meal, : 15% to 5%

Precious Metals

- Rate increased for articles of precious metals from 22% to 25%

- Rate of Imitation Jewellery increased from earlier 22% or INR 400 per kg., whichever is higher to 25% or INR 600 per kg., whichever is higher

Others

- Rates on Toys and parts of toys (other than parts of electronic toys) increased from 60% to 70%

- Aircraft (other than those Nil or 2.5%) and other aircraft tyres (other than Nil) rates reduced from 3% to 2.5%; also attracts AIDC of 0.5%

- Rates on Bicycles increased from 30% to 35%

- BCD on coal, peat and lignite is being increased to 2.5% but exempted from AIDC

Related Read: Union Budget 2023-24 – GIFT City IFSC

Conclusion

In conclusion, the Union Budget 2023-24 presents a well-rounded approach to boosting the economy while providing relief to taxpayers. The proposed changes to personal income tax, tax exemptions, and compliance simplify the process and provide support to achieve financial goals. The measures to promote agriculture and small business growth, along with the ease of doing business, highlight the government’s commitment to balanced economic growth and fiscal stability. Overall, the Union Budget 2023-24 offers positive takeaways for taxpayers and has brought about significant changes in Direct and Indirect Tax provisions that are set to benefit the economy and its citizens.