ESOP Taxation

ESOP Taxation is the most significant factor in determining the creation of wealth through ESOPs. When it comes to ESOP taxes, there are 2 instances when taxes are paid that is (i) At the time of exercise of ESOP and (ii) At the time of sale of ESOP’s.

Let us understand the implication of ESOP’s from the Employer’s perspective.

Tax implication of ESOP in hands of Employer & Employee

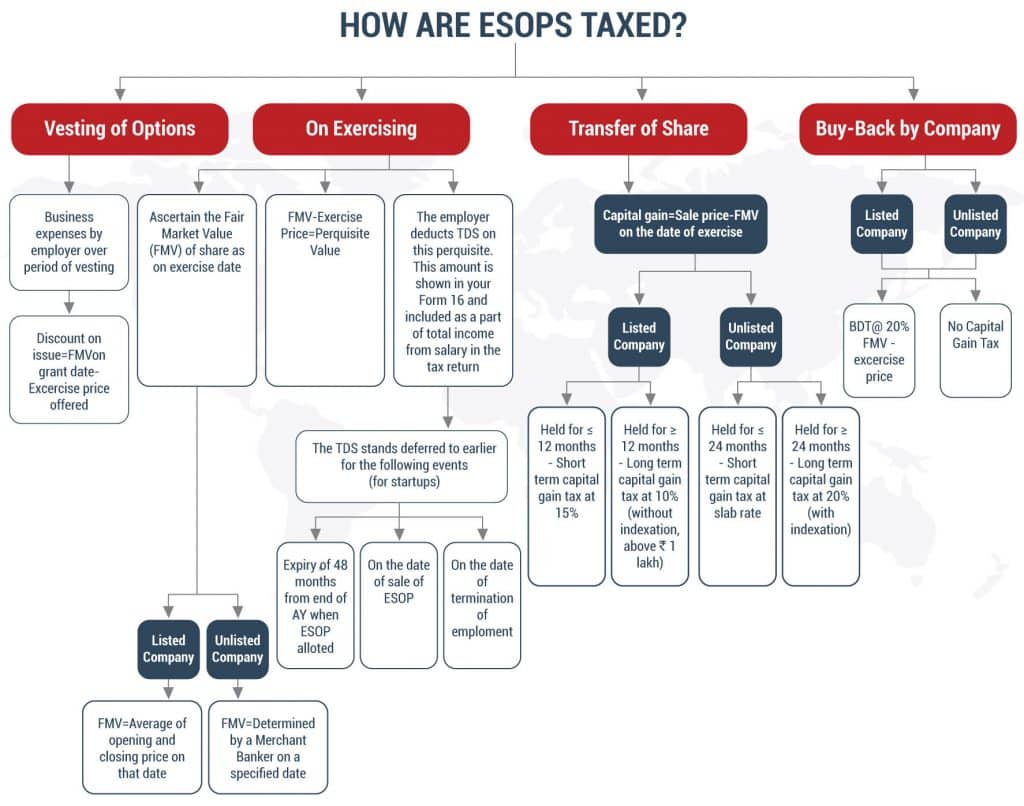

ESOP Taxation differs in the hands of employer and employee. Below chart explains tax implication of ESOP at different stages of ESOP’s lifecycle.

Tax implications in the hand of the Employer at the time of the vesting of ESOPs

Discount on issue of shares i.e. difference between FMV of shares on date of issue of shares and the grant price of ESOP’s, can be claimed by the employer as expenses incurred for the purpose of business over the period of vesting based on various caselaws[1]. The availability of discounts on the issue of ESOP as business expenses remains a litigable issue in the absence of any specific provision under the Act.

[1] CIT Vs. Biocon Limited (2021) (SC) (131 taxmann.com 188), Lemon Tree Hotels (P.) Ltd. (2019) (Del HC) and PVP Ventures Limited (Madras HC) (2012)(211 Taxman 554).

Tax obligation in the hand of Employer at the time of Exercise of ESOPs by employees

The benefit given to employees of exercising ESOPs at a lower price than the FMV on that day is taxable as a perquisite i.e. salary income in the hands of employees. The employer is responsible for withholding and deducting taxes from employee’s salary. The tax would be withheld by the employer at the time of the allotment of shares to the employees, i.e. the tax will be collected from the employee through the payroll of the corresponding month in which the shares are allotted. Typically, the allotment of shares takes place on the date of the exercise of options.

Method for Valuation of ESOP

| At the time of Grant of ESOP | At time of Exercise of ESOP | |

|---|---|---|

| Private/Unlisted Public company | Intrinsic/ Fair Value of share done by registered valuer | Valuation done by Merchant Banker |

| Listed Company | Intrinsic/ Fair Value of share done by registered valuer | Price quoted on recognised stock exchange |

However, the company cannot have 2 different ESOP valuations for a specified date.

Illustration explaining ESOP Taxation in the hands of the employer

Mr. A was granted 100 options under ESOP Scheme by Company XYZ where, 1 option = 1 share of the company.

| Grant Date | 01st April 2022 |

| Vesting period | 2 years from the grant date |

| Vesting conditions | Continuous employment in the company |

| Exercise Date | 01st April 2024 |

| Exercise Price | Rs. 10,000 per option |

| FMV as of 01.04.2022 | Rs. 11000 per share |

| FMV as of 01.04.2024 | Rs. 12,000 per share

(As per valuation report) |

Assumed that the employee exercises the options on 01st April 2024

Tax Implications in the hands of employer:

[a] At the time of Vesting that is 1.4.2022 to 31.3.2024 – Claim of business expenses by Employer

| Particulars | Amount (In Rs) |

|---|---|

| Fair Market Value per share on 1.4.2022 | 11,000 |

| Less: Exercise Price per option | (10,000) |

| Benefit under ESOP Scheme per share | 1,000 |

| No. of shares allotted | 100 shares |

| Business expenses allowed to the employer over the period of vesting | 1,00,000 |

| Claim in year 1 (1.4.2022 to 31.3.2023) | 50,000 |

| Claim in year 2 (1.4.2023 to 31.3.2024) | 50,000 |

[b] At the time of the Exercise of Options on 1 April, 2024 by an employee

| Particulars | Amount (In Rs) |

|---|---|

| Fair Market Value (Rs. 12000 X 100 shares) | 12,00,000 |

| Less: ESOP Exercise Price (10,000 x 100 shares) | 10,00,000 |

| Perquisite in hands of employee | 2,00,000 |

| Tax @ 30%* (assumed) | 60,000* |

| Tax to be deducted by the employer from employee’s salary for the month of April 2024 | 60,000* |

*Plus applicable surcharge & cess

Tax Incentive for Start-ups in the hands of employer

There is deferment of deduction of tax on perquisites in respect of ESOP issued by start-ups subject to conditions under the Act. Please refer to our note on ESOP for start-up.

Basic Accounting entries per Accounting Standard and guidance note on accounting for Share-based payments.

8.1 During Vesting Period

Employee Compensation Expense A/c Dr xxx

To Stock Options Outstanding A/c Cr xxx

(Being compensation expense recognised in respect of ESOP issued)

8.2 At the time of exercise

Bank A/c(Options exercised x Exercise Price) Dr xxx

Stock Options Outstanding A/c(Options exercised x Fair Value*) Dr xxx

To Equity Share Capital A/c(Shares allotted x Face Value) Cr xxx

To Securities Premium A/c (Shares allotted x Premium Value) Cr xxx

(Being shares issued to the employees against the options vested in them in pursuance of the ESOP Scheme)

8.3 After the expiry of the exercise period

The employees are eligible to exercise vested options only during the exercise price. In case any vested options remain unexercised at the expiry of the exercise period, then the expenditure booked for such vested options stands transferred to the General Reserve or Retained Earnings

Stock Options Outstanding A/c Dr. xxx

To General Reserve A/c Cr xxx

(Being unexercised vested options transferred)

Conclusion

With the help of ESOP strategy, giants like Amazon, TCS, Apple, Flipkart, etc., have minted millionaire staff. In the era of transitional shift from traditional business models to digital disruption, as most millennial and Gen Z employees are inclined towards faster growth and success in their careers, these companies have become attractive employers.