ESOP Taxation

Employee stock option plan (ESOP) are granted to eligible employees, who may exercise such options to acquire equity shares of the company in the future and at a predetermined exercise price. Such shares may be acquired subject to the conditions being met as per the plan. ESOPs will form part of the taxable income of the employee.

Let us understand the tax implication of ESOP from an employee’s perspective.

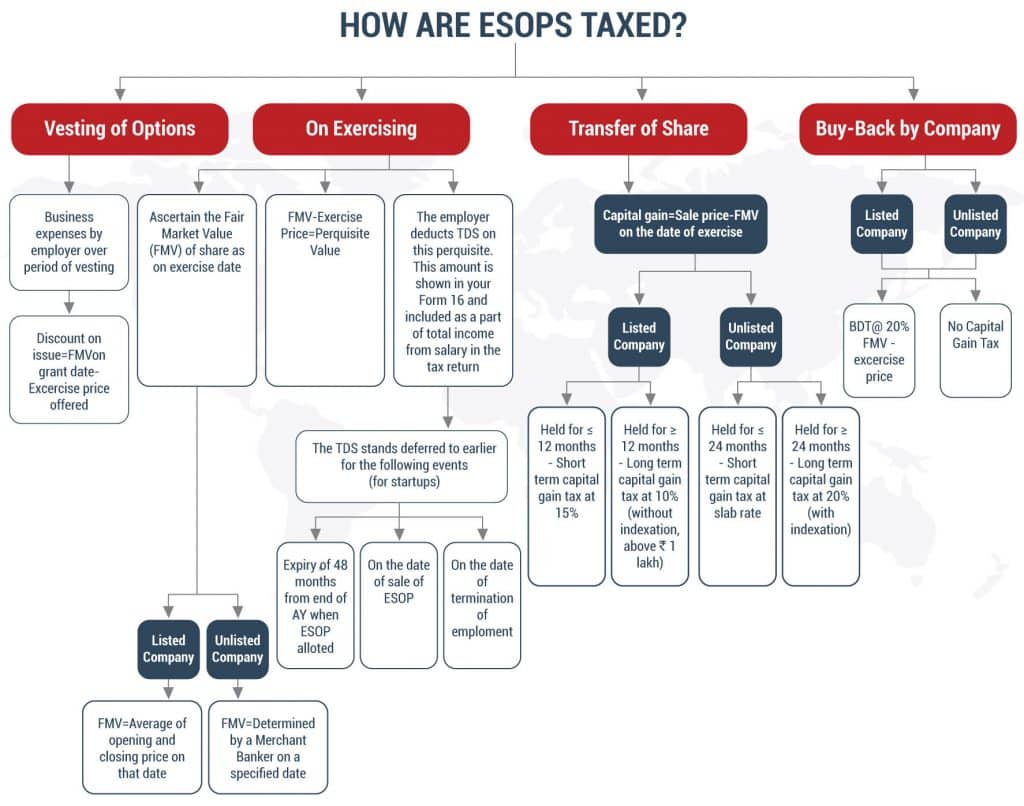

Tax implication of ESOP

*plus applicable surcharge and cess

Tax implications in the hands of the employee

Considering the various steps involved in the implementation of an ESOP (i.e. grant, vesting, exercise), it is important to understand the applicable tax provisions to determine taxability for the employees. The taxation of ESOPs is split into two components:

i. Tax on perquisite as income from salary at the time of exercise;

ii. Tax on income from capital gain at the time of sale/transfer.

Tax implication at the time of Exercise of ESOP

- Exercise of the options is the first taxable event in the hands of employees when the shares are allotted. The taxable perquisite value is determined under the head of income – “Salary”.

- Taxable perquisite = Difference between the Fair Market Value (FMV) of the shares as on the date of exercise as reduced by the price actually recovered from the employee (i.e. the exercise price).

- The liability to deduct tax on the above perquisite is on the employer.

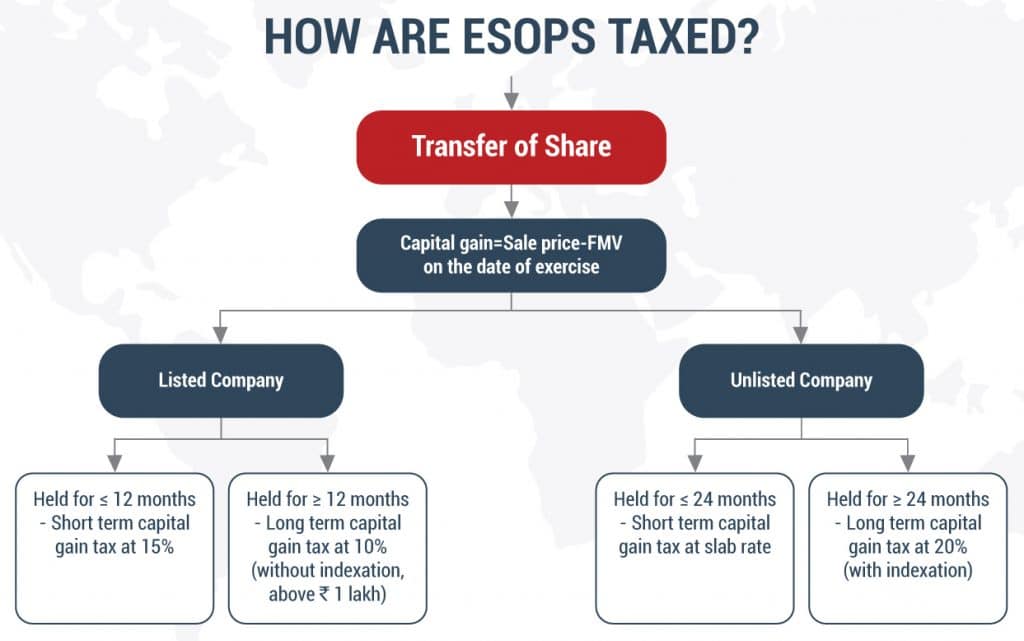

Tax Implication at the time of transfer/Sale of ESOPs

- The shares allotted to an employee under an ESOP are considered as a capital asset and any gain on sale of such shares would attract capital gain tax.

- The capital gains on the sale of shares will be computed on the difference between the sale price and purchase cost (i.e. FMV of the shares as on the date of exercise of options).

- Capital gains may be classified as long-term capital gains or short-term capital gains based on the period of holding of the shares. Refer the following infographic for better understanding.

- The period of holding is calculated from the exercise date to the date of sale. Various caselaws[1] have held that shares under ESOPs are allotted only when an employee exercises his ESOP option.

[1] ACIT Vs. Ambrish Kumar Jhambh (Delhi ITAT) (2013) (32 taxmann.com 210), Giridhar Krishna M. v. ACIT (Bang ITAT) (2008) (117 TTJ 965)

Illustration

Mr. A was granted 100 options under ESOP Scheme by Company XYZ where, 1 option = 1 share of the company.

| Grant Date | 01st April 2018 |

| Vesting period | 2 years from the grant date |

| Vesting conditions | Continuous employment in the company |

| Exercise Date | 01st April 2020 |

| Exercise Price | Rs. 10,000 per option |

| FMV as of 01.04.2020 | Rs. 12,000 per share

(As per valuation report) |

Assumed that the employee exercises the option on 01st April 2020

What are the tax implications if:

- A sells the shares on 04th June 2021 @ Rs. 15,000 per share, or

- A sells the shares on 15th August 2022 @ Rs. 17,500 per share.

Solution:

It is essential to compute whether the gain on sale is long-term in nature or short-term.

a. Holding Period of Unlisted Equity Shares

Long-term – Held for 24 months or more from the exercise date.

Short-term – Held for less than 24 months from the exercise date.

b. Tax Implications if shares are sold on 04th June 2021

| Particulars | Amount (In Rs) |

|---|---|

| Sale Consideration (15,000 x 100 shares) | 15,00,000 |

| Less: Fair Market Value (12,000 x 100 shares) |

(12,00,000) |

| Short-term Capital Gain (Held for < 24 months) |

3,00,000 |

| Tax @ 30% (assumed) | 90,000 |

| Cess @ 4% | 3,600 |

| Total Tax payable by employee | 93,600 |

c. Tax Implications if shares are sold on 15th August 2022

| Particulars | Amount (In Rs) |

|---|---|

| Sale Consideration (17,500 x 100 shares) | 17,50,000 |

| Less: Indexed Fair Market Value (12000*331)/301 = 13196*100 shares |

(13,19,600) |

| Long-term Capital Gain (Held for > 24 months) |

4,30,400 |

| Tax @ 20% | 86,080 |

| Cess @ 4% | 3,443 |

| Total Tax payable by employee | 89,523 |

Note: Cost Inflation Index for FY 2020-21: 301 and for FY 2022-23: 331

Reporting /disclosure requirements in a tax return for holding ESOP by an employee

- The details of shares held in an unlisted company (like company’s name, PAN, number of shares acquired or sold during the year etc.) need to be reported by an employee in their personal income-tax return Part A – General.

- ESOP allotted of a foreign company to an employee in India would also be considered as unlisted shares, if they are not listed on an Indian stock exchange.

- Non-reporting or incorrect reporting of ESOP could result in interest and/ or penalties being levied.

Conclusion

ESOPs provide an opportunity for wealth creation by increasing equity exposure in one’s financial portfolio, allowing long term wealth creation. ESOPs provide flexibility at the time of investments, allowing employees to maximise profits by exercising options when the market price exceeds the grant price (exercise price). ESOPs are generally a win-win for employers and employees, encouraging greater effort and commitment in exchange for bigger financial rewards.