There are several grounds on which a company may be wound up in India. The two major laws governing winding up of a company are the Insolvency and Bankruptcy Code (IBC), 2016 and the Companies Act, 2013.

In this blog, we’ll be looking at the grounds which are covered for winding up of a company under both these above named laws.

Table Of Contents

Winding Up Of A Company Under IBC, 2016

Voluntary Winding Up of Company Under IBC, 2016

Winding Up Of A Company Under Companies Act, 2013

Conclusion

Why Choose Incorp?

FAQs On Winding Up Of A Company

Winding Up of a Company under IBC, 2016

The ground for winding up ‘inability to pay debts’ was earlier covered under Section 271 of the Companies Act, 2013 and was one of the six grounds for winding up under that section. However after the passing of IBC, 2016, the said ground has been omitted from Companies Act, 2013 and is now exclusively covered under IBC, 2016.

Hence, if an entity is unable to pay debts and has committed a default of the minimum amount prescribed, it will have to undergo a process called ‘Corporate Insolvency Resolution Process’ (CIRP) under IBC,2016. The application can be filed by the creditors of the entity or by the entity itself. An attempt will be made to rescue the entity (corporate debtor) and revive it.

If the revival / rescue / rehabilitation is not possible within the prescribed timelines, then the entity will have to undergo winding up and a liquidator will be appointed to execute the process. Hence, the entity may or may not have to undergo liquidation, depending upon the result of insolvency resolution.

Voluntary Winding up of a Company Under IBC, 2016

Apart from the inability to pay debts, there is another mode of winding up a company under IBC called “Voluntary Winding Up.” Section 59 of IBC, 2016 provides that “A corporate person who intends to liquidate itself voluntarily and has not committed any default may initiate voluntary liquidation proceedings under this chapter”.

The Code mandates a ‘Declaration of Solvency’ by majority of the directors of the company by passing a resolution verified by an affidavit stating that the liquidation is not for the purposes of defrauding anyone. This mode is applicable when the reason for winding up is other than insolvency like completion of the business / project of the company, completion of the duration for which the company was incorporated etc.

Related Read: Pre-Packaged Insolvency Resolution Process for MSMEs

Winding Up of a Company under Companies Act, 2013

Grounds Covered under Companies Act, 2013

This is also referred to as ‘Compulsory Winding Up’ / ‘Winding Up by National Company Law Tribunal (NCLT)’ and Section 271 of the Companies Act, 2013 has provided 5 grounds for the same. As stated before, there was one more ground “Inability to pay debts” earlier, which has now been omitted from the Companies Act, 2013. The grounds prescribed are:

- Special Resolution (SR) passed by the members for winding up by NCLT;

- Actions against the sovereignty, integrity of India or security of the State or against public order / decency / morality;

- Affairs conducted in a fraudulent manner or there is misconduct / misfeasance;

- Default in filing financial statements or annual returns for 5 consecutive financial years;

- Other just and equitable ground for winding up.

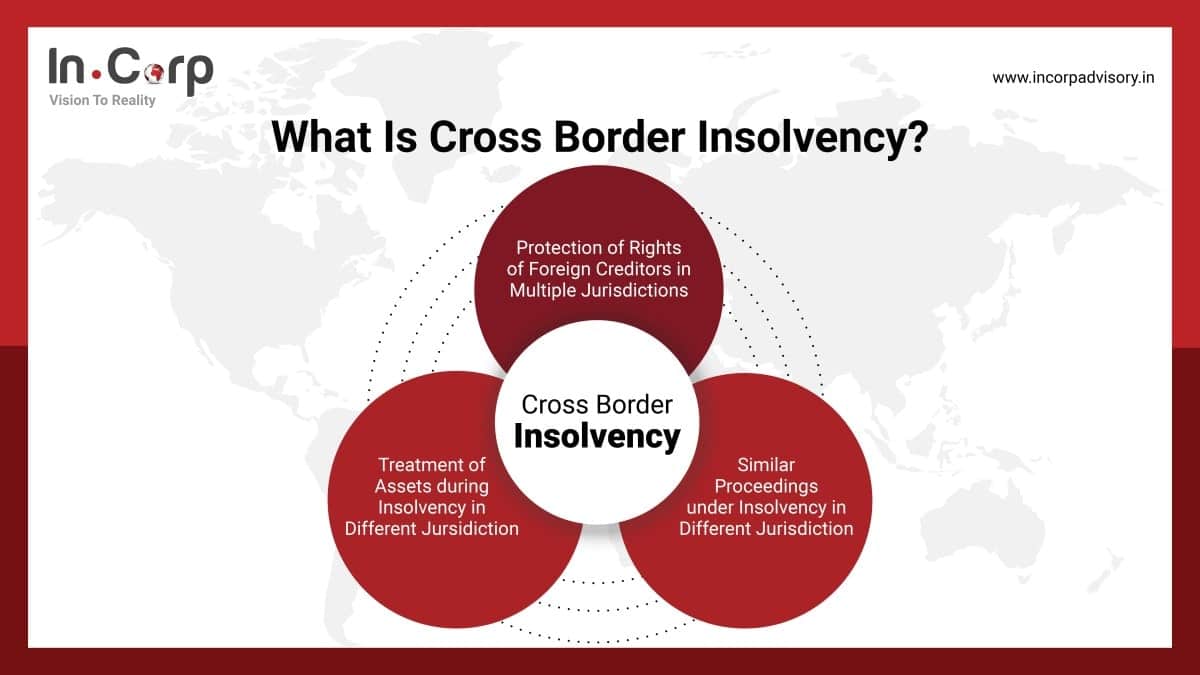

Related Read: What is Cross-Border Insolvency?

Conclusion

The lawmaker has tried to avoid an overlap between IBC, 2016 and Companies Act, 2013. The grounds under which a particular law would be applicable to the case are thoroughly prescribed. Some of the points to be checked before deciding upon the Law applicable are:

- Whether the entity is insolvent or solvent

- Whether the entity has defaulted in repayment of debt(s)

- Whether the reason for winding up of a company is as per Section 271 of the Companies Act, 2013

- Whether the solvent entity is to be voluntarily liquidated

Why choose Incorp?

With the advent of the Insolvency and Bankruptcy Code (IBC), our team actively guides financial as well as operational creditors through the turmoil of the non-recovery of debts and dues from defaulting entities.

Our professionals offer Corporate Recovery and Corporate Restructuring services under the framework of Companies Act as well as the Insolvency and Bankruptcy Code.