Employee stock option plan (ESOP) are liquid assets for listed companies as employees can see their value or wealth created. In the case of Startups or unlisted companies, ESOPs cannot be sold in an open market.

To mitigate this problem, many startups have started buying back the ESOPs issued to their employees, thereby providing them a chance to liquidate their holdings.

Statistics

Startups are increasingly announcing ESOP buybacks to retain and hire top talent amid the growing competitive market. Companies such as Oyo, Unacademy, Meesho, CarDekho, Razorpay, Swiggy, Byju’s, and Zerodha have rewarded their employees via ESOP buybacks.

(Source: Fintrackr, Media report)

What is Buy-back?

Buy-back is a corporate action in which a company buys back its own shares from the existing shareholders. A buyback allows companies to invest in their own shares. A company can buy back shares either periodically or in a single transaction. A company can buy back the shares periodically or all at once.

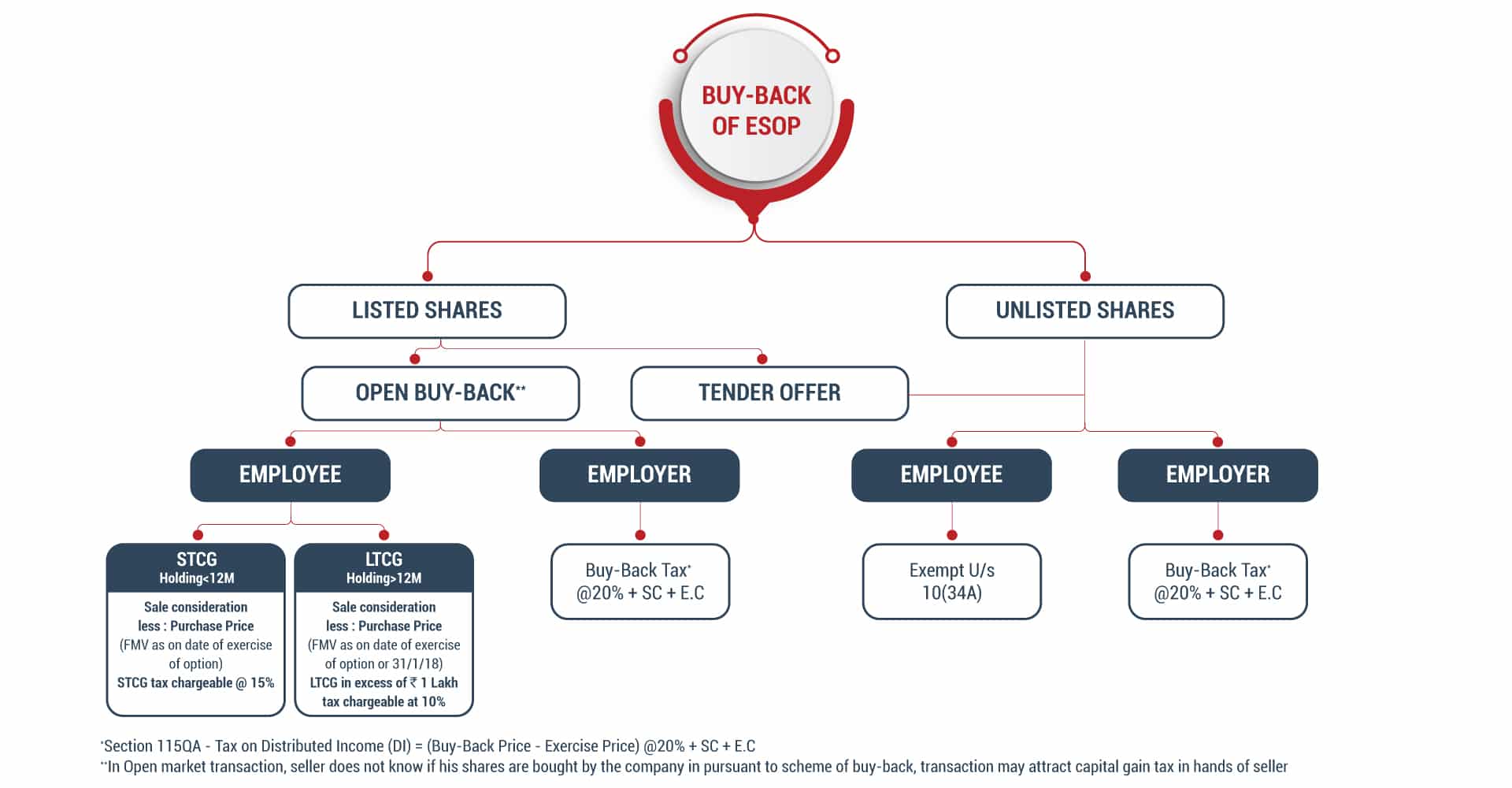

Tax implication of ESOP Buy-back per Income-tax Act, 1961 (the Act)

Under the Companies Act, 2013, which funds can we use for buy-back of shares

As per the companies Act, 2013, companies can purchase their own shares out of:

- Free reserves;

- Securities premium account;

- Proceeds of issue of any shares or specified securities [no buy-back shall be made (i) out of proceeds of an earlier issue of the same kind, or (ii) out of the same kind of other specified securities].

More articles from the ESOP series

Demystifying Basics Of Employee Stock Option Plans

ESOP Tax Implications From Employer’s Perspective

Decoding The Tax Implication Of ESOP – Employee’s Perspective

Conditions for buy-back of shares as per Companies Act, 2013

- Authorised by Articles of Association.

- Special resolution to be passed at general meeting.

- Less than 25% of total paid-up capital and free reserves.

- Secured & unsecured loan post buy-back shlould not be more that twice paid-up capital and free reserves.

- All the shares and/or other specified securities for buy-back should be fully paid-up.

- Listed companies separate SEBI compliance.

- Separate regulation for unlisted companies.

- For unlisted companies – no offer of buy-back can be made within a period of one year from preceding offer of buy-back.

Process for Buy-back of ESOP

- Board Approval & Shareholder’s approval

- Determine the ESOP share buy-back price.

- Compliance with company’s act & SEBI regulations.

- Offer the ESOP buy-back scheme/terms to eligible employees.

- Employees may accept or decline the buy-back scheme.

- Arranging the fund for Buy-back of ESOP.

- Transfer the funds and buy-back the ESOP.

- Intimating SEBI if buy-back exceeds the threshold.

- Maintaining records and ensure compliance with tax regulations.

- Filing of required reports with regulatory authorities like Form SH-8, PAS-4, MGT-14.

Success Story of ESOP Buy-Back in the recent past

Caratlane was founded in 2008 by Mithun Sacheti and Srinivasa Gopalan. by offering an online platform for selling diamonds and jewellery. Over the years, it has grown phenomenally and currently boasts a base of over four lakh customers.

- ESOPs were given to 75 employees out of 400 employees of Caratlane holding almost 1.72% of the company shareholding.

- Balance 27.18 % is held by Mithun Sacheti and 62 % is held by Titan.

- In 2016, Titan bought 62% of Caratlane at a valuation of around Rs. 908 crores from Tiger Global Management

In September, 2023, Titan announced to buy the stake of Founder Mithun Sacheti (27.18%) and ESOPs (1.72%) at a valuation of around Rs.17,000 crores of the company.

Accordingly, based on above, Titan will buy ESOP’s of an employee holding 1.72% in Caratlane at around Rs.292 crores. Employees will receive around a five times increase in valuation as compared to the year 2016 valuation.

Conclusion

While ESOPs found their way into compensation packages offered by new-age start-ups. They should also give a plan for buy-back of ESOP, as it gives employees an opportunity to liquidate their ESOP and make money.

As the company grows, so will the value of its share and this concept of future gains can instil ownership in employees and motivate them to take charge and work towards building the company than just fulfil their targets.