The growing popularity and demand for online services demonstrate that digitization is the way of the future. Today, every action is automated, whether it is a domestic function or a corporate operation.

One of the most noticeable changes in the digital economy is the growth of e-commerce operators (mostly foreign-based). In this article, we discuss the income tax and other direct tax implications for e-commerce operators who could either be a resident or a non-resident.

Table Of Contents

An Overview

What Is The Flow Of Transactions In An E-Commerce Ecosystem?

What Are The Applicable Income Tax Provisions For E-Commerce Taxation In India?

Summary: Implications Of Section 194-0 And Equalization Levy On ECO

Conclusion

Why Choose Incorp?

An overview

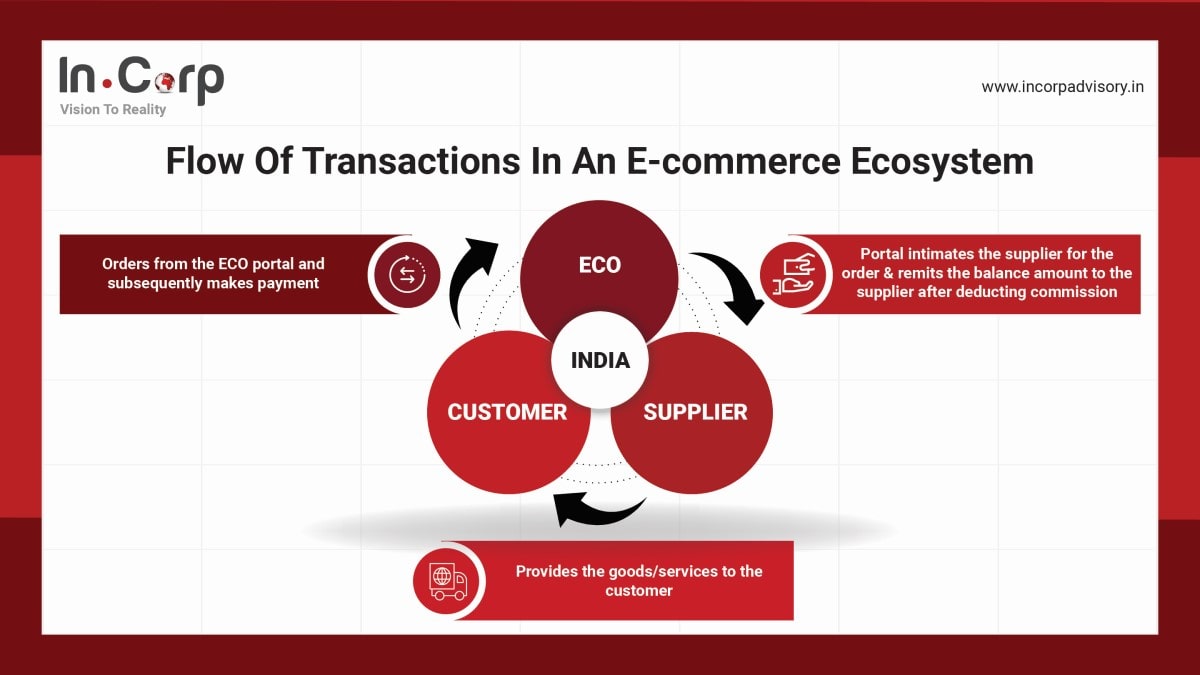

E-Commerce transactions consists of the following:

E-commerce Operator (Aggregator)

E-commerce Operator means any person who owns, operates or manages digital or electronic facility or platform for electronic commerce (‘referred as ECO’)

E-commerce participant

(Seller / Buyer)

E-commerce participant is a person who uses the platform to buy/sell goods, services, or both through an electronic platform provided by an e-Commerce operator.

E-commerce platform

(Website / App)

E-commerce platform is software/platform that allows online businesses to manage their commercial process of buying and selling over the internet.

Related Read: GST On E-Commerce Business Models: A Quick Guide

What is the Flow of Transactions in an E-commerce Ecosystem?

What Are The Applicable Income Tax Provisions For E-commerce Taxation in India?

Let us take a look at the various provisions under Income Tax Act, that you need to be aware of as an E-commerce operator in India:

For Resident ECO:

An ECO registered in India or having a Permanent Establishment in India or fulfilling the provisions of Section 6 (residency test) is regarded as a Resident ECO. Following compliances are required by Resident ECO under Income Tax provisions:

1. Income Tax Return

Commission on sale, which is the major source of Income for ECO, is grouped under the head ‘Profits and Gains from Business and Profession’ to compute Income Tax. The compliance for resident ECO is tabulated below

Type of PersonRateCompliance

| Individual/ HUF | Slab rates as per Finance Act plus surcharge | ITR-3 to be filed on or before 31st July |

| Partnership Firm /LLP | 30% plus surcharge | ITR-5 to be filed on or before 31st October |

| Company |

|

ITR-6 to be filed on or before 31st October. |

Note: If the turnover of the ECO exceeds INR 10 crore and more than 95% of the transactions are taken place in ‘Other than Cash’ mode, Tax Audit is mandatorily required to be conducted, If the condition of ‘other than cash’ is not fulfilled, then the limit for applicability of Tax Audit reduces to INR 5 crore.

Related Read: What Are The GST Compliances In E-Commerce?

2. TDS under Section 194-O

ParticularsSection 194-O

| Meaning | An ECO facilitating the supply of goods/ services to its online platform to the supplier is liable to deduct TDS if the amount is remitted to the supplier |

| Applicability | The ECO participant is a resident of India |

| Threshold Limit | Supplier: Resident Individual/HUF: INR 5 lakhs (Gross payment made during the FY) |

| Non-applicability | If the supplier is a non-resident, no TDS deduction applies to ECO. Section 195 will come under the picture in this case. |

| Rate applicable |

|

| Compliance |

|

Note: When a resident ECO remits the amount to a non-resident supplier, TDS is required to be deducted under Section 195.

For Non-resident ECO:

An ECO not registered in India and not fulfilling the provisions of Section 6 is regarded as a Non-resident ECO.

Provisions of Equilization Levy and Income Tax for NRI E-commerce Operators is mentioned as below::

1. Income Tax Return

Type of ECORateCompliance

| Individual/ HUF | Slab rates for Individual/HUF plus surcharge. | ITR-3 to be filed on or before 31st July |

| Partnership Firm /LLP | 30% plus surcharge | ITR-5 to be filed on or before 31st October |

| Company | 40% plus surcharge | ITR-6 to be filed on or before 31st October. |

2. Equalisation Levy under Sec 165A:

ParticularsNon-resident E-commerce Operator

| Applicability |

|

| Non- Applicability |

|

| Rate of levy | 2% of gross consideration received/ receivable by a non-resident E-commerce operator. |

Summary – Income Tax for Ecommerce in Current Ecosystem

Summary: Implications of Section 194-0 and Equalization Levy on ECO

We have prepared a comprehensive list of the direct tax implications on an E-commerce operator under various circumstances:

| Resident ECO where participant is | ||||

| Resident Individual/HUF in India and IP address of India | 2.15 crore | |||

| Non-Resident Individual | 1.06 Crore | |||

| Resident Individual/HUF | 4.99 Lakhs | |||

| Resident Company and IP address of England | 1 Lakh | |||

| Non-resident Company | 3 Lakhs | |||

| Non-resident LLP and IP address of India | 5 Lakhs | |||

| Non-resident ECO where participant is | ||||

| Resident Company | 2.22 crore | |||

| Non-resident Company having IP address in India | 1.99 crore | |||

| Non-resident Company having IP address in India | 3 crores | |||

| Resident Individual but IP address of England | 10 Crore | |||

| Non-resident Company newly registered in India but IP address of England | 50 Crores | |||

| A firm wherein one partner was a Resident, and four are non-resident | 2.15 crore | |||

| Individual of Indian Origin (unable to furnish PAN) and IP address of England | 6 crores | |||

| Resident Individual (here ECO has a PE in India) | 3 crores | |||

| Non-resident individual on behalf of the resident individual- IP address outside India | 10 crores | |||

Conclusion

The digital economy is swiftly becoming intertwined with the traditional economy, thus making it harder to delineate the digital economy’s true meaning. India has been at the forefront of digital economy taxation. Businesses will need to continually review their operating models to assess the effect, identify risks, explore planning possibilities, and meet their commitments as tax law evolves.

The taxation for e-commerce operators in India has a widespread applicability and so, e-commerce businesses should be aware of the same.

Why Choose Incorp?

Our Advisory and Taxation Team at Incorp offers seamless assistance with advisory services. We shall evaluate and assist in assessing ECO’s impact under the Direct Tax Laws. We shall help with transactions subjected to foreign taxes and comply with all applicable rules and regulations.

Apart from direct taxation, we can take care of GST on your e-commerce business as well along with other indirect taxation levies.