Infrastructure Company Avails InCorp’s Taxation And Litigation Services During CIRP And Liquidation Process

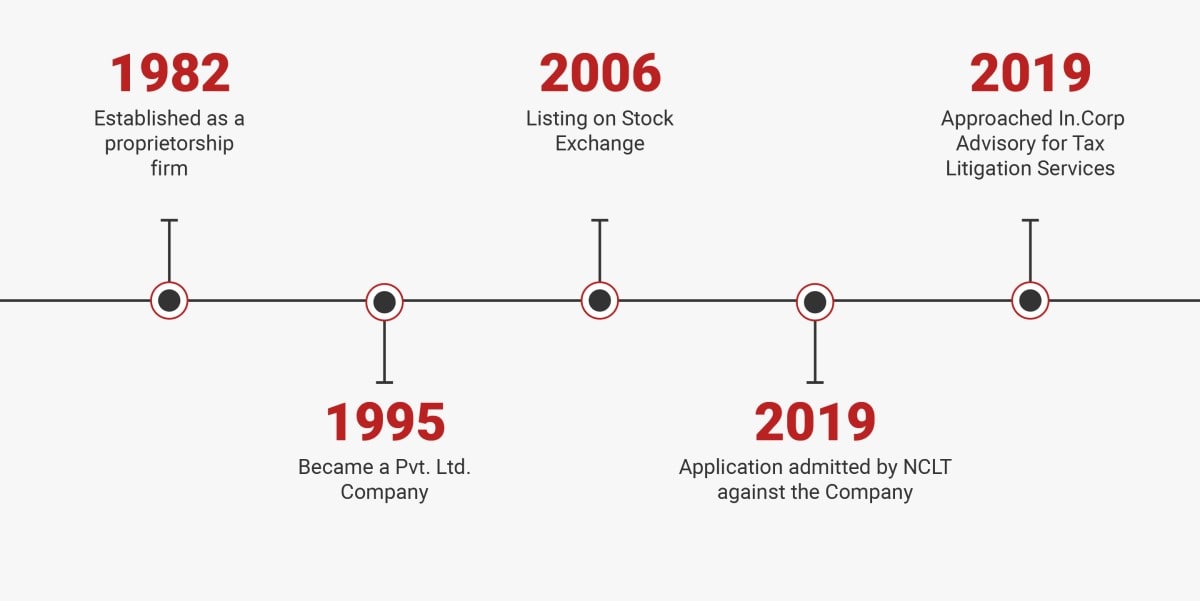

Established as a proprietorship firm in 1982 and incorporated in the year 1995. By 2005, the company had established inherent expertise in design, construction, operation & maintenance of complex water supply projects, water treatment plants, and distribution systems.

There was a shift in the government’s mindset and certain other project implementing agencies; there was a determined focus to promote projects on PPP [Public Private Partnership] basis.

The company was executing mid-sized projects on annuity & deferred payment models. The net worth and accessibility to debt funds were limited. This could prove to be detrimental to the company’s future growth.

There were two paths available –

- To maintain the existing status and subsequently to act as a subcontractor to more prominent contractors or

- To strengthen its financial position in the quest for a place amongst the top construction companies.

Industry Focus

End to end construction of various water projects across the country

Construction of various airport projects across the country.

Construction of metro projects to the tune of more than 3000 crores

Timeline

What services did the client engage InCorp Advisory for?

- Tax compliances and litigation

- Securing stay on demands raised

- Procuring refunds as due to assessee-company

- Representation before Appellate Authorities

- Various Compliances under Income Tax laws

What was the client’s long-term vision?

- During the CIRP period, various statutory authorities filed claims of outstanding dues.

- The Income Tax Department was one of the claimants who had filed claims exceeding 175 crores.

- Banks Accounts of the clients were attached under the Income Tax Act.

- The client’s vision was to ensure that the Recovery Process stops, the accounts are released and refunds, if any, could be received by them. This would smoothen the CIRP process with the availability of funds.

- With Appropriate representation before Appellate authorities, get the Demands reduced or deleted.

How did InCorp turn the client’s Vision into Reality

| Client’s Main Challenges | With InCorp |

|---|---|

| To get abeyance on Recovery Proceedings | With Appropriate application of provisions of Income Tax Law and Insolvency and Bankruptcy Code, abeyance was secured on recovery proceedings |

| Release of Bank Accounts attached for Recovery | Assisted Counsel in securing an order from NCLT directing authorities to release the Bank Attachments |

| Securing Tax Refunds despite Outstanding Demands | With representation before various Tax Authorities, refunds were successfully secured, aggregating to more than 75-80 crores despite large outstanding demand exceeding 175 Crores. |

| To Tackle the Demands raised by Tax Department before Appellate Authorities | We not only got Stay on demands, but thereafter, with appropriate representation before Appellate Authorities also got those demands deleted. |

| Tedious tax Compliance services | Handling compliance under Tax Laws and appearing before Assessing Officer to Ensure no further demands were raised. |

- Industry

Infrastructure development - Incorporated

1995 - Operation History

26+ years