The Union Budget 2021 has introduced a new section, i.e., Section 194Q of the Income Tax Act, 1961, regarding “TDS on Purchase of Goods,” which is effective from 1st July 2021.

In this article, we shall guide you through the details and applicability of Section 194Q under direct taxes.

Table Of Contents

Features Of Section 194Q

Details Of Section 194Q That You Need To Be Aware Of

Applicability Of Section 194Q In Various Situations

Examples To Help You Better Understand Section 194Q

What Is The Timeline For Filing TDS Returns And Issue Of TDS Certificate?

Why Choose Incorp?

Frequently Asked Questions

Firstly, Let Us Take A Look At The Features Of Section 194Q

The salient features of Section 194Q, as given by the Income Tax Department are as follows:

- It applies only to the purchase of goods and not to the provision of services.

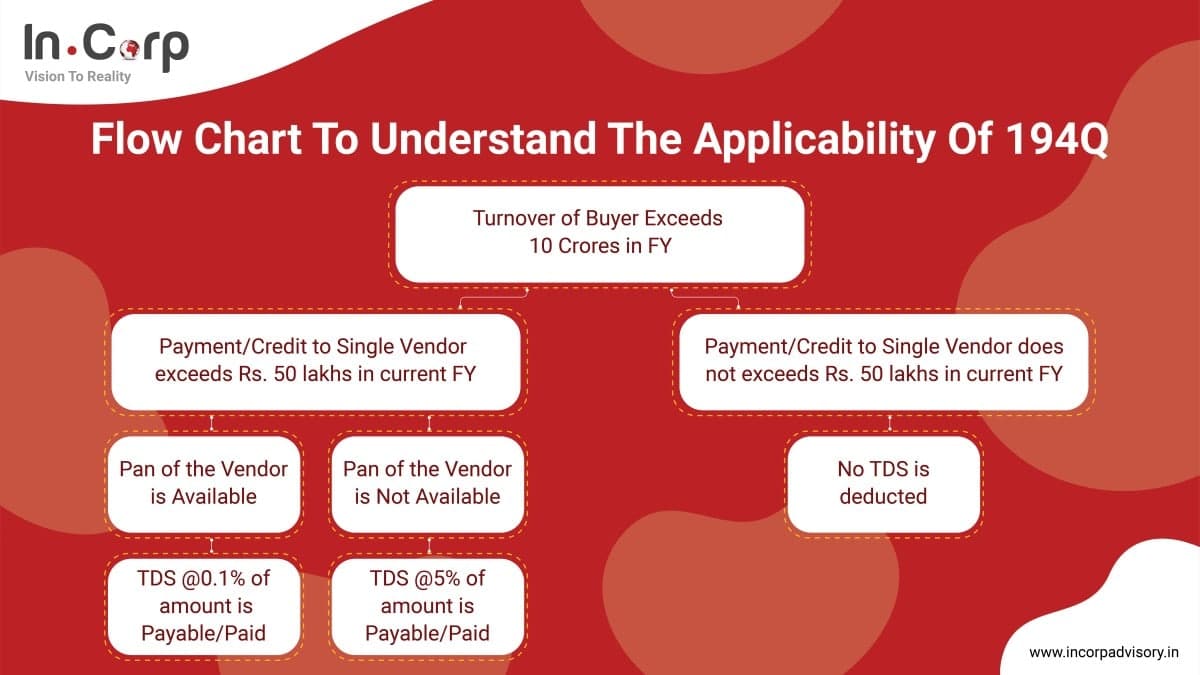

- It applies to a buyer whose turnover

- In the preceding F.Y. (financial year) was more than Rs. 10 Crores and

- In the current F.Y., who has paid more than 50 lakhs to a resident seller for the purchase of goods.

You must check this limit every year to determine the applicability of this section.

- The TDS is to be deducted either on payment or on credit exceeding Rs. 50 Lakhs, whichever is earlier.

- You don’t have to deduct TDS at the time of purchase.

- This section does not apply to the Import of goods from outside India.

- If TDS or TCS is applicable under any other section of the Income Tax Act, TDS will be deducted under the other relevant section and not under section 194Q.

However, If TDS on purchase of Goods u/s 194Q and TCS on sale of goods u/s. 206C(1H) both are applicable, then TDS has to be deducted u/s. 194Q and section 206C(1H) will not apply in such cases.

Here, we have highlighted the details of Section 194Q that you need to be aware of:

What is the rate of TDS under Section 194Q?

The TDS rates under Section 194Q are shown below:

| PARTICULARS | TDS RATE |

|---|---|

| Where the seller has a valid PAN | 0.1% |

| Where the seller does not have a valid PAN | 5% |

Who should deduct tax under Section 194Q?

- According to the Income Tax Act, a buyer conducting business shall deduct tax when the gross receipts, the total sales, or turnover from his business exceeds Rs. 10 crores during the year immediately preceding the F.Y (financial year) in which such goods are purchased.

- Thus, you (purchaser) are liable to deduct tax in F.Y. 2021-22 if your turnover was more than Rs. 10 crores in F.Y. 2020-21

When should you deduct TDS under Section 194Q?

The Income Tax Act states that TDS is deducted on the purchases made by a buyer when:

- Goods are purchased from a resident person;

- Payment or Credit is made to the account of the vendor of value more than Rs. 50 lakhs in any previous year; and

- The buyer should not be on the list of persons who are excluded from the provision for deduction of tax.

You must deduct TDS either:

- at the time of credit of the amount to the seller’s account or

- at the time of payment by any mode, whichever is earlier.

Further, tax shall be deducted even if the sum is credited to the Suspense Account.

Now, let us take a look at the applicability of Section 194Q in various situations

Case 1: A Buyer Importing Goods From Outside India

Section 194Q is not applicable as the obligation to deduct tax arises when the payment is made to a resident seller. When goods are imported, the seller is a non-resident; hence the buyer will not have any obligation to deduct tax.

Case 2: Adjustment Made On Account Of Purchase Return, Discount Or GST

- You need to deduct TDS under section 194Q either on payment or on credit, whichever is earlier.

- Hence, no adjustment if the amount is paid and the purchase return or discount happens later.

- Further, TDS is not to be deducted from the GST amount.

- If GST on services has been indicated separately in the invoice, no tax would be deducted on the GST component.

- GST includes CGST, SGST, IGST, UTGST.

Related Read: GST On E-Commerce Business Models: A Quick Guide

Case 3: On Purchase From SEZ, 100% EOU, A Merchant Exporter

- The purchases made from SEZ, 100% EOU, or Merchant exporter are treated as Imports under other laws.

- However, under the Income Tax laws, there is no specific provision stating that such purchases will be treated as importing goods in India.

- Hence, it is recommended that you should apply this provision even on such purchases.

Case 4: If TDS Or TCS Under Another Section Is Also Applicable To The Same Transaction, Then Is TDS Applicable Under Section 194Q?

TDS under section 194Q is not applicable on transactions that are specifically covered by other sections of TDS or TCS. However, when TDS is deducted under Section 194Q, TCS on receipt from the sale of goods shall not apply.

Related Read: TCS On Sale Of Goods

Here, we have included a few examples to help you better understand Section 194Q.

Illustration 1:

During FY 2020-21, XYZ had a gross turnover of Rs. 15 crores. XYZ purchases goods from ABC. On 31st March 2021, the amount payable by XYZ to ABC is Rs. 70 Lakhs for purchases made till 31st March 2021. No purchase was made between 1st April 2021 to 30th June 2021.

No, purchase of Rs. 15 Lakhs is made on 1st July 2021. On 5th July 2021, payment of Rs. 70 Lakhs made against the old payable and on 20th July 2021, payment of Rs. 10 Lakhs made against new purchases.

Whether TDS is required to be deducted and if yes, then on what amount?

- As per the provisions, under section 194Q if the total payments made during the year exceed Rs. 50 Lakhs, then TDS has to be deducted.

- Thus, in the present case, since total payments made during the year have exceeded 50 Lakhs, then TDS is required to be deducted.

- Further, since the section is applicable w.e.f 1st July 2021, TDS must be deducted on payment made after the said date.

- Thus, TDS is to be deducted on the entire Rs. 80 Lakhs irrespective of the date of their purchases @ 0.1% assuming that ABC has PAN.

Illustration 2:

Continuing with the above Illustration, if XYZ makes the aggregate purchase of Rs. 30 Lakhs from ABC between 1st April 2021 to 30th June 2021 and makes the following payments:

| Date of Payment | Amount |

|---|---|

| 30th April 2021 | 30,00,000 |

| 30th May 2021 | 30,00,000 |

| 10th July 2021 | 40,00,000 |

| Total | 1,00,00,000 |

In this illustration, how much TDS is required to be deducted?

- In this illustration, since the aggregate payment to ABC has exceeded Rs. 50 Lakhs in FY 2021-2022, TDS is required to be deducted.

- However, since the new provisions are applicable only from 1st July 2021, no TDS will be deducted on the amount paid before 1st July 2021.

- Thus, TDS is required to be deducted on Rs. 40,00,000, which was paid after 01.07.2021.

- No TDS required to be deducted on Rs. 10,00,000 being excess of total payments of Rs. 60 Lakhs made before 1st July 2021 and Rs. 50 Lakhs

Related Read: Section 194R – Take A Dive Into The Ocean Of 194R

What Is The Timeline For Filing TDS Returns And Issue Of TDS Certificate?

| Deduction Month | Due date of Payment | Quarter Ending | Due Date of filing return | Date for generating TDS certificates |

|---|---|---|---|---|

| April | 7th May | 30th June | 31st July | 15th August |

| May | 7th June | |||

| June | 7th July | |||

| July | 7th August | 30th September | 31st October | 15th November |

| August | 7th September | |||

| September | 7th October | |||

| October | 7th November | 31st December | 31st January | 15th February |

| November | 7th December | |||

| December | 7th January | |||

| January | 7th February | 31st March | 31st May | 15th June |

| February | 7th March | |||

| March | 30th April |

Why Choose Incorp?

At Incorp, we have the expertise and skills to guide you through the entire TDS and TCS processes. Our professionals work under the framework of the Income Tax Act to take care of all your compliances. We are here to ensure peace of mind, from setting up your company to staying compliant and managing your taxes on time with ease.